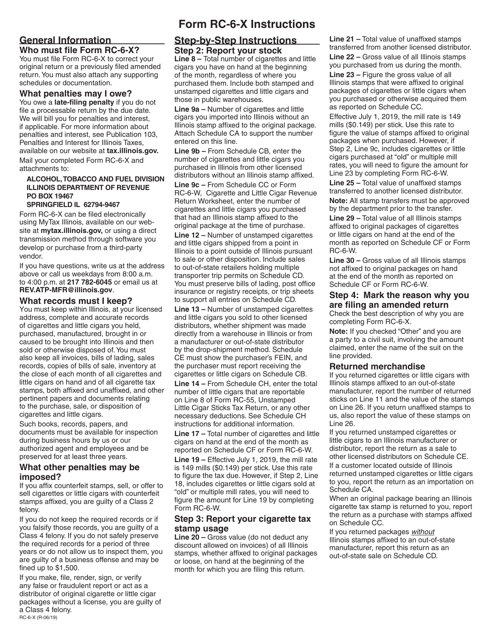

Instructions for Form RC-6-X, 437 Amended Cigarette and Little Cigar Revenue Return - Illinois

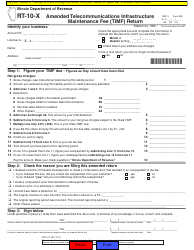

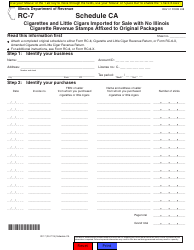

This document contains official instructions for Form RC-6-X , and Form 437 . Both forms are released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form RC-6-X?

A: Form RC-6-X is the Amended Cigarette and Little Cigar Revenue Return for businesses in Illinois.

Q: Who needs to file Form RC-6-X?

A: Businesses in Illinois that sell cigarettes and little cigars need to file Form RC-6-X.

Q: What is the purpose of Form RC-6-X?

A: Form RC-6-X is used to report any changes or amendments to the original Cigarette and Little Cigar Revenue Return.

Q: When is the deadline to file Form RC-6-X?

A: The deadline to file Form RC-6-X is generally the same as the original Cigarette and Little Cigar Revenue Return, which is due on the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing Form RC-6-X?

A: Yes, failure to file or filing late can result in penalties and interest charges.

Q: What should I do if I discover an error on my original Cigarette and Little Cigar Revenue Return?

A: If you discover an error, you should promptly file Form RC-6-X to amend your return and correct the mistake.

Q: Can I file Form RC-6-X electronically?

A: Yes, the Illinois Department of Revenue provides an electronic filing option for Form RC-6-X.

Q: Is there any additional documentation required when filing Form RC-6-X?

A: No, generally no additional documentation is required unless specifically requested by the Illinois Department of Revenue.

Q: Who do I contact if I have questions about filing Form RC-6-X?

A: If you have questions, you can contact the Illinois Department of Revenue directly for assistance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.