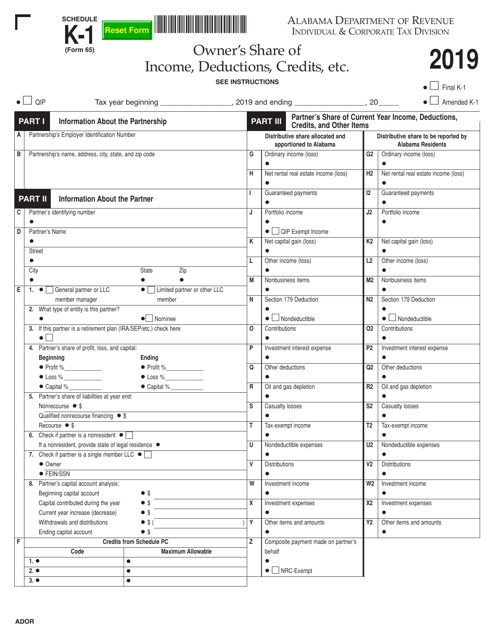

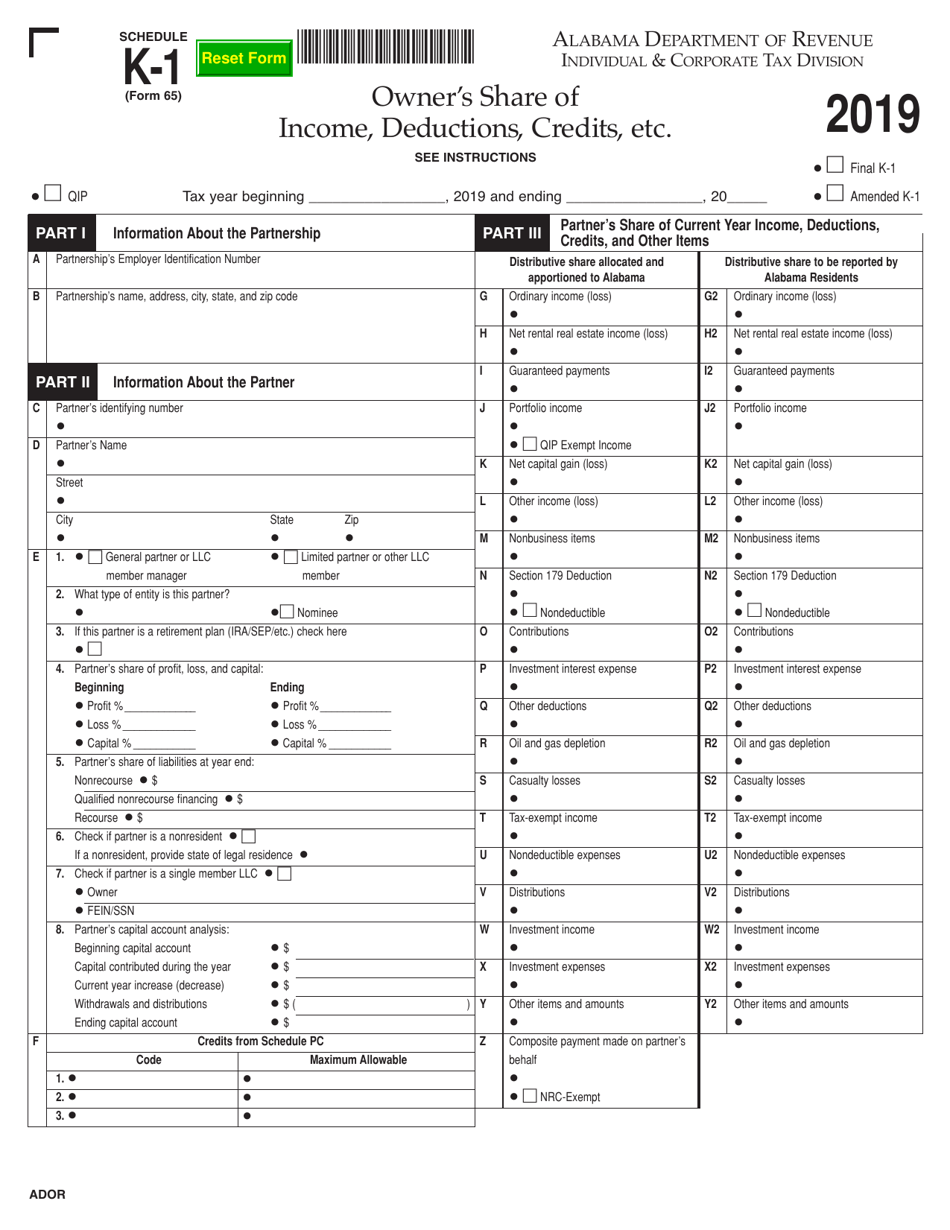

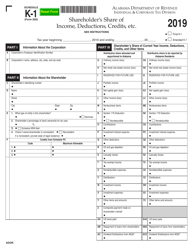

Form 65 Schedule K-1 Owner's Share of Income, Deductions, Credits, Etc. - Alabama

What Is Form 65 Schedule K-1?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 65?

A: Form 65 is a tax form used to report the owner's share of income, deductions, credits, and other tax information in Alabama.

Q: Who needs to file Form 65?

A: Individuals or entities who are owners or beneficiaries of partnerships, trusts, or S corporations in Alabama need to file Form 65.

Q: What information does Form 65 report?

A: Form 65 reports the owner's share of income, deductions, credits, and other tax information from partnerships, trusts, or S corporations.

Q: When is the deadline to file Form 65?

A: The deadline to file Form 65 is the same as the federal tax return deadline, which is April 15th, or the next business day if it falls on a weekend or holiday.

Q: Do I need to include Form 65 with my federal tax return?

A: No, Form 65 is specific to Alabama and should be filed separately with the Alabama Department of Revenue.

Q: Are there any penalties for not filing Form 65?

A: Yes, if you fail to file Form 65 or file it late, you may be subject to penalties and interest on any unpaid tax amounts.

Q: Do I need to attach any additional documentation with Form 65?

A: You may need to attach supporting documents, such as Schedules A, B, C, or D, depending on your specific tax situation. Refer to the instructions provided with Form 65 for more information.

Q: Can I e-file Form 65?

A: Yes, you can e-file Form 65 through the Alabama Department of Revenue's e-filing system, or you can choose to file a paper copy by mail.

Q: What should I do if I have questions or need help with Form 65?

A: If you have questions or need assistance with Form 65, you can contact the Alabama Department of Revenue or consult a tax professional for guidance.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 65 Schedule K-1 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.