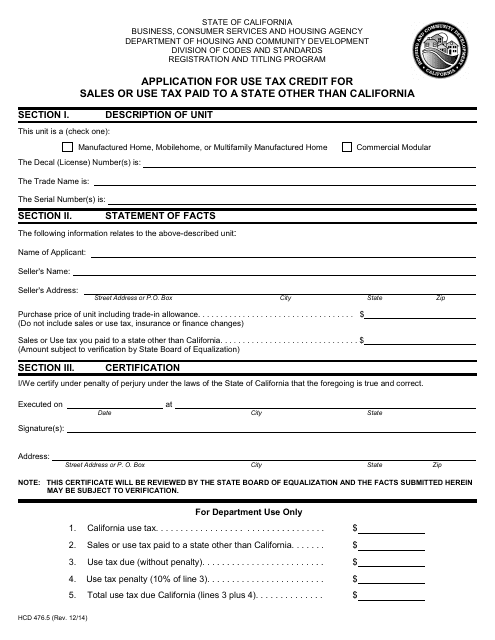

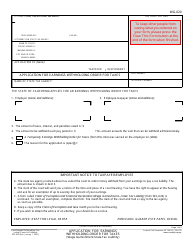

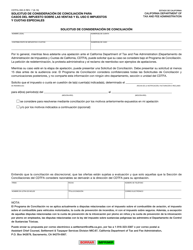

Form HCD476.5 Application for Use Tax Credit for Sales or Use Tax Paid to a State Other Than California - California

What Is Form HCD476.5?

This is a legal form that was released by the California Department of Housing & Community Development - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HCD476.5?

A: Form HCD476.5 is the Application for Use Tax Credit for Sales or Use Tax Paid to a State Other Than California in California.

Q: When should I use Form HCD476.5?

A: You should use Form HCD476.5 when you have paid sales or use tax to a state other than California and want to claim a credit on your California tax return.

Q: What is the purpose of Form HCD476.5?

A: The purpose of Form HCD476.5 is to determine the amount of credit you can claim on your California tax return for sales or use tax paid to another state.

Q: Are there any supporting documents required for Form HCD476.5?

A: Yes, you will need to attach copies of your receipts or other proof of sales or use tax paid to the state outside of California.

Q: What is the deadline for filing Form HCD476.5?

A: Form HCD476.5 must be filed by the due date of your California tax return, including extensions if applicable.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the California Department of Housing & Community Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HCD476.5 by clicking the link below or browse more documents and templates provided by the California Department of Housing & Community Development.