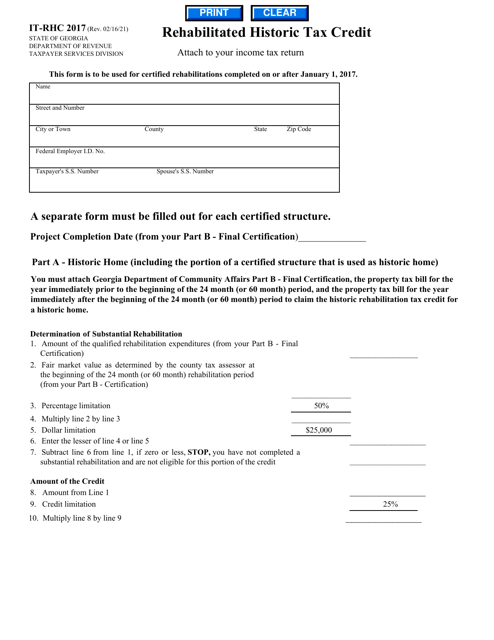

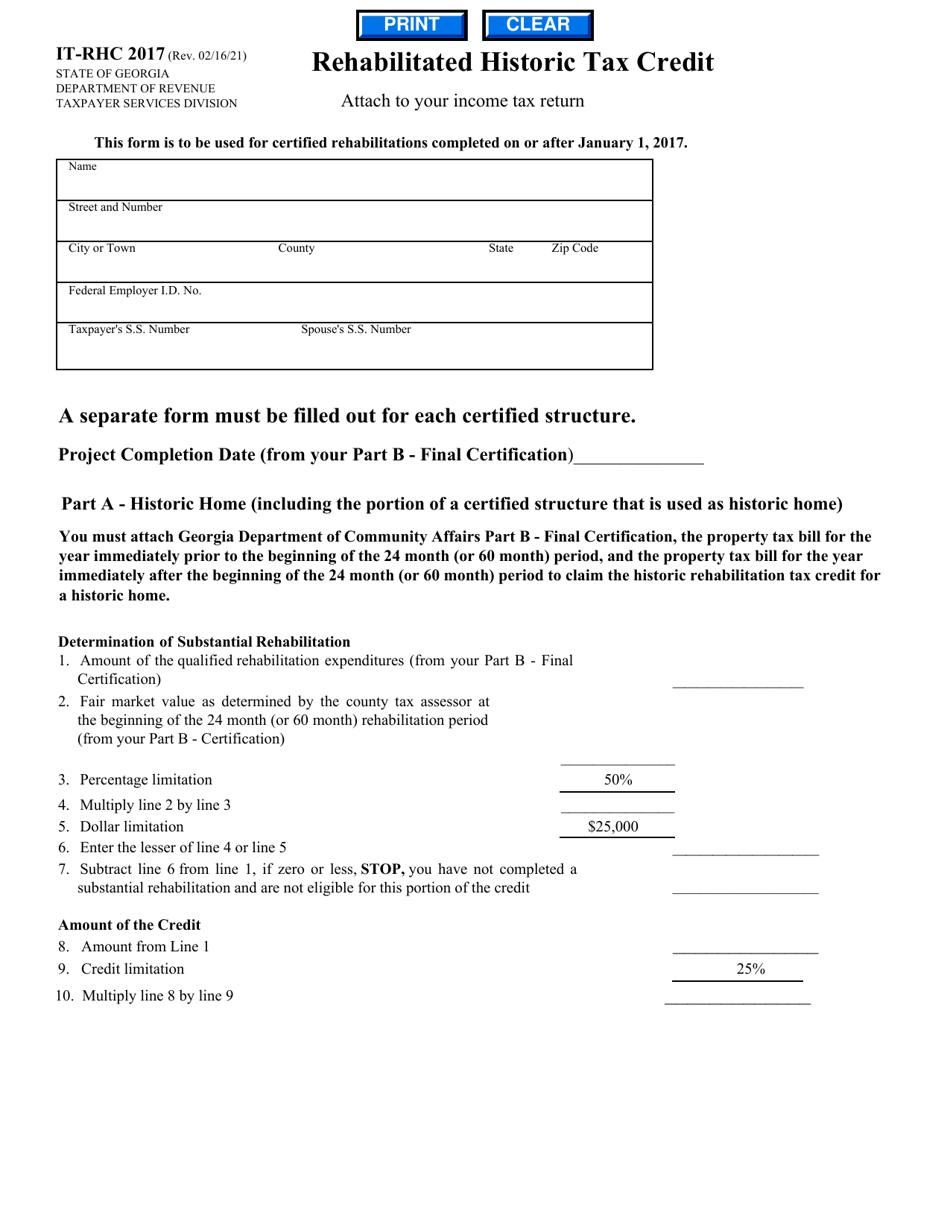

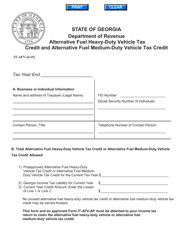

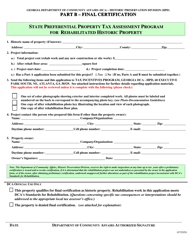

Form IT-RHC Rehabilitated Historic Tax Credit - Georgia (United States)

What Is Form IT-RHC?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT-RHC Rehabilitated Historic Tax Credit?

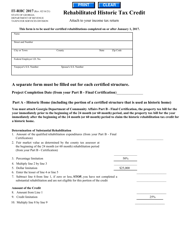

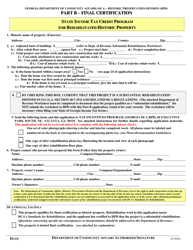

A: The IT-RHC Rehabilitated Historic Tax Credit is a program in Georgia that provides tax credits to individuals or businesses who rehabilitate historic properties.

Q: Who is eligible for the IT-RHC Rehabilitated Historic Tax Credit?

A: Individuals or businesses that undertake qualified rehabilitation projects on historic properties in Georgia may be eligible for the tax credit.

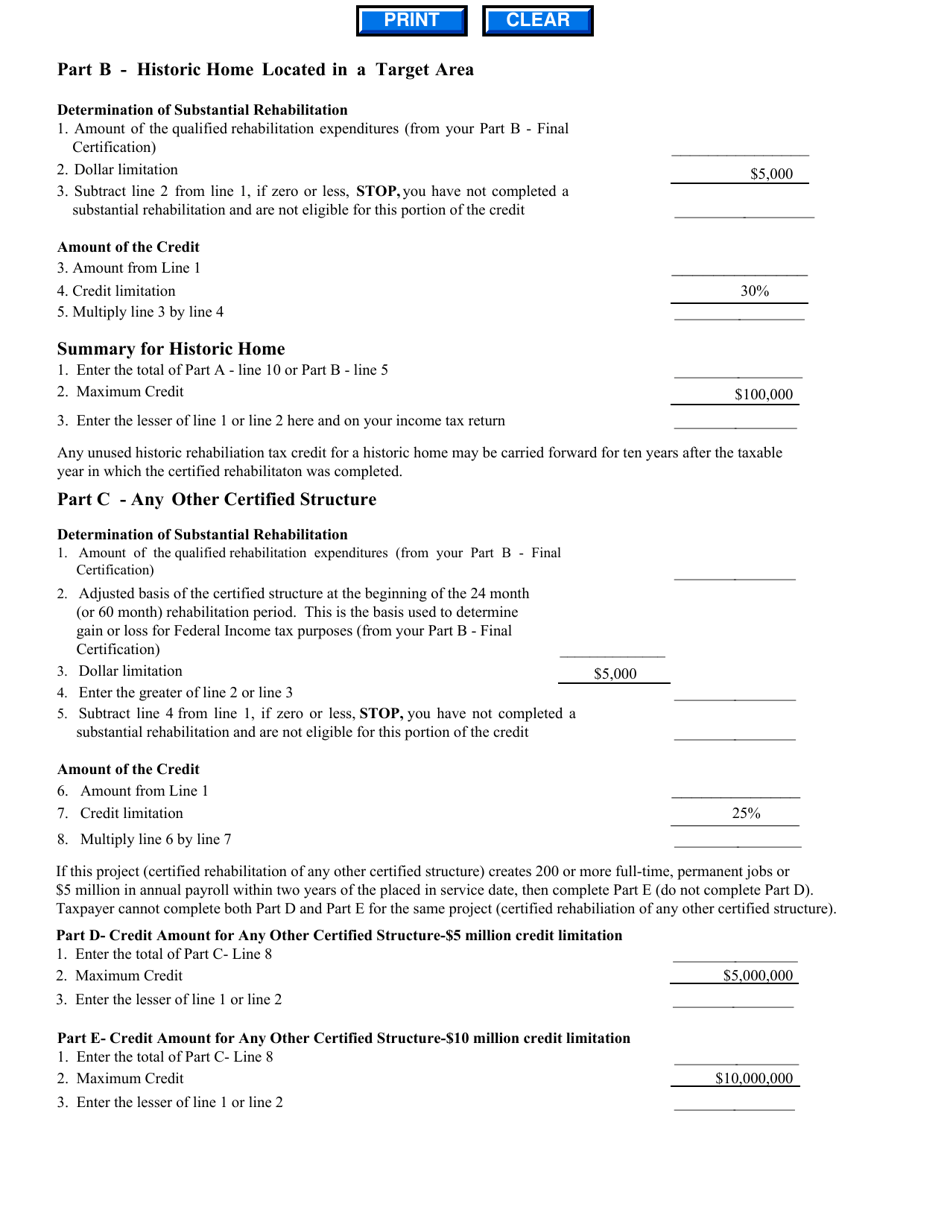

Q: How much is the IT-RHC Rehabilitated Historic Tax Credit?

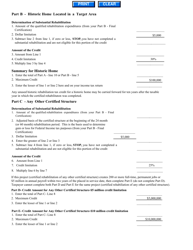

A: The tax credit is equal to 25% of the qualified rehabilitation expenses incurred by the taxpayer.

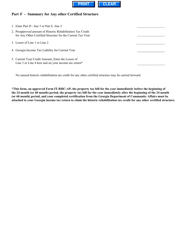

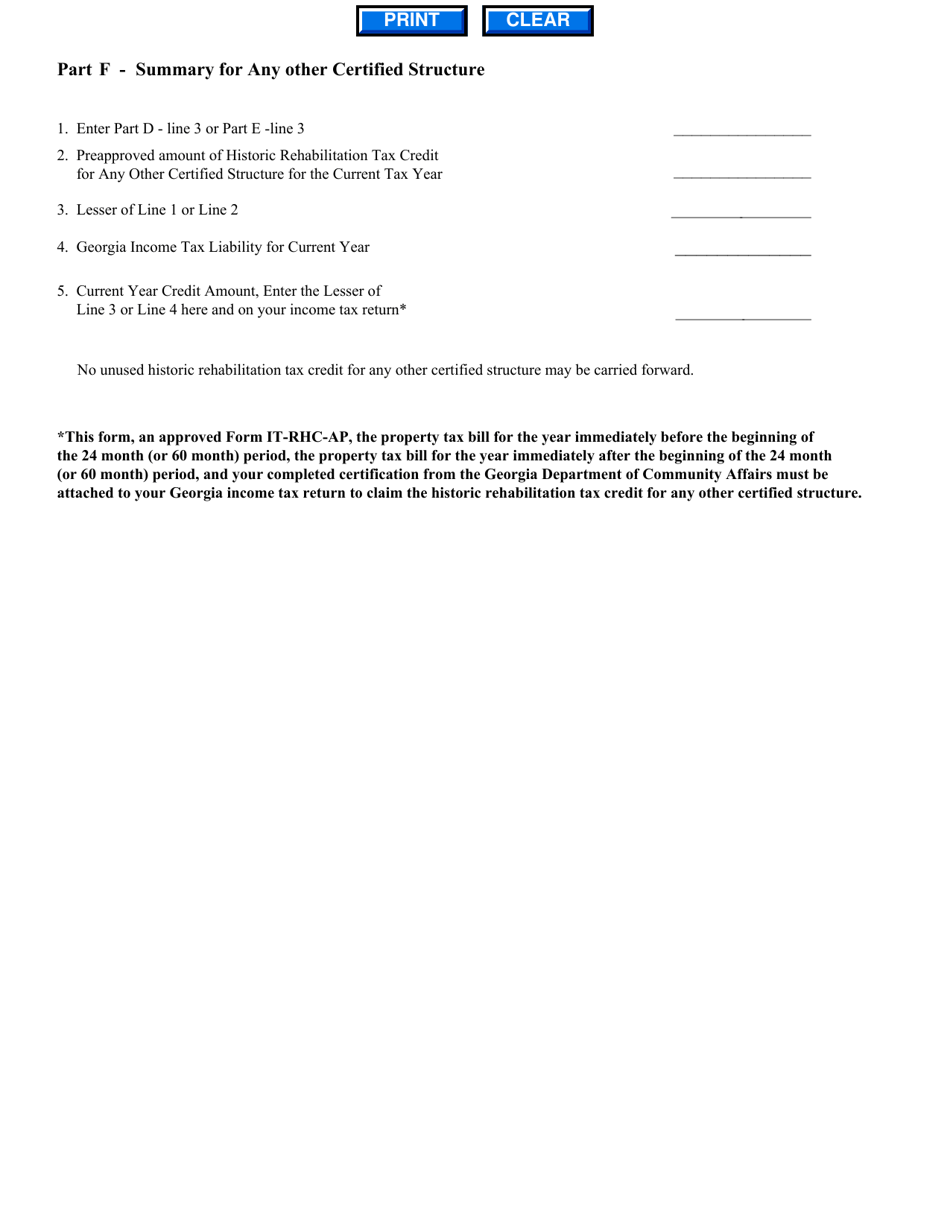

Q: What can the IT-RHC Rehabilitated Historic Tax Credit be used for?

A: The tax credit can be used to offset Georgia income tax liability or, if there is excess credit, it can be carried forward for up to 10 years.

Q: Are there any limitations or requirements for the IT-RHC Rehabilitated Historic Tax Credit?

A: Yes, there are specific criteria and guidelines that must be met in order to qualify for the tax credit. These include the property being listed on the National Register of Historic Places or located in a historic district designated by the local government.

Form Details:

- Released on February 16, 2021;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-RHC by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.