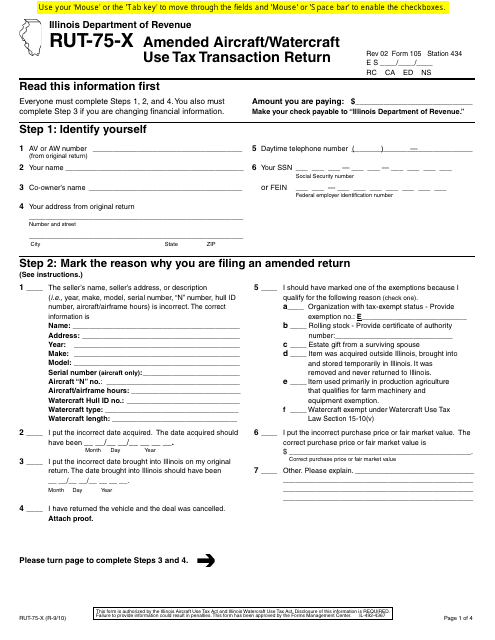

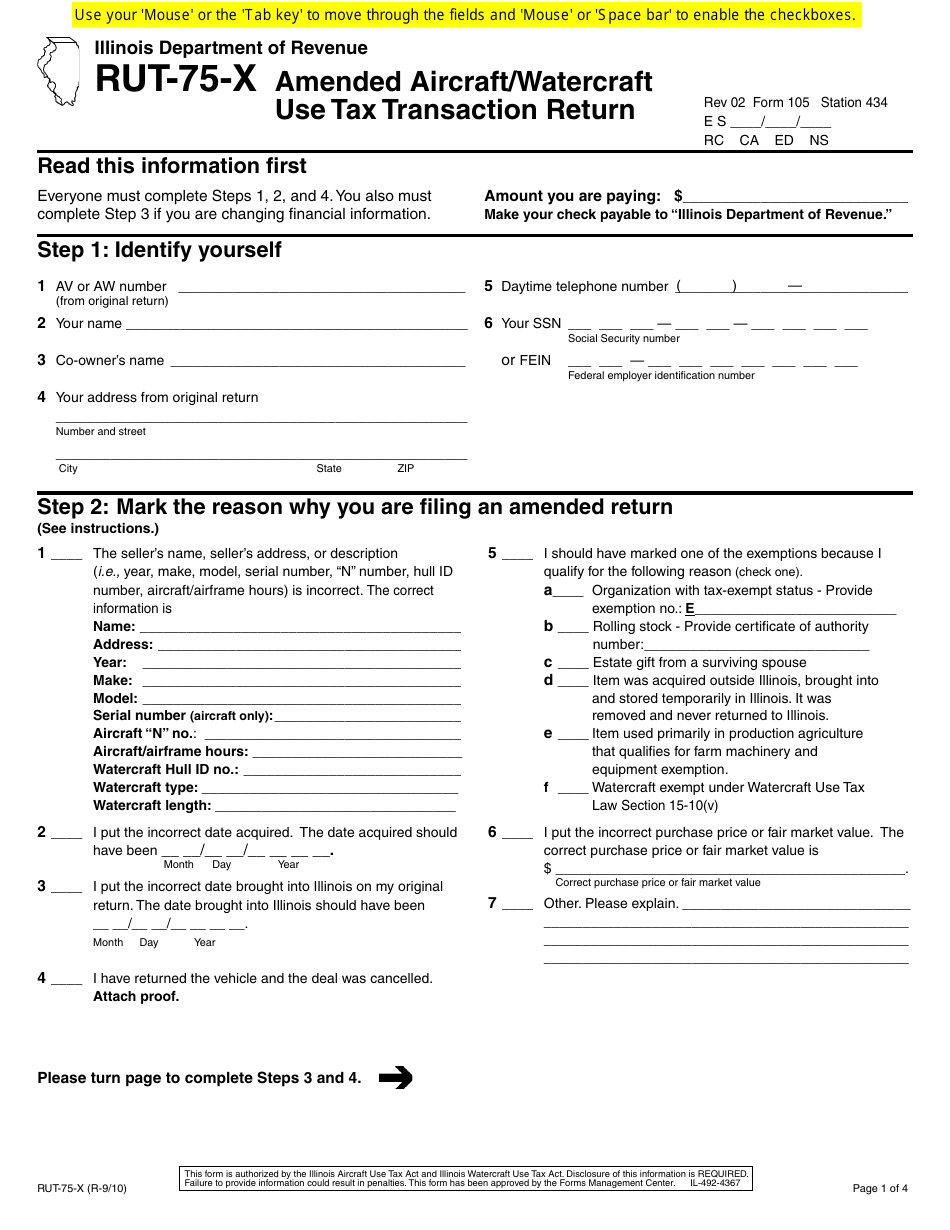

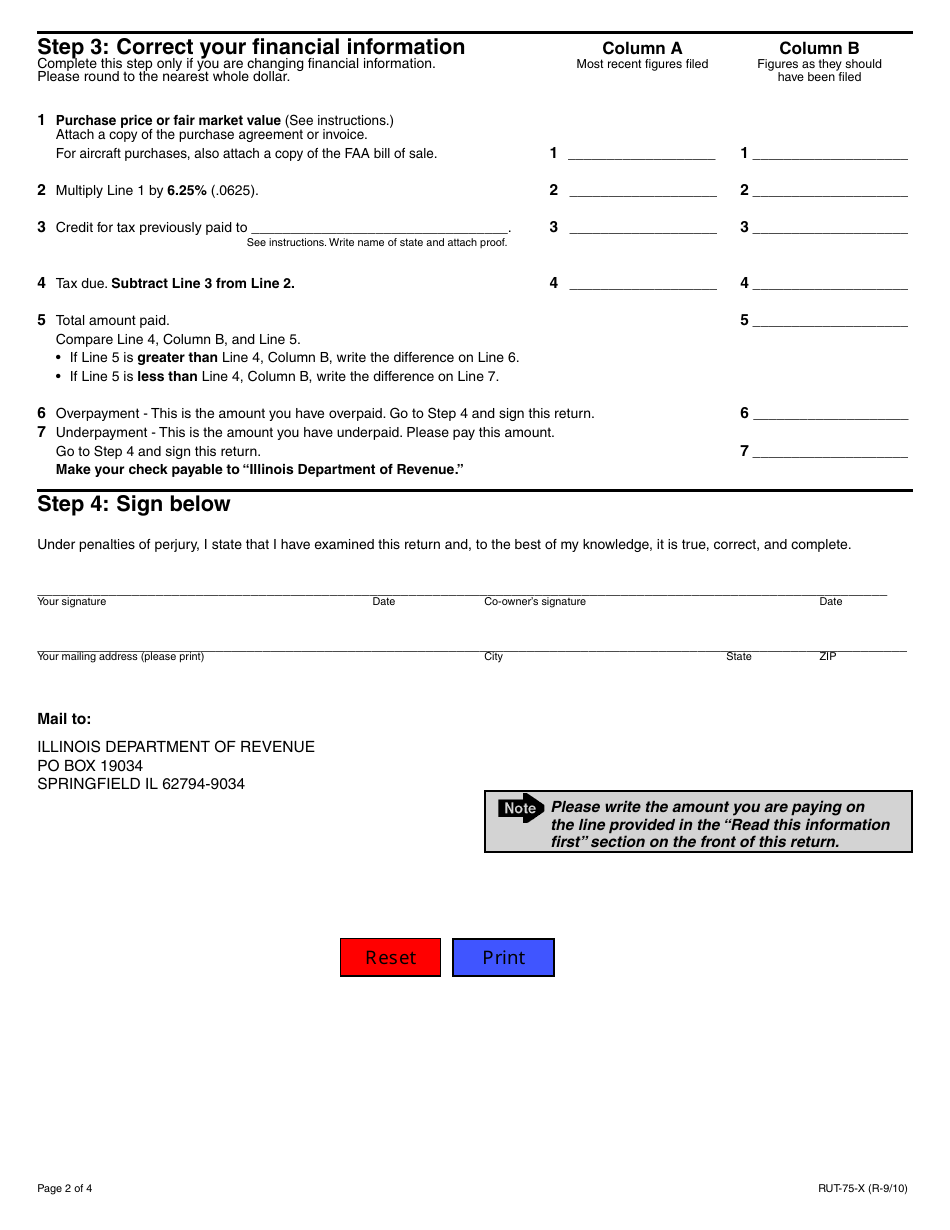

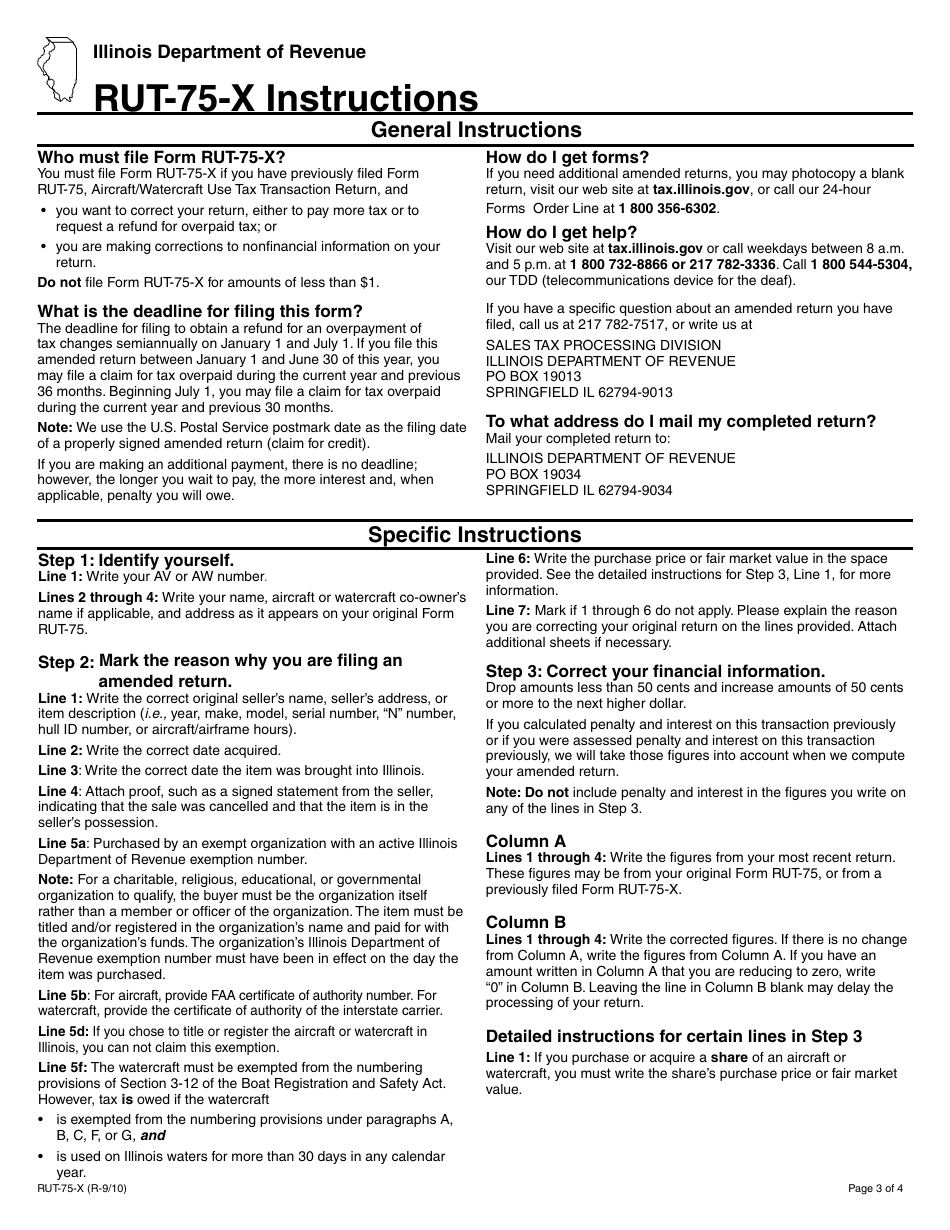

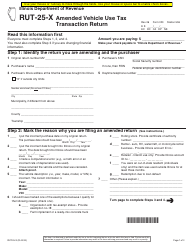

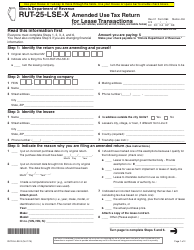

Form RUT-75-X (105) Amended Aircraft / Watercraft Use Tax Transaction Return - Illinois

What Is Form RUT-75-X (105)?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RUT-75-X?

A: Form RUT-75-X is the Amended Aircraft/Watercraft Use Tax Transaction Return in Illinois.

Q: Who needs to file Form RUT-75-X?

A: Individuals and businesses in Illinois who have made a mistake or need to make changes to a previously filed Aircraft/Watercraft Use Tax Transaction Return.

Q: What is the purpose of filing Form RUT-75-X?

A: The purpose of filing Form RUT-75-X is to correct any errors or changes made to a previously filed Aircraft/Watercraft Use Tax Transaction Return in Illinois.

Q: What information is required on Form RUT-75-X?

A: Form RUT-75-X requires information such as the original transaction number, identification numbers, and details of the changes being made.

Q: Are there any fees associated with filing Form RUT-75-X?

A: No, there are no fees associated with filing Form RUT-75-X.

Q: What is the deadline for filing Form RUT-75-X?

A: Form RUT-75-X must be filed within three years from the original due date of the Aircraft/Watercraft Use Tax Transaction Return.

Form Details:

- Released on September 1, 2010;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RUT-75-X (105) by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.