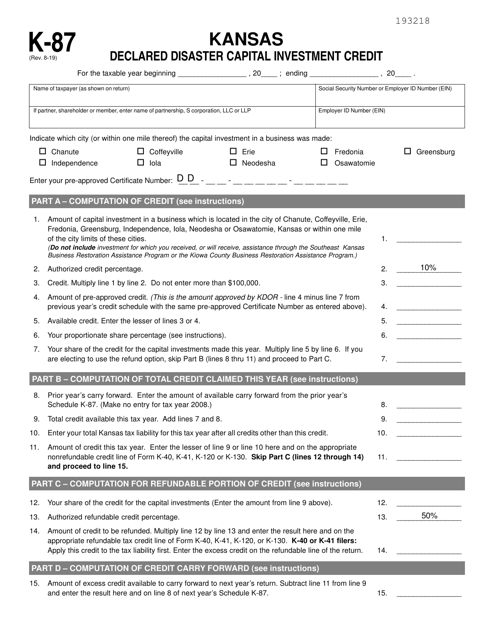

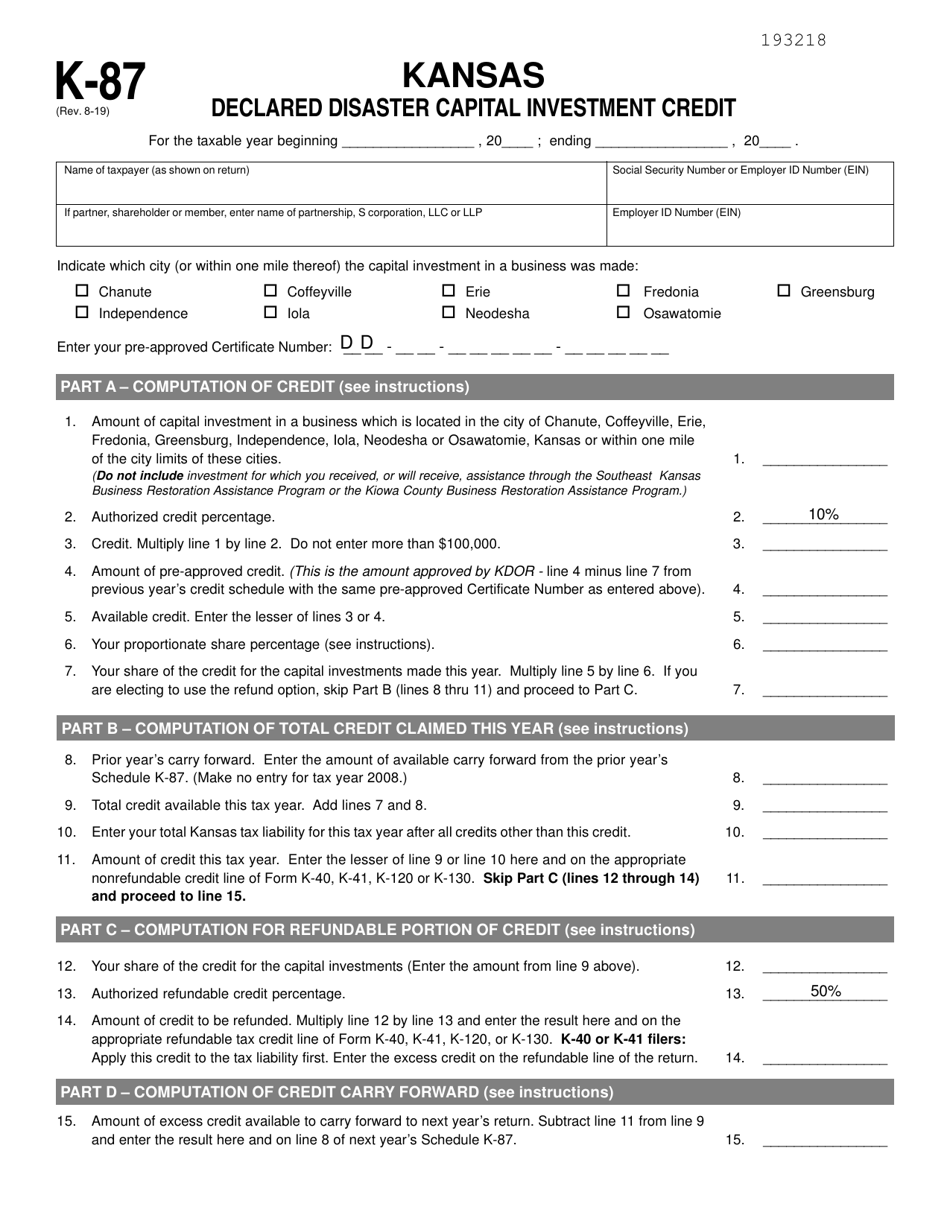

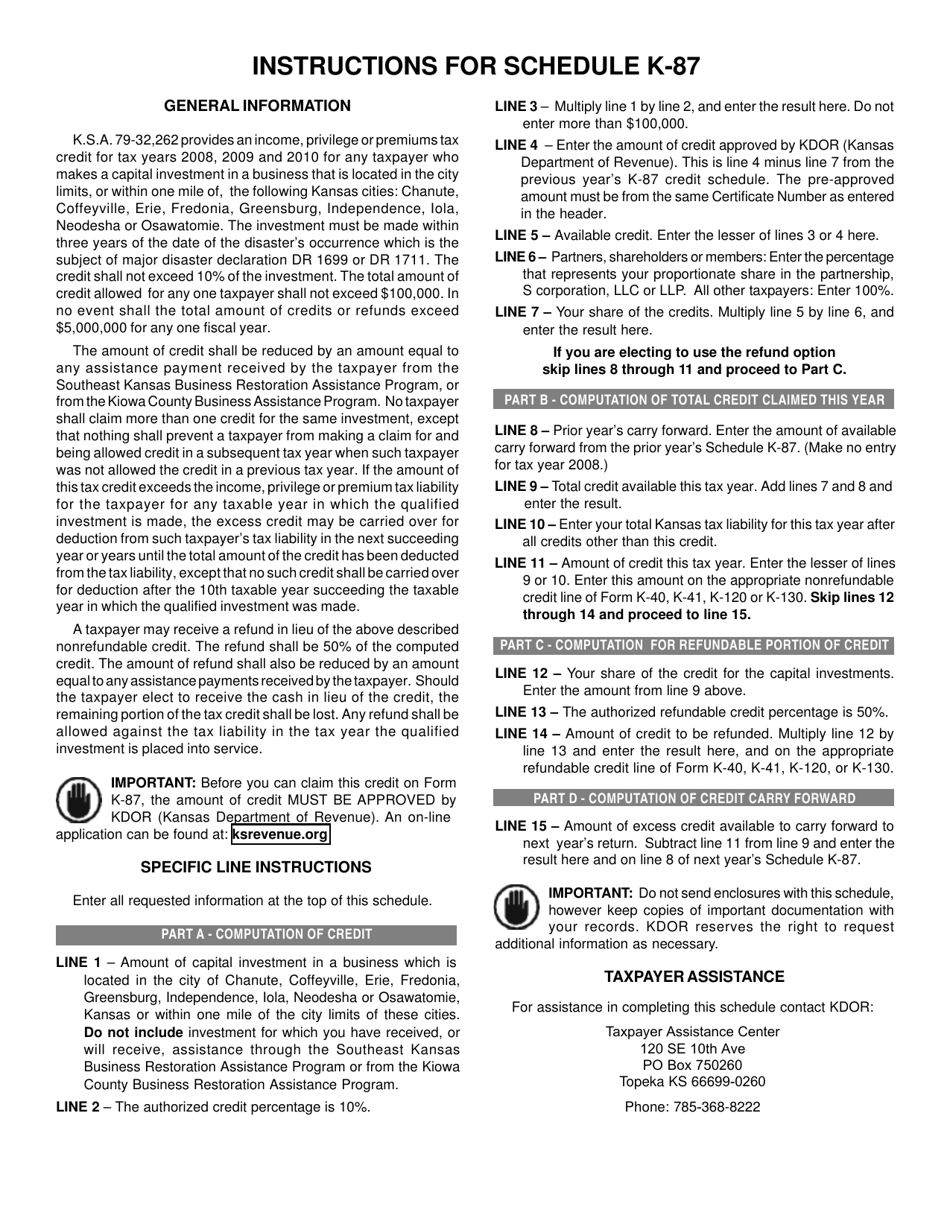

Schedule K-87 Kansas Declared Disaster Capital Investment Credit - Kansas

What Is Schedule K-87?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-87?

A: Schedule K-87 is a form used by taxpayers in Kansas to claim the Declared Disaster Capital Investment Credit.

Q: What is the Kansas Declared Disaster Capital Investment Credit?

A: The Kansas Declared Disaster Capital Investment Credit is a tax credit available to businesses that make qualifying capital investments in certain declared disaster areas in Kansas.

Q: Who is eligible for the Kansas Declared Disaster Capital Investment Credit?

A: Businesses that make qualifying capital investments in certain declared disaster areas in Kansas are eligible for the credit.

Q: What are qualifying capital investments?

A: Qualifying capital investments are investments in depreciable tangible personal property used in a trade or business.

Q: How much is the Kansas Declared Disaster Capital Investment Credit?

A: The credit is 20% of the qualified capital investments made in the declared disaster area.

Q: Are there any limitations on the credit?

A: Yes, the credit is subject to certain limitations, including a maximum credit amount and a cap on the total amount of credits that can be claimed for all disasters in a tax year.

Q: How do I claim the Kansas Declared Disaster Capital Investment Credit?

A: To claim the credit, you must complete and attach Schedule K-87 to your Kansas tax return.

Q: Is there a deadline to claim the Kansas Declared Disaster Capital Investment Credit?

A: Yes, the credit must be claimed on or before the due date of the original return, including extensions.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-87 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.