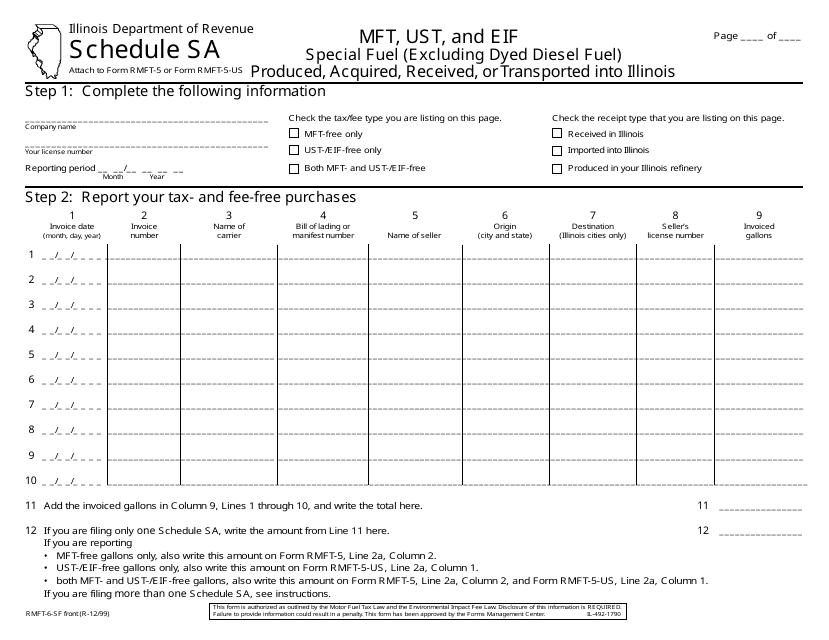

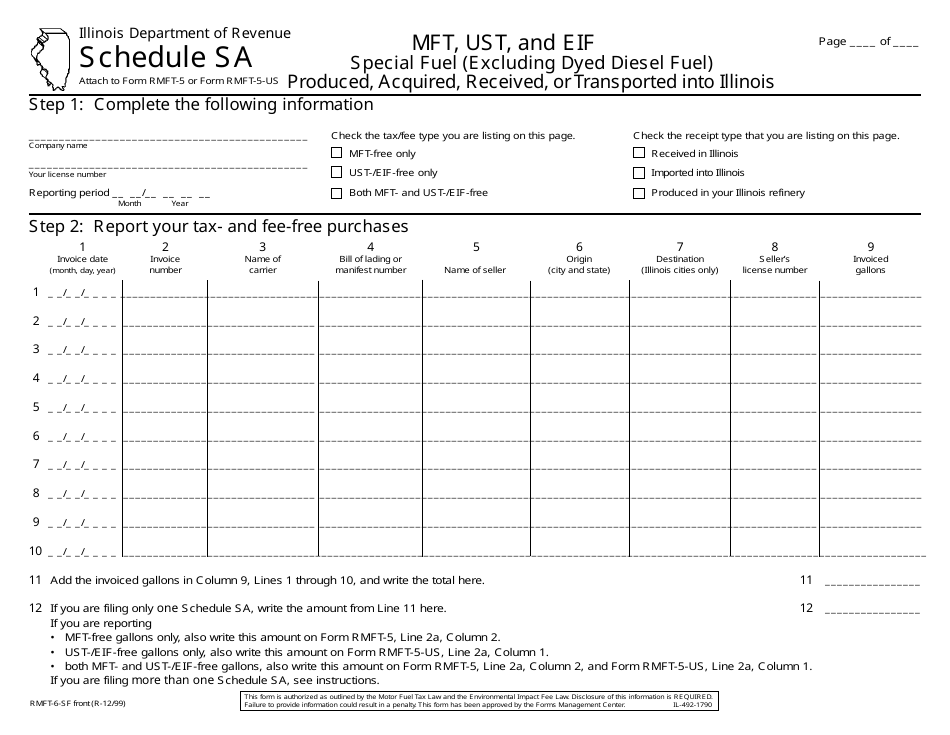

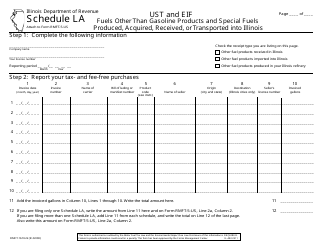

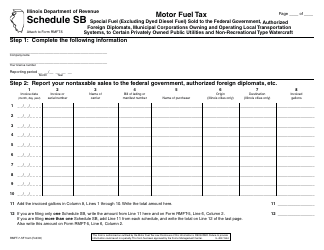

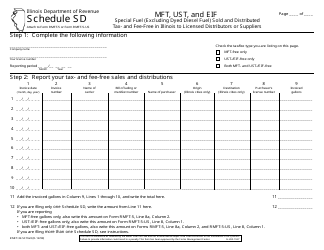

Form RMFT-6-SF Schedule SA Special Fuel (Excluding Dyed Diesel Fuel) Produced, Acquired, Received, or Transported Into Illinois - Illinois

What Is Form RMFT-6-SF Schedule SA?

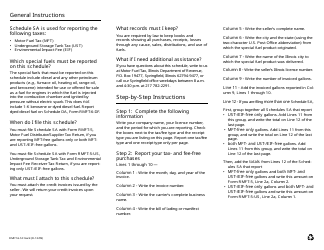

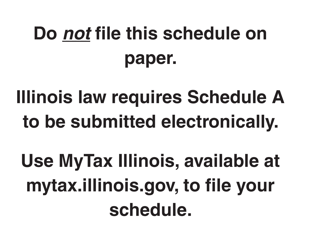

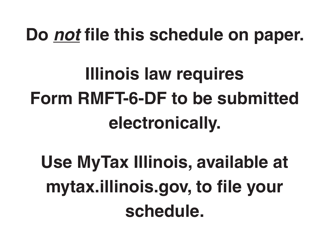

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

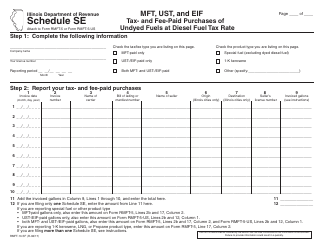

Q: What is Form RMFT-6-SF Schedule SA?

A: Form RMFT-6-SF Schedule SA is a form used to report special fuel (excluding dyed diesel fuel) produced, acquired, received, or transported into Illinois.

Q: What kind of fuel does Form RMFT-6-SF Schedule SA cover?

A: Form RMFT-6-SF Schedule SA covers special fuel (excluding dyed diesel fuel).

Q: Who needs to complete Form RMFT-6-SF Schedule SA?

A: Anyone who produces, acquires, receives, or transports special fuel (excluding dyed diesel fuel) into Illinois needs to complete Form RMFT-6-SF Schedule SA.

Q: What is the purpose of Form RMFT-6-SF Schedule SA?

A: The purpose of Form RMFT-6-SF Schedule SA is to report special fuel (excluding dyed diesel fuel) activities in Illinois.

Q: Are there any penalties for not filing Form RMFT-6-SF Schedule SA?

A: Yes, there are penalties for not filing or filing the form incorrectly. It is important to comply with the reporting requirements to avoid penalties.

Form Details:

- Released on December 1, 1999;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-6-SF Schedule SA by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.