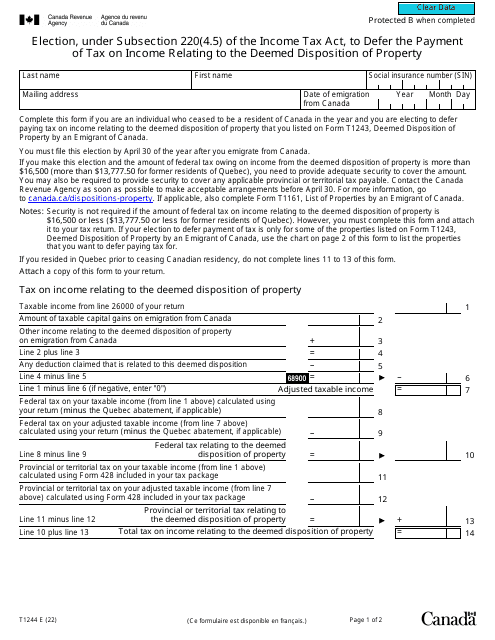

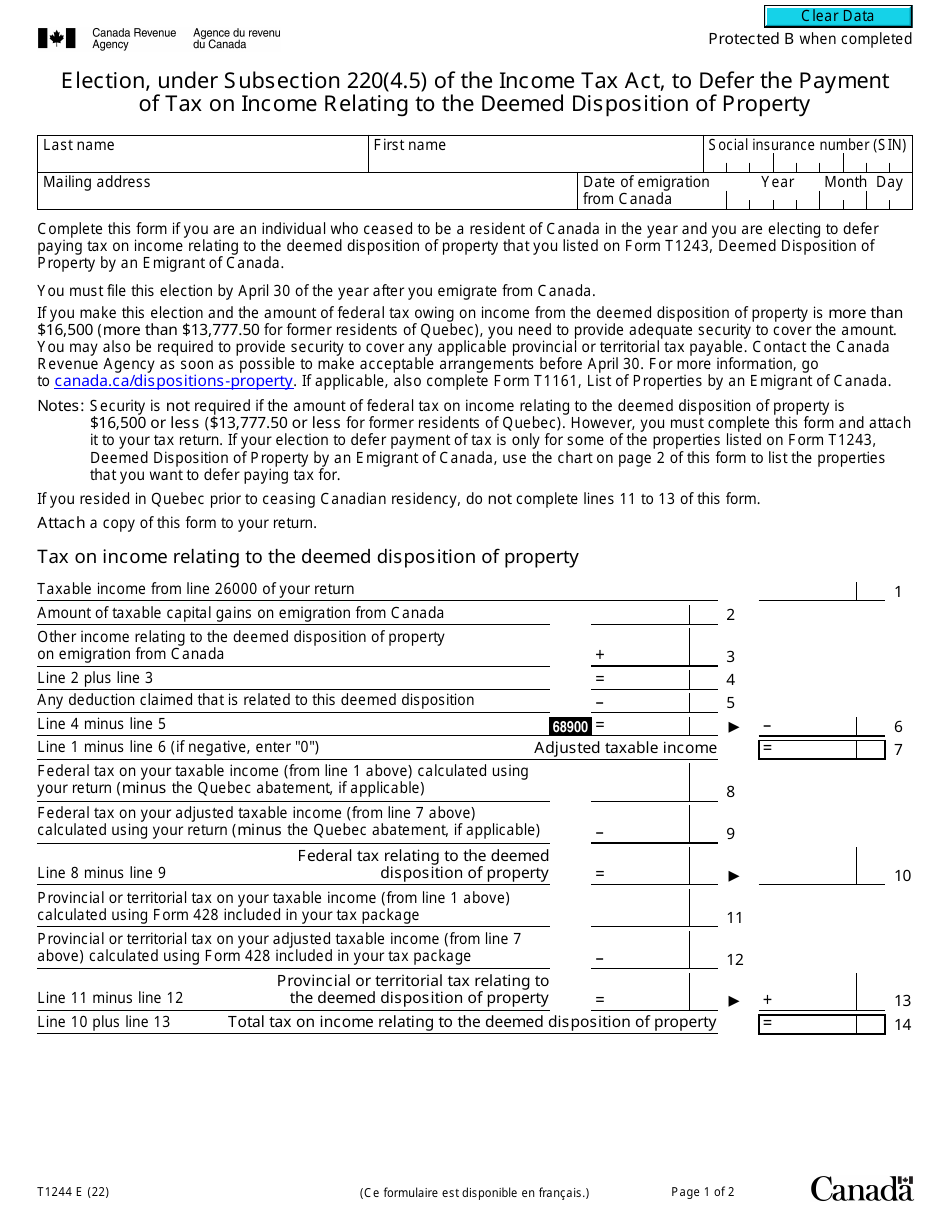

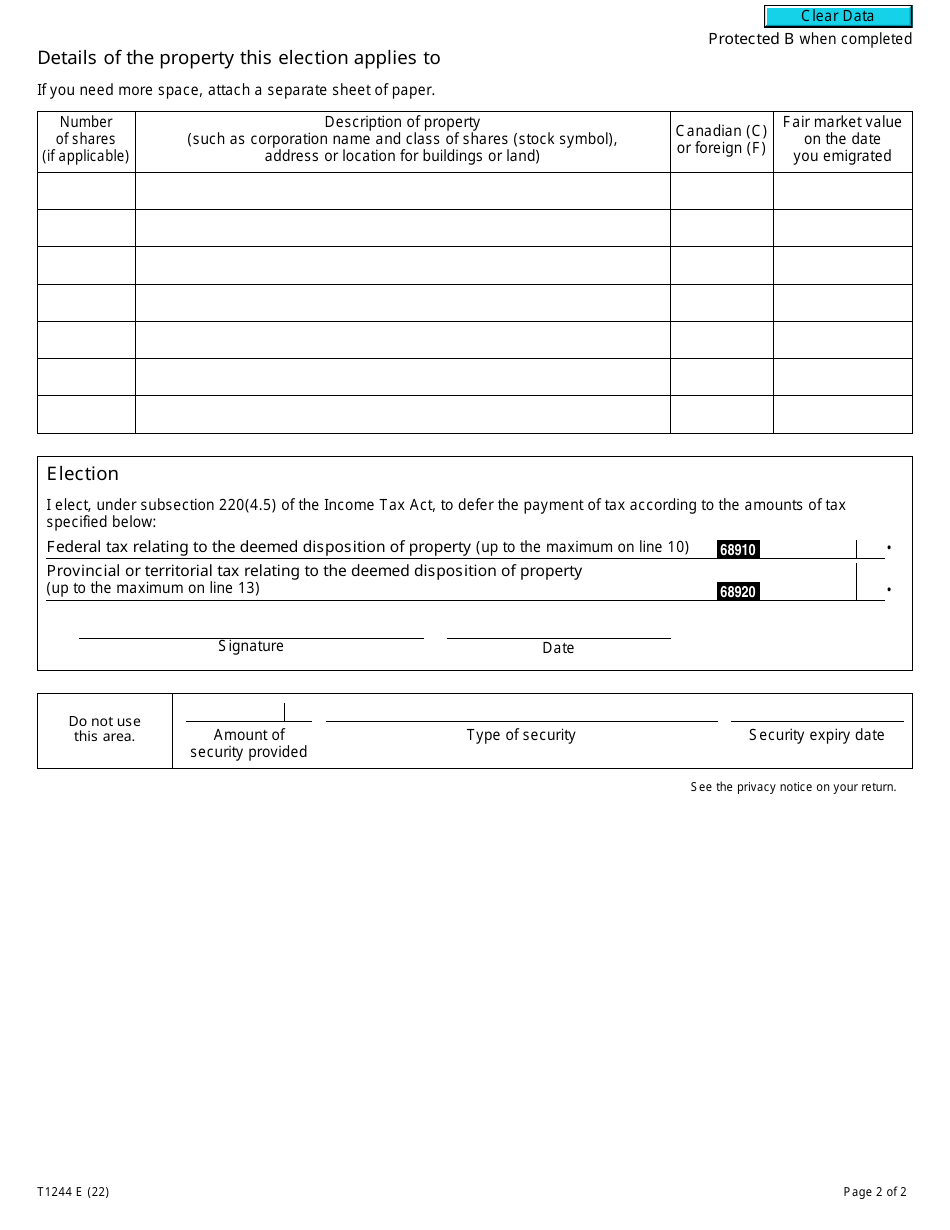

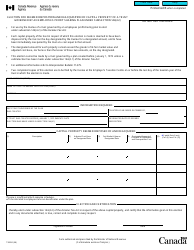

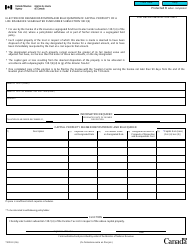

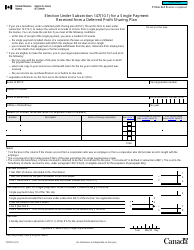

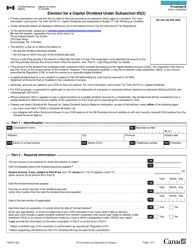

Form T1244 Election, Under Subsection 220(4.5) of the Income Tax Act, to Defer the Payment of Tax on Income Relating to the Deemed Disposition of Property - Canada

Form T1244 Election, Under Subsection 220(4.5) of the Income Tax Act, to Defer the Payment of Tax on Income Relating to the Deemed Disposition of Property in Canada is used to postpone the payment of taxes on income that is related to the deemed disposition of property. It allows eligible individuals or organizations to defer the tax payment to a later date.

The taxpayer who wants to defer the payment of tax on income relating to the deemed disposition of property would file the Form T1244 Election in Canada.

Form T1244 Election, Under Subsection 220(4.5) of the Income Tax Act, to Defer the Payment of Tax on Income Relating to the Deemed Disposition of Property - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1244?

A: Form T1244 is a tax form used in Canada to elect to defer the payment of tax on income relating to the deemed disposition of property.

Q: What is the purpose of Form T1244?

A: The purpose of Form T1244 is to allow individuals or corporations to defer the payment of tax on income that arises from the deemed disposition of property.

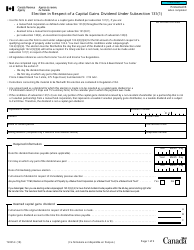

Q: What is a deemed disposition of property?

A: A deemed disposition of property refers to the situation where the Income Tax Act considers a property to have been disposed of, even if no actual sale or transfer takes place.

Q: What is a subsection 220(4.5) election?

A: A subsection 220(4.5) election is a provision in the Income Tax Act that allows taxpayers to defer the payment of tax on income from a deemed disposition of property.

Q: How does the election work?

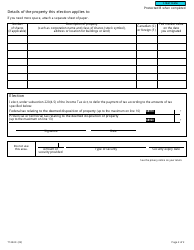

A: By completing and filing Form T1244, taxpayers can elect to defer the payment of tax on the income arising from the deemed disposition of property. The deferred tax is then payable in the future when certain triggering events occur.

Q: What are the eligibility criteria for making the election?

A: To be eligible to make the subsection 220(4.5) election using Form T1244, the taxpayer must meet specific criteria outlined in the Income Tax Act. These criteria include the type of property being disposed of and the timing of the deemed disposition.

Q: Are there any restrictions on the election?

A: Yes, there are certain restrictions on the subsection 220(4.5) election. For example, the election cannot be made for certain types of property, such as inventory. Additionally, the election must be made within a specified timeframe after the deemed disposition.

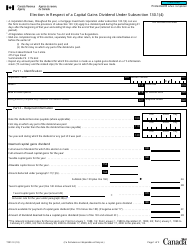

Q: How long can the tax payment be deferred?

A: The length of the deferral period depends on the specific circumstances and triggering events outlined in the Income Tax Act. Generally, the deferred tax becomes payable when one of these triggering events occurs, such as the actual sale or transfer of the property.

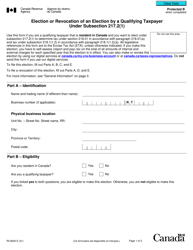

Q: What should I do if I want to make a subsection 220(4.5) election?

A: If you want to make a subsection 220(4.5) election to defer the payment of tax on income relating to the deemed disposition of property, you should consult with a tax professional or refer to the official guidelines provided by the Canada Revenue Agency.

Q: Is Form T1244 applicable only to individuals, or can corporations also use it?

A: Both individuals and corporations can use Form T1244 to make a subsection 220(4.5) election and defer the payment of tax on income arising from the deemed disposition of property.