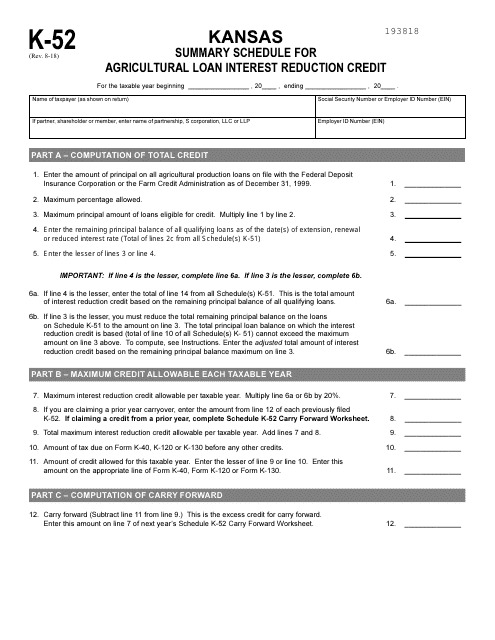

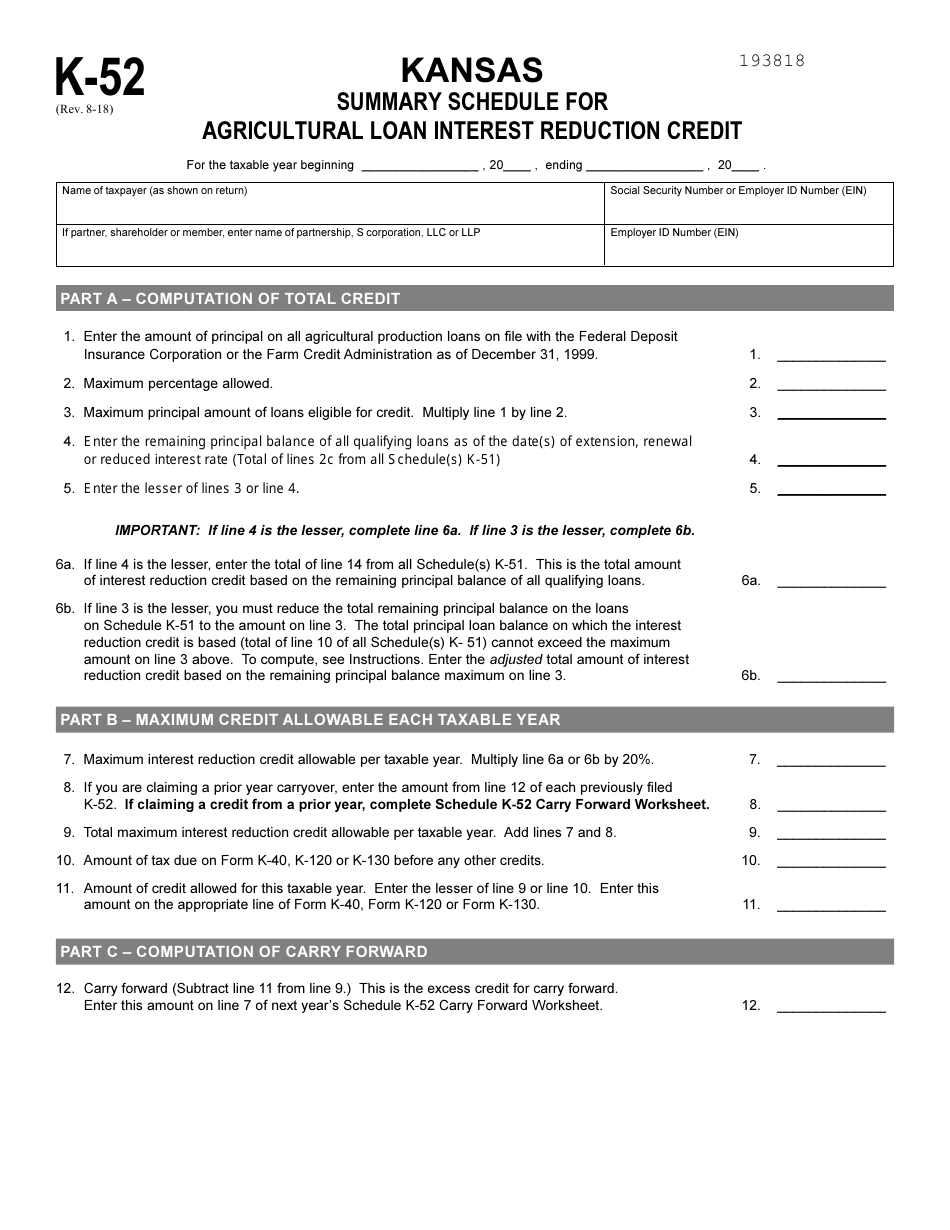

Schedule K-52 Kansas Summary Schedule for Agricultural Loan Interest Reduction Credit - Kansas

What Is Schedule K-52?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-52?

A: Schedule K-52 is a summary schedule for the Agricultural Loan Interest Reduction Credit in Kansas.

Q: What does Schedule K-52 apply to?

A: Schedule K-52 applies to the Agricultural Loan Interest Reduction Credit in Kansas.

Q: What is the purpose of the Agricultural Loan Interest Reduction Credit?

A: The purpose of the Agricultural Loan Interest Reduction Credit is to help farmers in Kansas by providing a credit for interest paid on agricultural loans.

Q: Who is eligible for the Agricultural Loan Interest Reduction Credit?

A: Farmers in Kansas who have agricultural loans are eligible for the Agricultural Loan Interest Reduction Credit.

Q: How does the Agricultural Loan Interest Reduction Credit work?

A: Farmers can claim a credit on their Kansas tax return for a percentage of the interest paid on their agricultural loans.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule K-52 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.