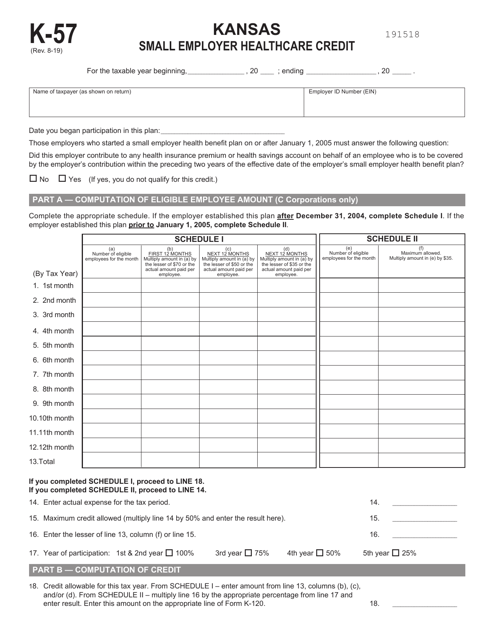

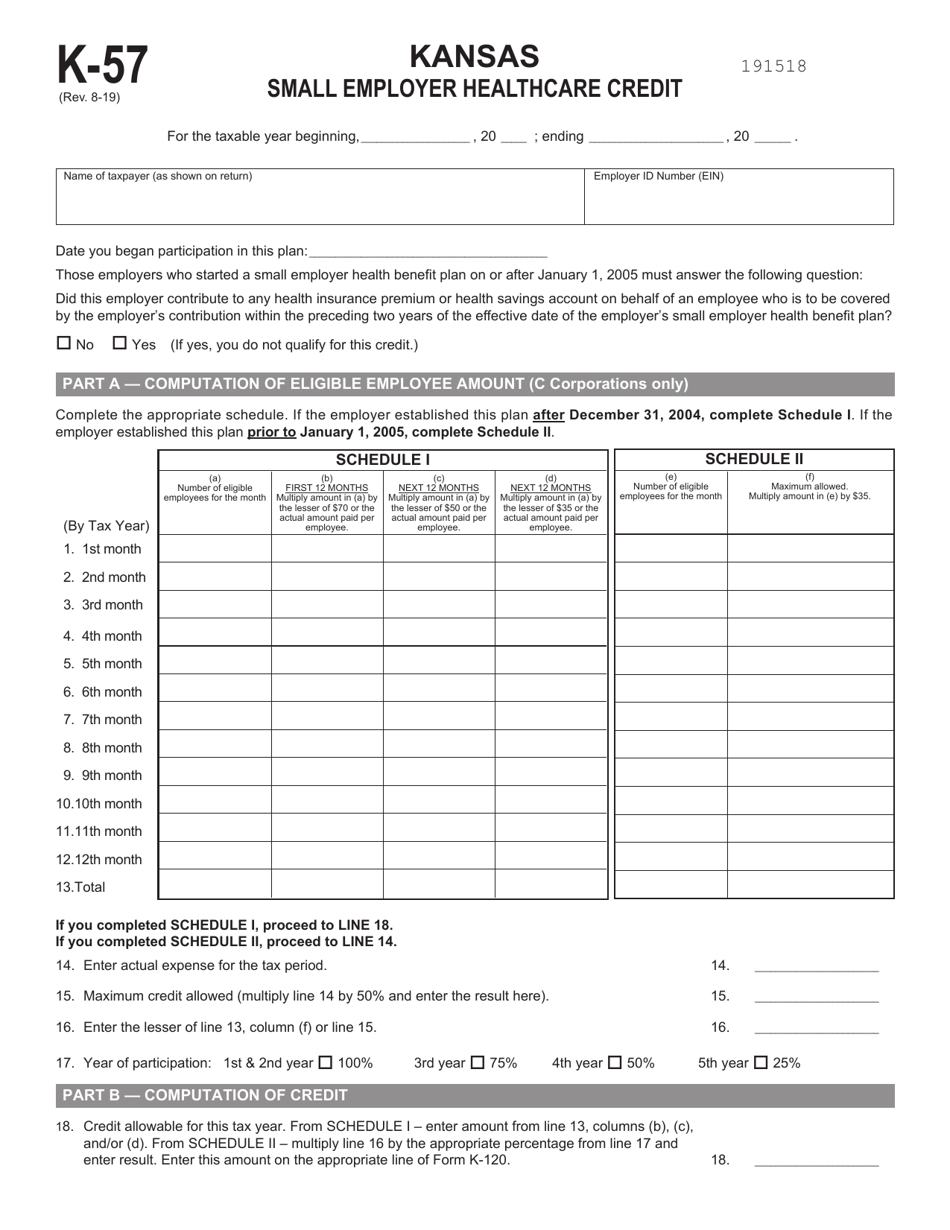

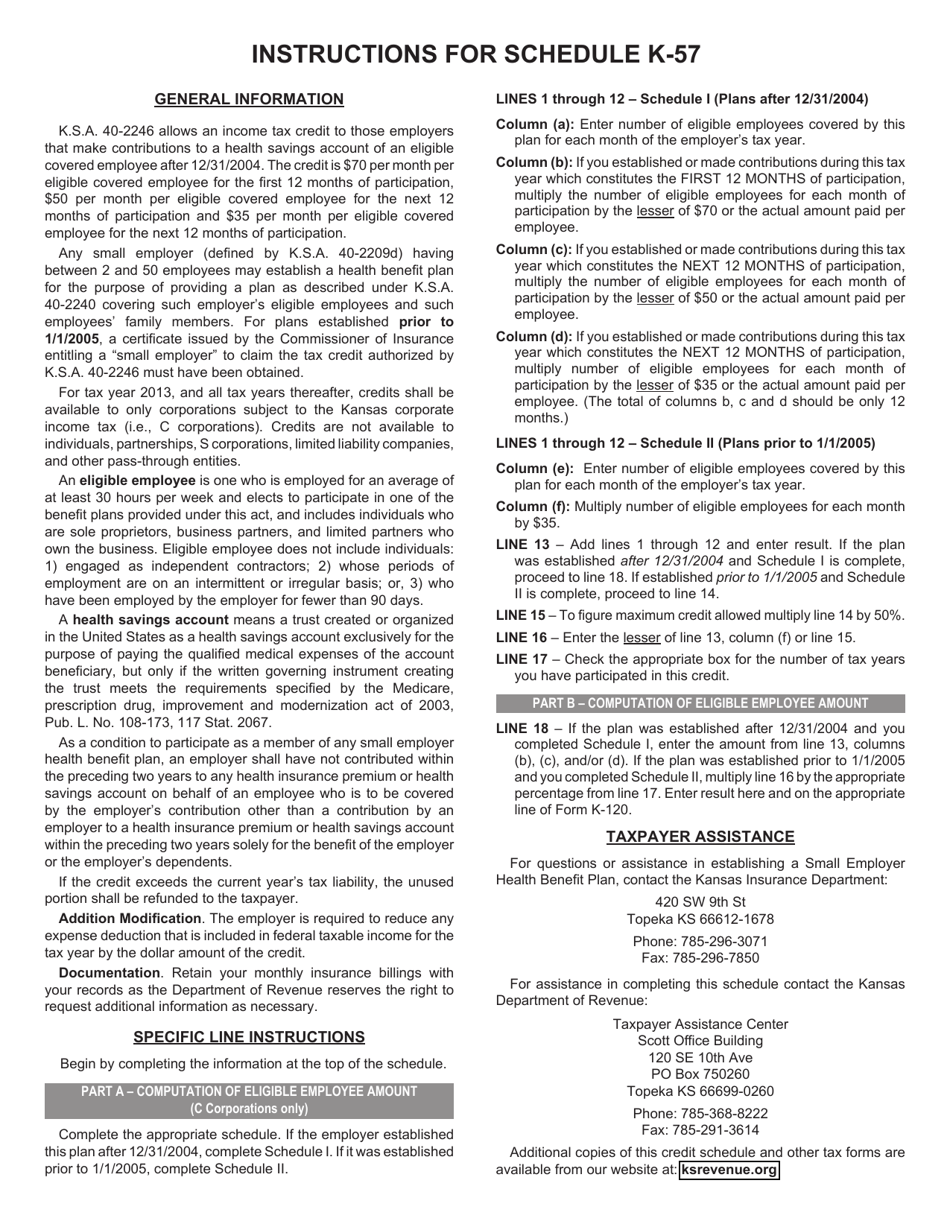

Schedule K-57 Kansas Small Employer Healthcare Credit - Kansas

What Is Schedule K-57?

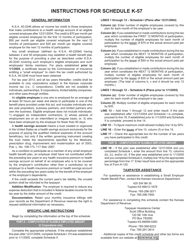

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-57?

A: Schedule K-57 is a form used in Kansas to claim the Small Employer Healthcare Credit.

Q: What is the Small Employer Healthcare Credit?

A: The Small Employer Healthcare Credit is a credit available to small employers in Kansas who provide health insurance to their employees.

Q: Who is eligible for the Small Employer Healthcare Credit?

A: Eligible employers in Kansas must have no more than 50 employees, pay at least 50% of the health insurance premiums, and meet other requirements.

Q: How much is the Small Employer Healthcare Credit worth?

A: The credit amount is calculated based on a percentage of the total health insurance premiums paid by the employer.

Q: How do I claim the Small Employer Healthcare Credit?

A: To claim the credit, you need to fill out Schedule K-57 and attach it to your Kansas state tax return.

Q: Is there a deadline for claiming the Small Employer Healthcare Credit?

A: The credit must be claimed within the same tax year that the health insurance premiums were paid.

Q: Are there any other requirements or limitations for the Small Employer Healthcare Credit in Kansas?

A: Yes, there are additional requirements and limitations, so it's important to review the instructions and guidelines provided by the Kansas Department of Revenue.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-57 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.