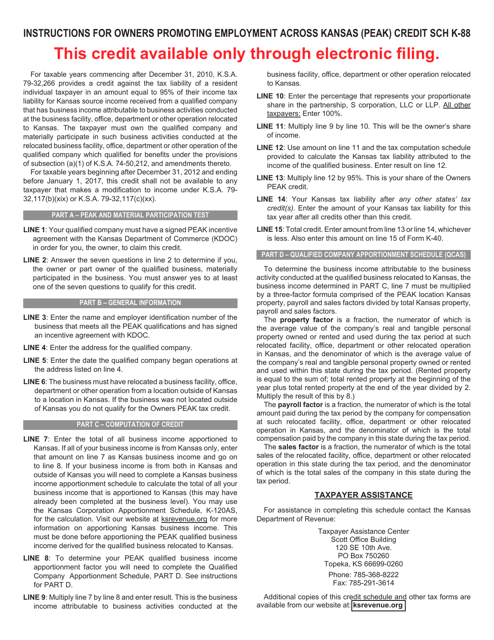

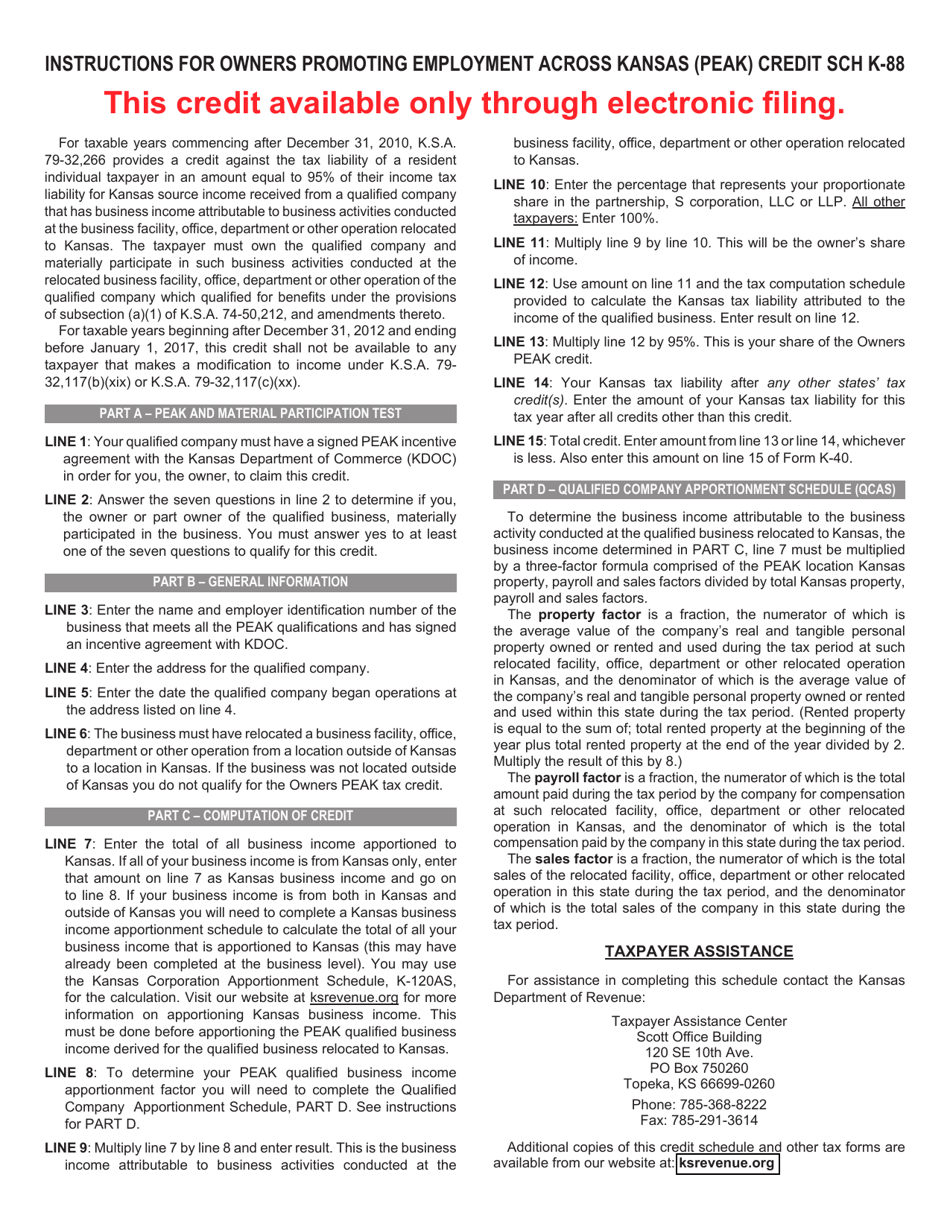

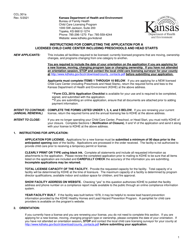

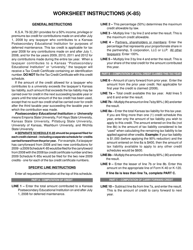

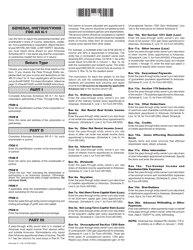

Instructions for Schedule K-88 Owners Promoting Employment Across Kansas (Peak) Credit - Kansas

This document contains official instructions for Schedule K-88 , Owners Promoting Employment Across Kansas (Peak) Credit - a form released and collected by the Kansas Department of Revenue.

FAQ

Q: What is Schedule K-88?

A: Schedule K-88 is a form used in Kansas to claim the Owners Promoting Employment Across Kansas (PEAK) Credit.

Q: What is the PEAK Credit?

A: The PEAK Credit is a tax credit provided to Kansas business owners who create jobs in the state.

Q: How do I qualify for the PEAK Credit?

A: To qualify for the PEAK Credit, you must meet specific criteria such as creating new jobs, paying certain wages, and meeting industry requirements.

Q: What is the purpose of the PEAK Credit?

A: The PEAK Credit aims to promote employment growth and economic development in Kansas.

Q: What information is required on Schedule K-88?

A: Schedule K-88 requires information about the business, the number of new employees, their wages, and other relevant details.

Q: When is the deadline to file Schedule K-88?

A: The deadline to file Schedule K-88 is usually the same as the deadline for filing your Kansas income tax return.

Q: What are the benefits of claiming the PEAK Credit?

A: Claiming the PEAK Credit can result in significant tax savings for qualifying Kansas business owners and encourage job creation in the state.

Q: Are there any limitations or restrictions on the PEAK Credit?

A: Yes, there are certain limitations and restrictions on the PEAK Credit, such as the maximum credit amount and specific industry requirements.

Q: Can I claim the PEAK Credit if I am not a business owner?

A: No, the PEAK Credit is only available to Kansas business owners who meet the qualifying criteria.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Kansas Department of Revenue.