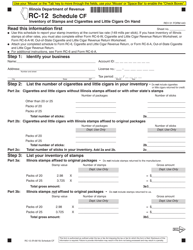

Instructions for Form RC-6-X Amended Cigarette and Little Cigar Revenue Return - Illinois

This document contains official instructions for Form RC-6-X , Amended Cigarette and Little Cigar Revenue Return - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form RC-6-X?

A: Form RC-6-X is a tax return form used in Illinois for reporting amended cigarette and little cigar revenue.

Q: Who needs to file Form RC-6-X?

A: Any taxpayer in Illinois who is amending their cigarette and little cigar revenue return needs to file Form RC-6-X.

Q: What is the purpose of Form RC-6-X?

A: Form RC-6-X is used to report any changes or corrections to previously filed cigarette and little cigar revenue return.

Q: What information is required on Form RC-6-X?

A: Form RC-6-X requires the taxpayer to provide their identification details, original return information, and the changes or corrections being made.

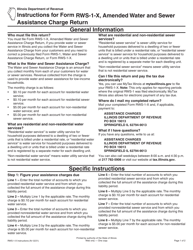

Q: When is the deadline for filing Form RC-6-X?

A: The deadline for filing Form RC-6-X in Illinois is typically the same as the original return filing deadline, which is usually on a quarterly basis.

Q: Are there any penalties for not filing Form RC-6-X?

A: Yes, failure to timely file Form RC-6-X or filing an incomplete or inaccurate form may result in penalties and interest.

Q: Can I e-file Form RC-6-X?

A: Yes, Illinois allows taxpayers to e-file Form RC-6-X.

Q: Is there a fee for filing Form RC-6-X?

A: There is no fee for filing Form RC-6-X in Illinois.

Q: What should I do if I make a mistake on Form RC-6-X?

A: If you make a mistake on Form RC-6-X, you should file an amended return as soon as possible to correct the error.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.