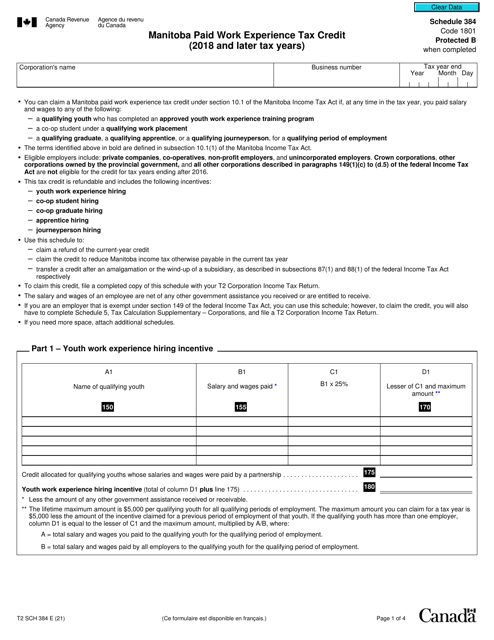

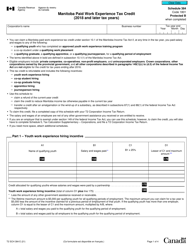

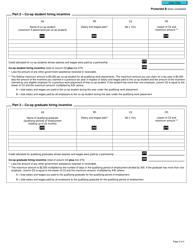

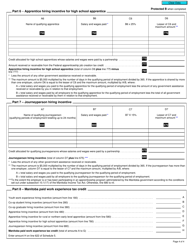

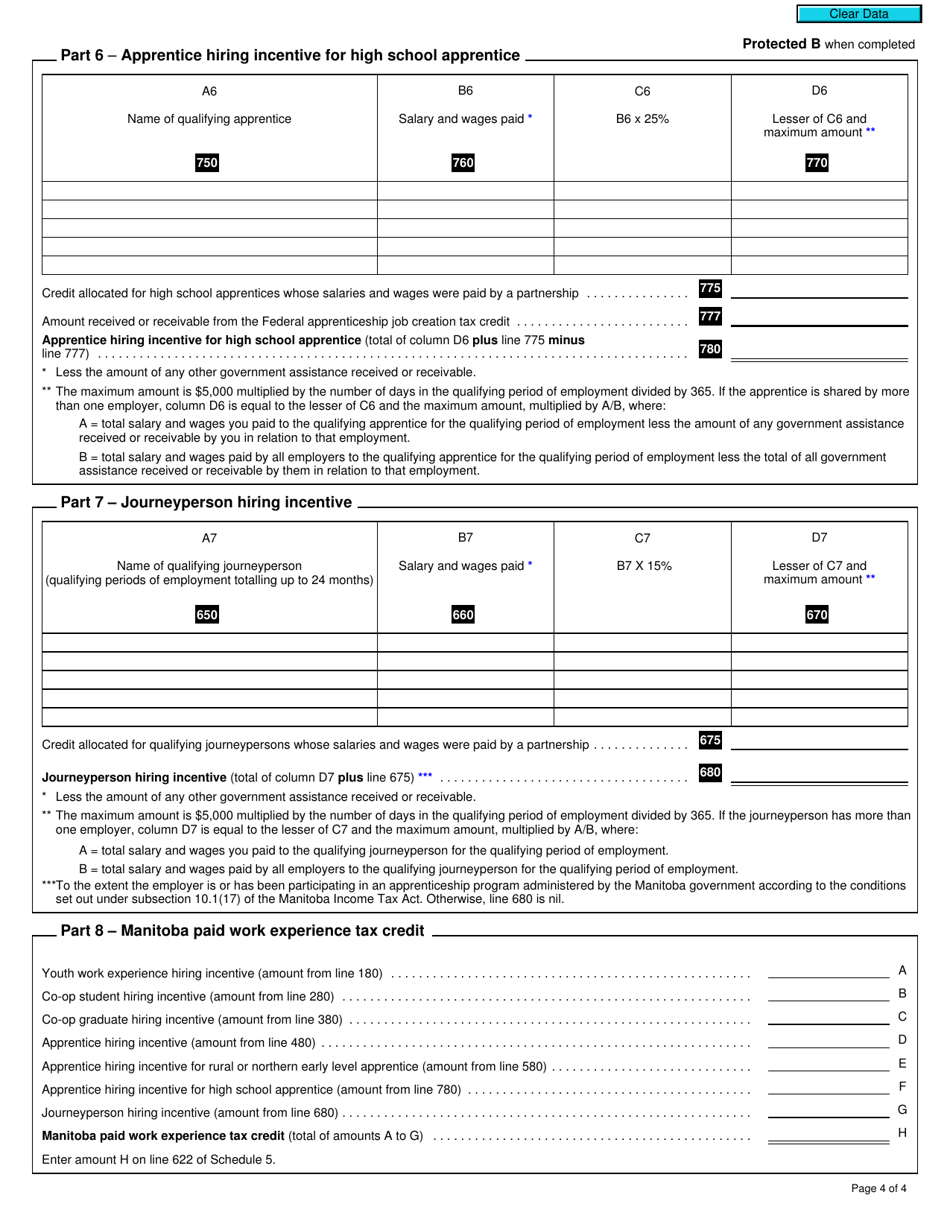

Form T2 Schedule 384 Manitoba Paid Work Experience Tax Credit (2018 and Later Tax Years) - Canada

Form T2 Schedule 384 in Canada is used to calculate the Manitoba Paid Work Experience Tax Credit. It is for corporations that have paid eligible wages to employees who have completed eligible work experience programs in Manitoba. The tax credit helps to reduce the amount of taxes owed by the corporation.

The Form T2 Schedule 384 Manitoba Paid Work Experience Tax Credit is filed by businesses or corporations in Canada that are eligible for the tax credit.

Form T2 Schedule 384 Manitoba Paid Work Experience Tax Credit (2018 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 384?

A: Form T2 Schedule 384 is a Canadian tax form.

Q: What is the purpose of Form T2 Schedule 384?

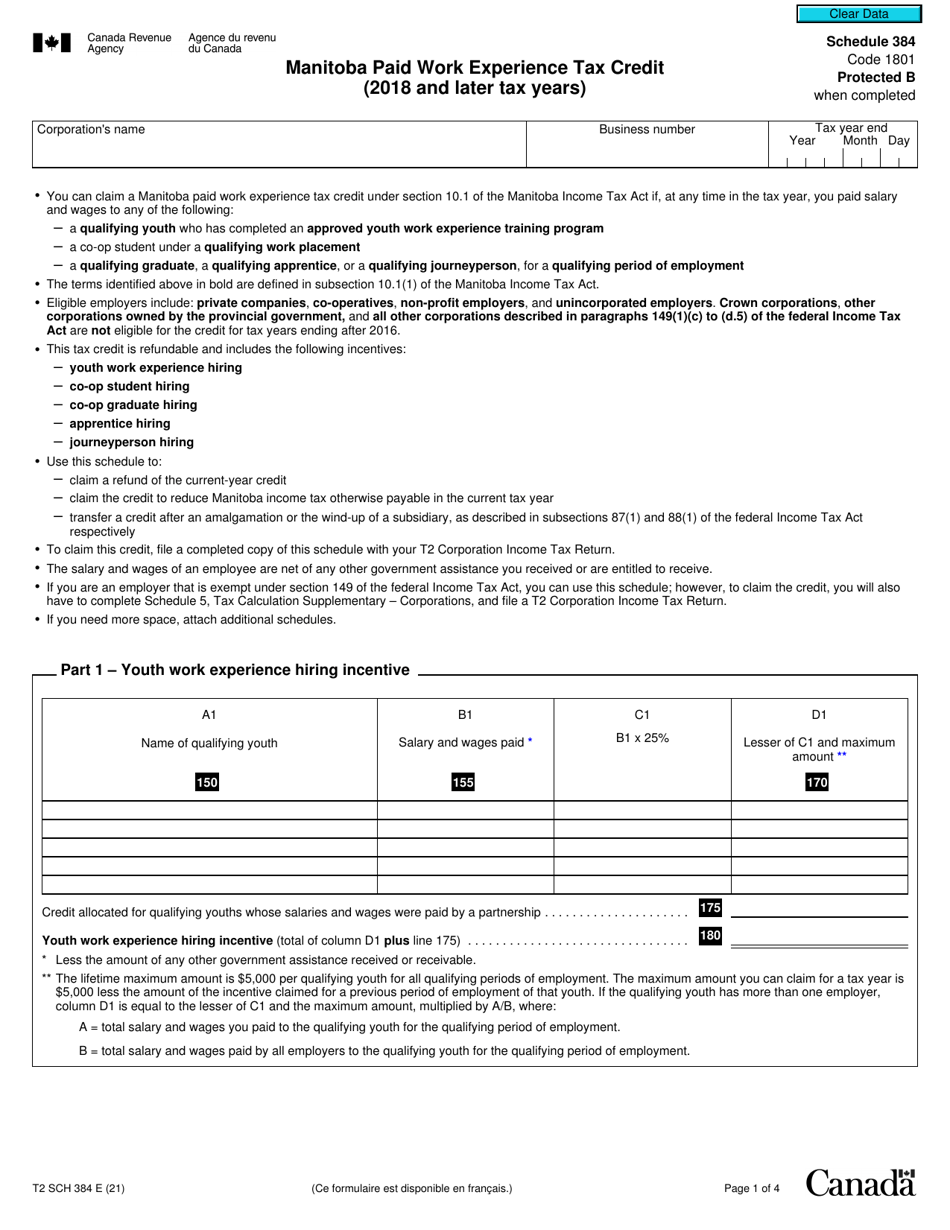

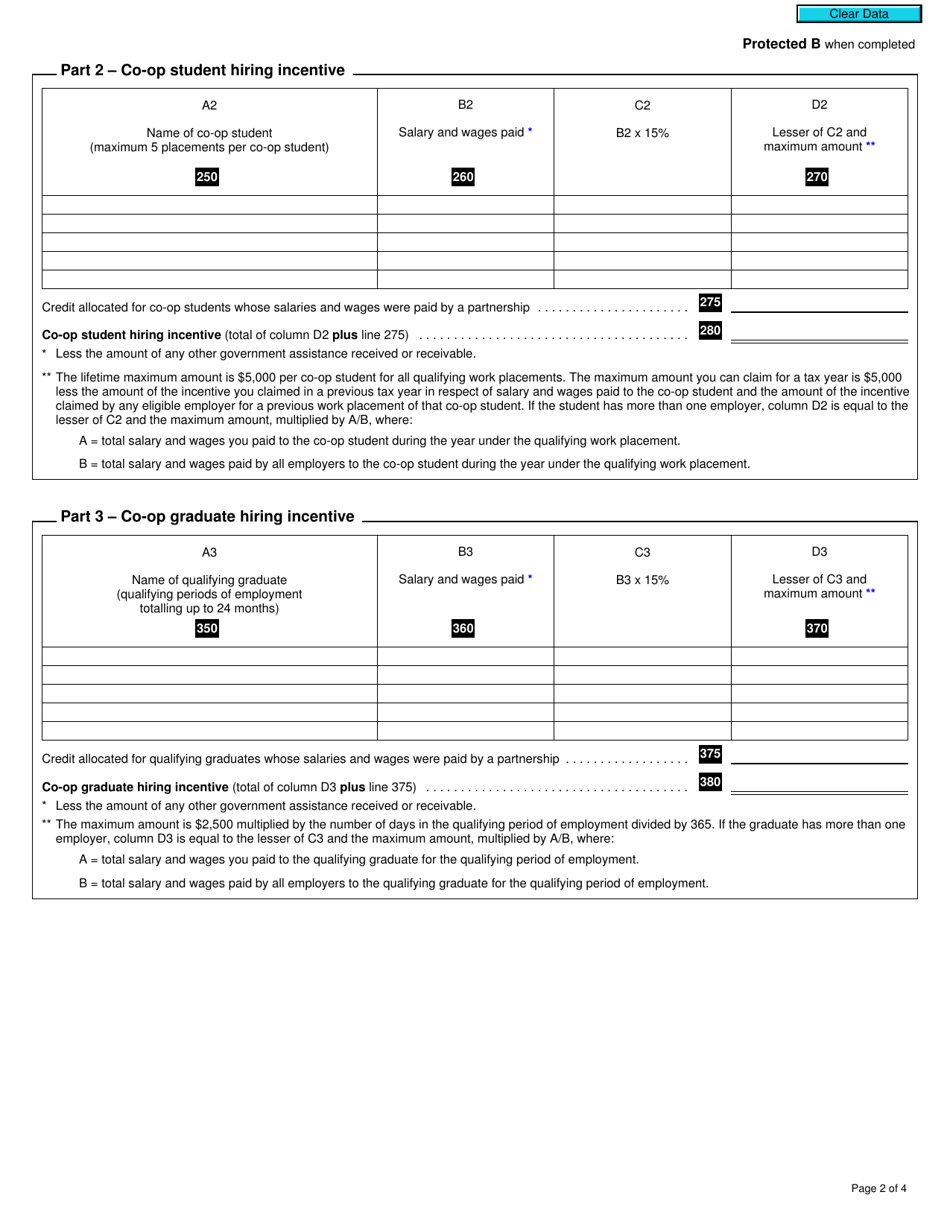

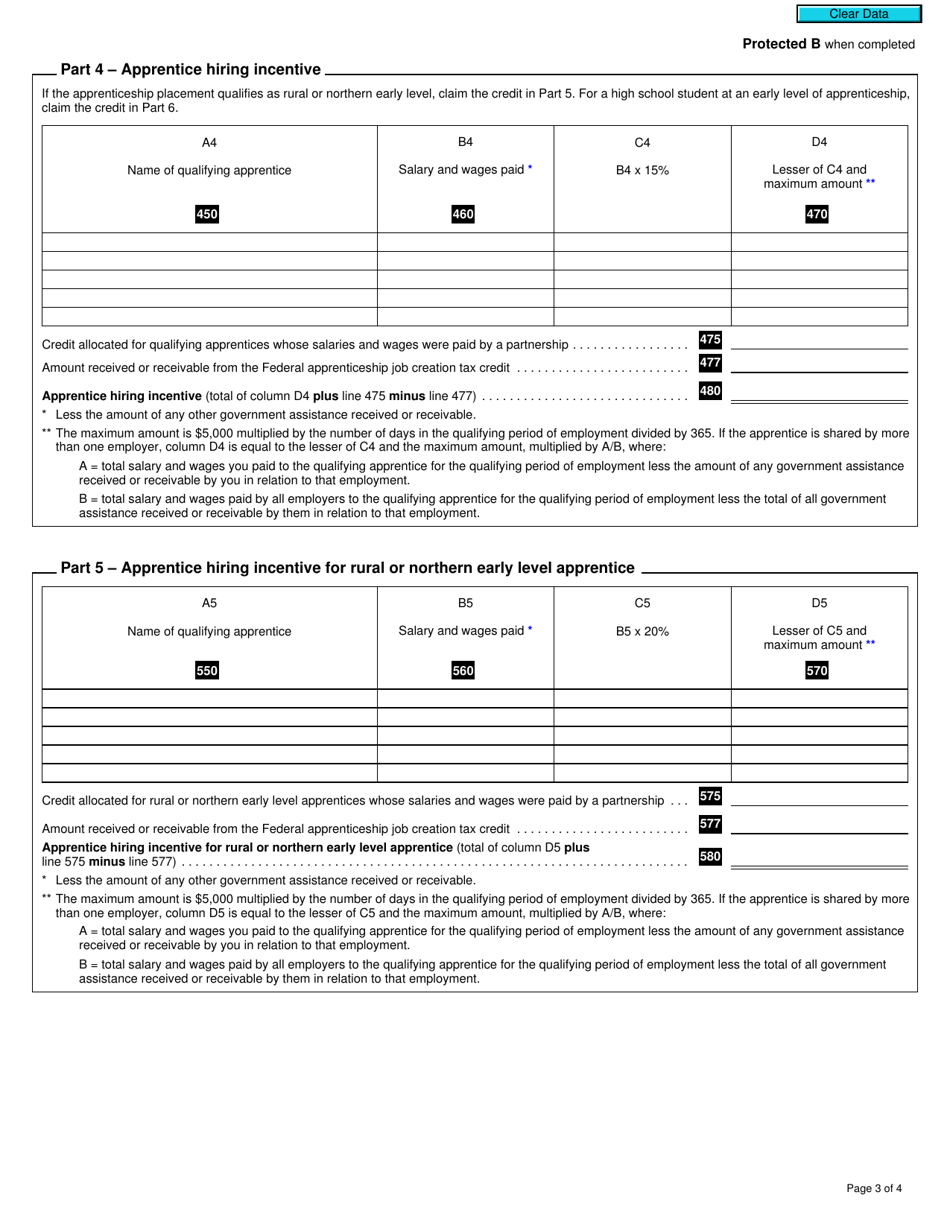

A: The purpose of Form T2 Schedule 384 is to claim the Manitoba Paid Work Experience Tax Credit for tax years 2018 and later.

Q: Who can use Form T2 Schedule 384?

A: Form T2 Schedule 384 can be used by businesses in Manitoba that qualify for the Paid Work Experience Tax Credit.

Q: What is the Paid Work Experience Tax Credit?

A: The Paid Work Experience Tax Credit is a tax credit aimed at encouraging Manitoba businesses to hire students for work experience placements.

Q: What expenses can be claimed on Form T2 Schedule 384?

A: Expenses related to work experience placements for students can be claimed on Form T2 Schedule 384.