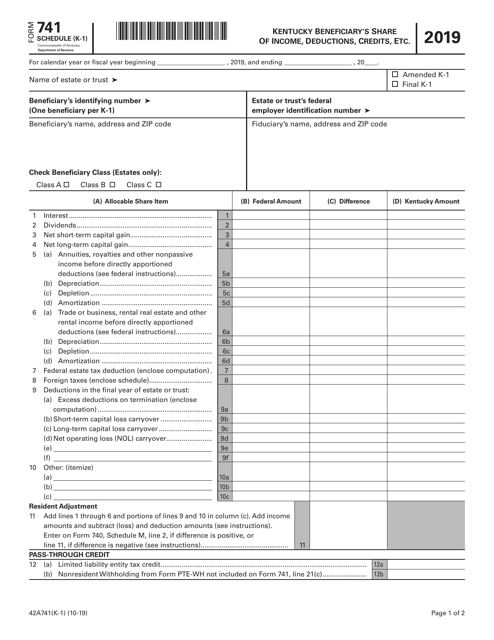

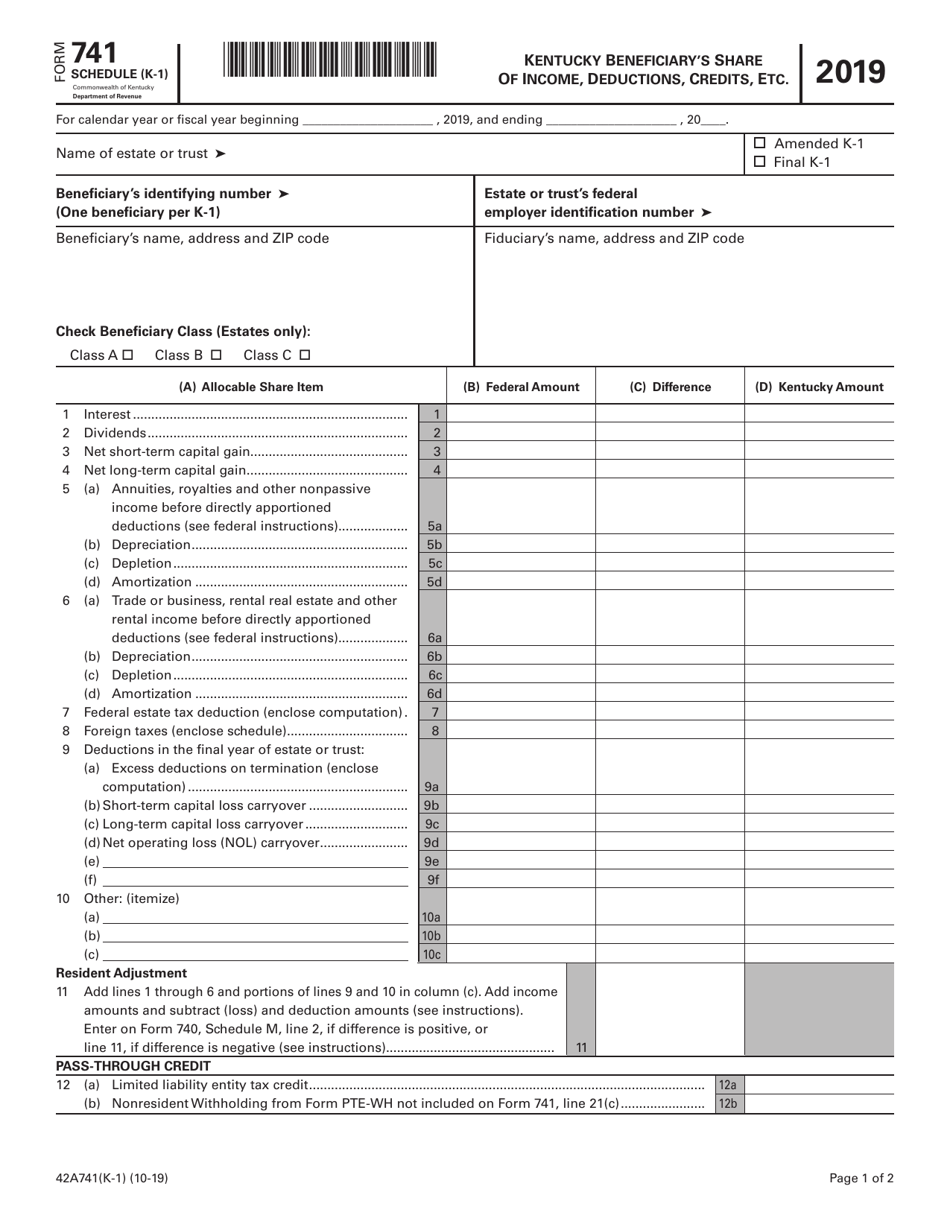

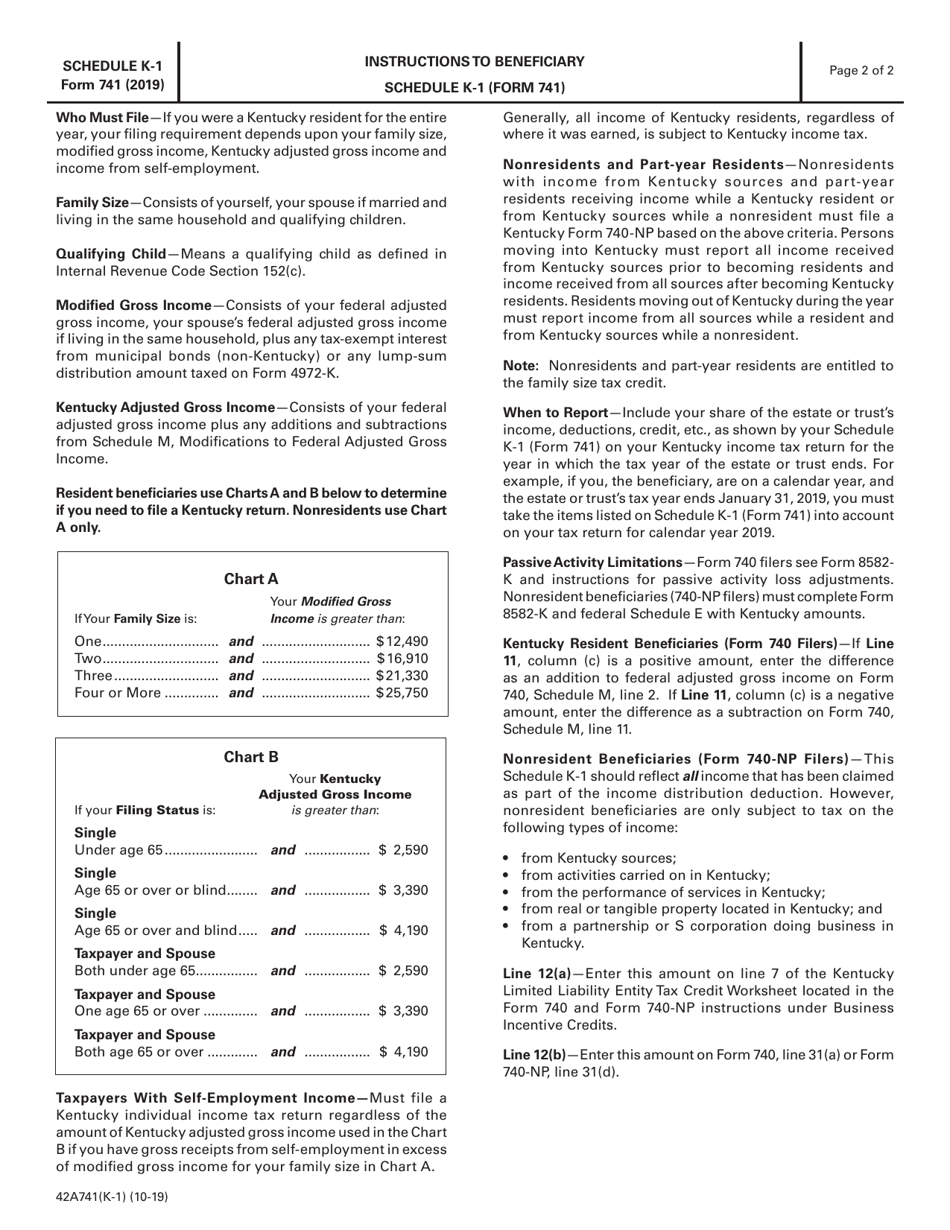

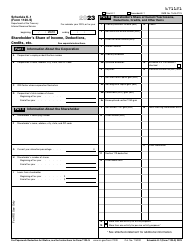

Form 741 (42A741(K-1)) Schedule K-1 Kentucky Beneficiary's Share of Income, Deductions, Credits, Etc - Kentucky

What Is Form 741 (42A741(K-1)) Schedule K-1?

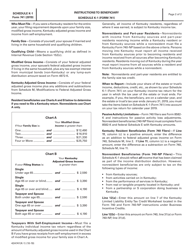

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 741?

A: Form 741 is a tax form used in Kentucky to report a beneficiary's share of income, deductions, credits, etc.

Q: What is Schedule K-1?

A: Schedule K-1 is a part of Form 741 that provides details of a beneficiary's share of income, deductions, credits, etc.

Q: Who needs to file Form 741?

A: Form 741 is filed by beneficiaries in Kentucky who receive income from an estate or trust.

Q: What is the purpose of Form 741?

A: Form 741 is used to report a beneficiary's share of income, deductions, and credits from an estate or trust.

Q: When is Form 741 due?

A: Form 741 is generally due on the same date as the beneficiary's federal income tax return, which is April 15th.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing of Form 741. It is important to file on time to avoid any penalties.

Q: What should I do if I make a mistake on Form 741?

A: If you make a mistake on Form 741, you can file an amended return or contact the Kentucky Department of Revenue for guidance.

Q: Can I e-file Form 741?

A: Yes, Form 741 can be filed electronically using Kentucky's e-file system.

Q: Do I need to include any supporting documents with Form 741?

A: You may need to attach certain documents related to your share of income, deductions, credits, etc., as instructed on the form or by the Kentucky Department of Revenue.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 741 (42A741(K-1)) Schedule K-1 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.