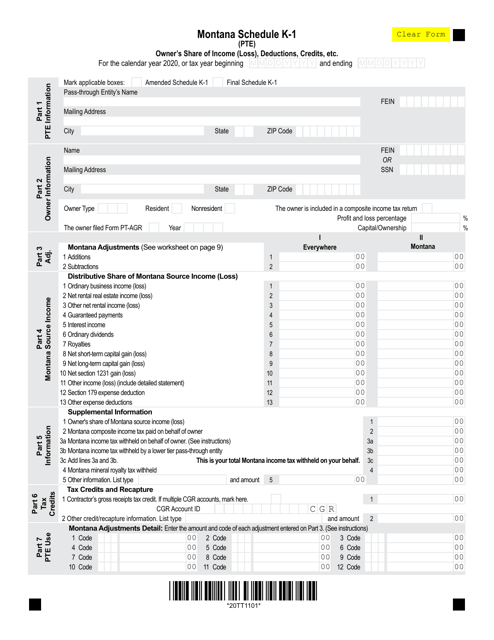

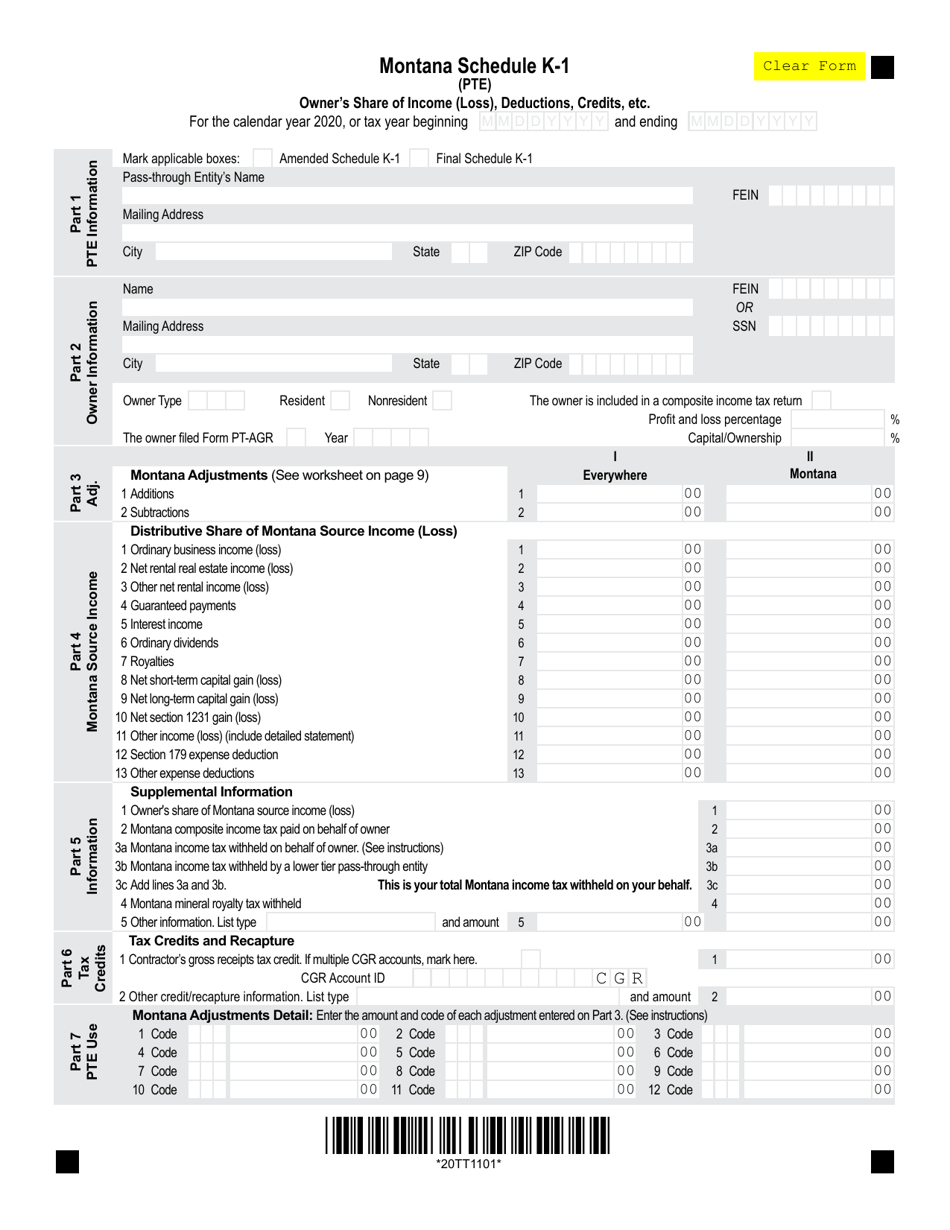

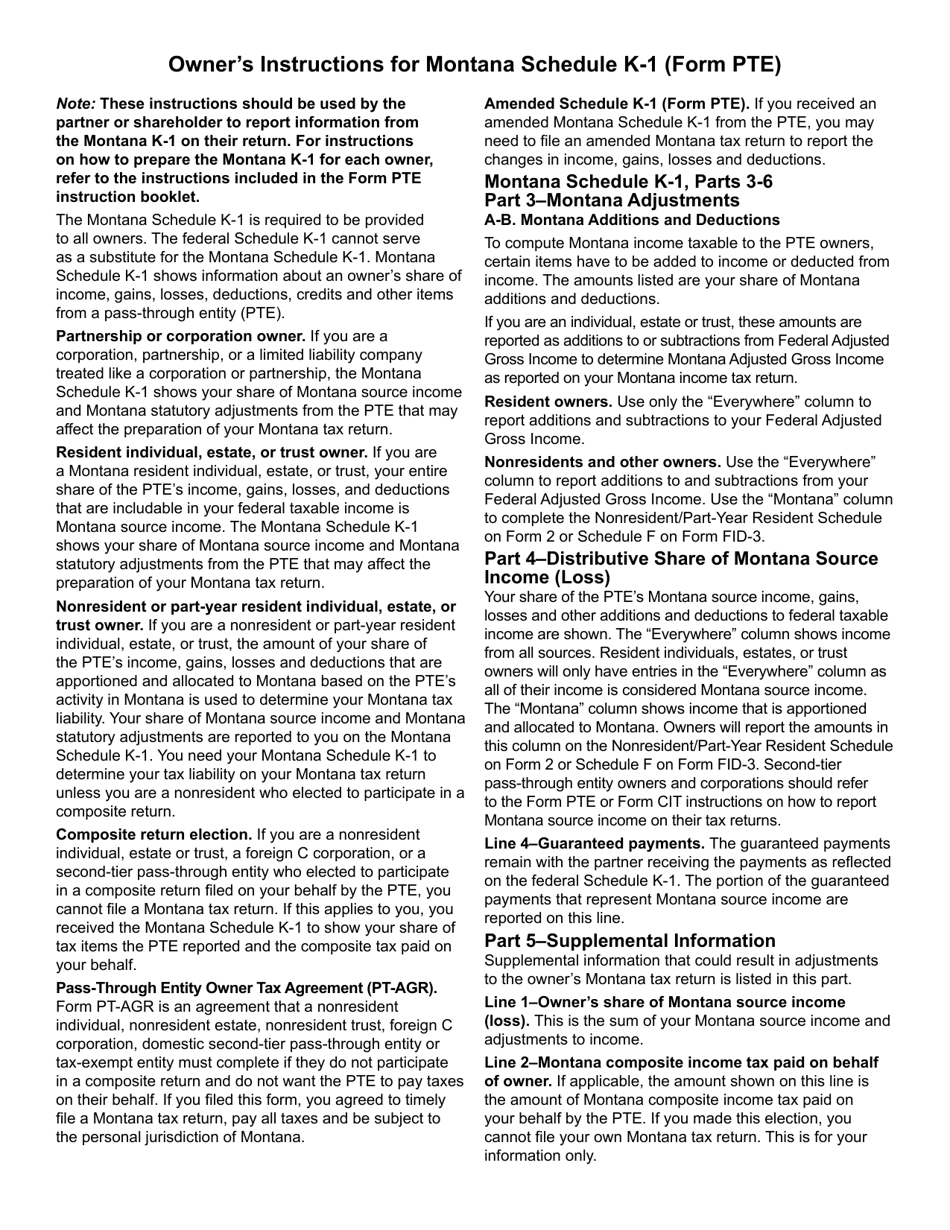

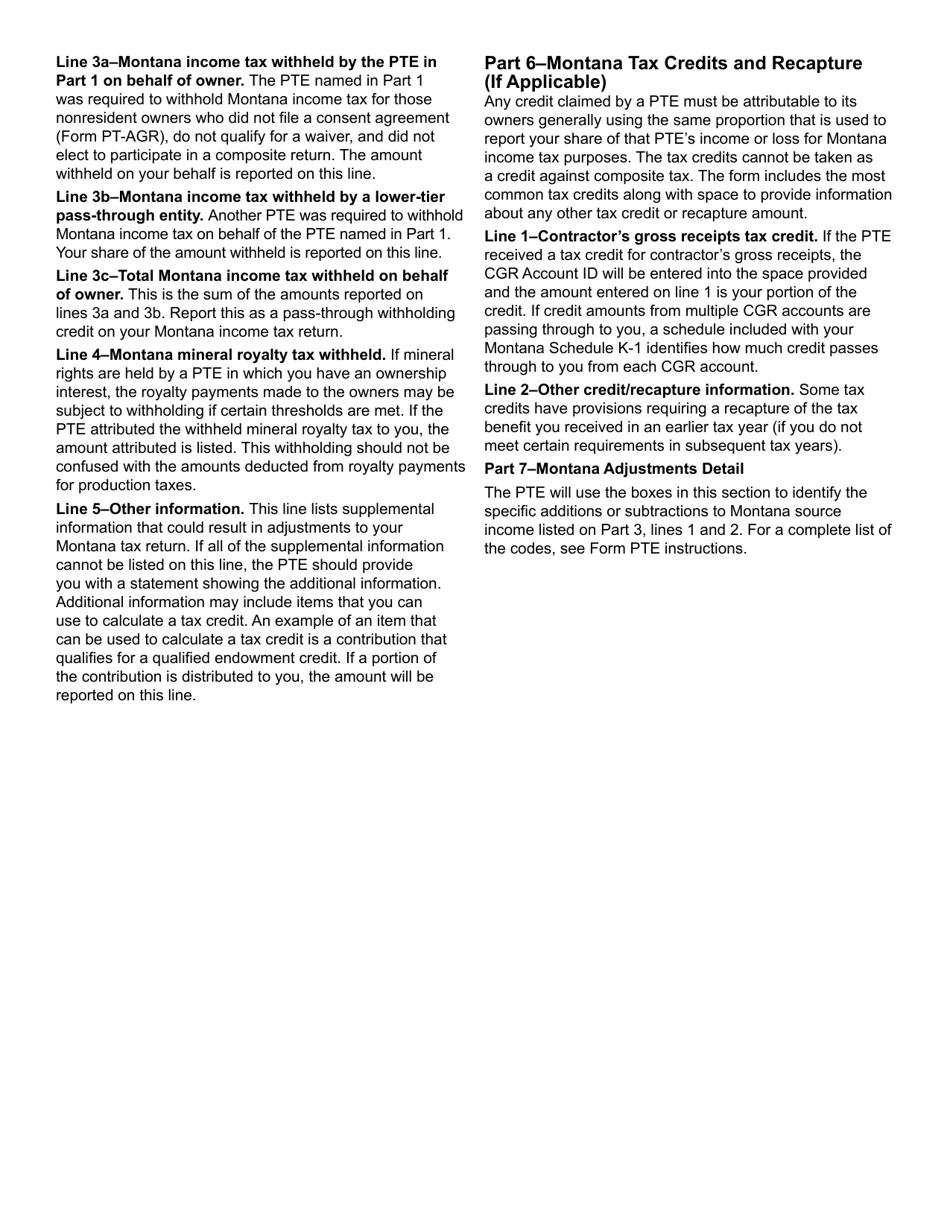

Schedule K-1 Owner's Share of Income (Loss), Deductions, Credits, Etc. - Montana

What Is Schedule K-1?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-1?

A: Schedule K-1 is a tax form used to report the income, deductions, credits, etc. of a partnership, S corporation, estate, or trust to its owners or beneficiaries.

Q: Who receives a Schedule K-1?

A: Owners or beneficiaries of a partnership, S corporation, estate, or trust receive a Schedule K-1.

Q: What is the purpose of Schedule K-1?

A: The purpose of Schedule K-1 is to report the owner's or beneficiary's share of income, deductions, credits, etc. from a partnership, S corporation, estate, or trust.

Q: Do I need to include Schedule K-1 with my tax return?

A: Yes, if you receive a Schedule K-1, you generally need to include it with your individual tax return.

Q: Can I have multiple Schedule K-1s?

A: Yes, if you have ownership in multiple partnerships, S corporations, estates, or trusts, you may receive multiple Schedule K-1s.

Q: What should I do if I have questions about my Schedule K-1?

A: If you have questions about your Schedule K-1, you should consult a tax professional or refer to the instructions provided with the form.

Q: Is Schedule K-1 specific to Montana?

A: No, Schedule K-1 is a federal tax form and is not specific to any particular state. However, it may be used for reporting income, deductions, credits, etc. related to Montana activities.

Form Details:

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-1 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.