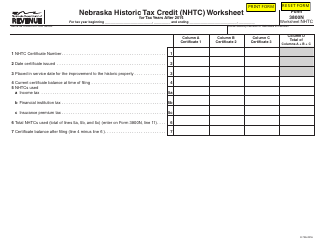

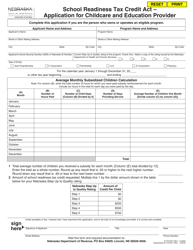

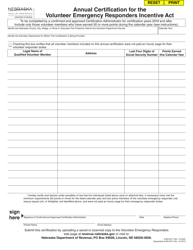

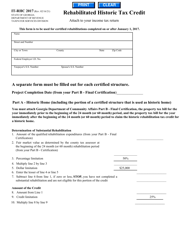

Instructions for Form 8-767-2017 Part 4, 5 Nebraska Historic Tax Credit (Nhtc) - Nebraska

This document contains official instructions for Form 8-767-2017 Part 4 and Part 5 . Both forms are released and collected by the Nebraska Department of Revenue.

FAQ

Q: What is Form 8-767-2017?

A: Form 8-767-2017 is a tax form related to the Nebraska Historic Tax Credit (NHTC).

Q: What is Part 4 of Form 8-767-2017?

A: Part 4 is a section of the tax form where you provide information about the Nebraska Historic Tax Credit (NHTC).

Q: What is Part 5 of Form 8-767-2017?

A: Part 5 is a section of the tax form where you report the total credit and any carryforward amounts for the Nebraska Historic Tax Credit (NHTC).

Q: What is the Nebraska Historic Tax Credit?

A: The Nebraska Historic Tax Credit (NHTC) is a tax credit program that encourages the rehabilitation of historic buildings in Nebraska.

Q: How do I claim the Nebraska Historic Tax Credit?

A: To claim the Nebraska Historic Tax Credit, you need to complete Part 4 and Part 5 of Form 8-767-2017 and include it with your tax return.

Q: Can I carry forward unused Nebraska Historic Tax Credit?

A: Yes, you can carry forward unused Nebraska Historic Tax Credit amounts to future tax years.

Q: What should I do if I have questions about Form 8-767-2017?

A: If you have questions about Form 8-767-2017 or the Nebraska Historic Tax Credit, you should contact the Nebraska Department of Revenue for assistance.

Instruction Details:

- This 9-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Nebraska Department of Revenue.