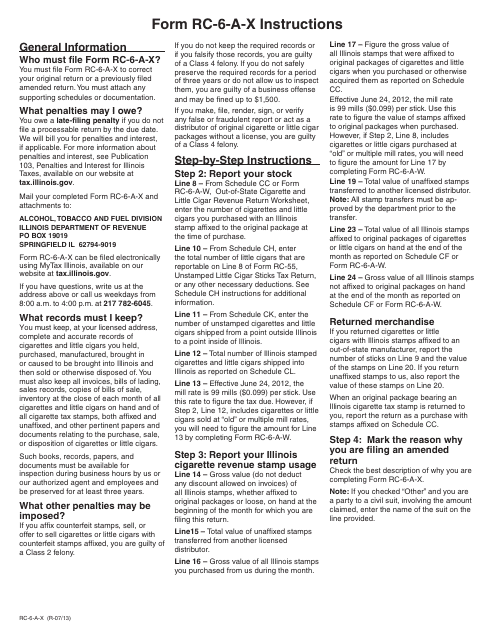

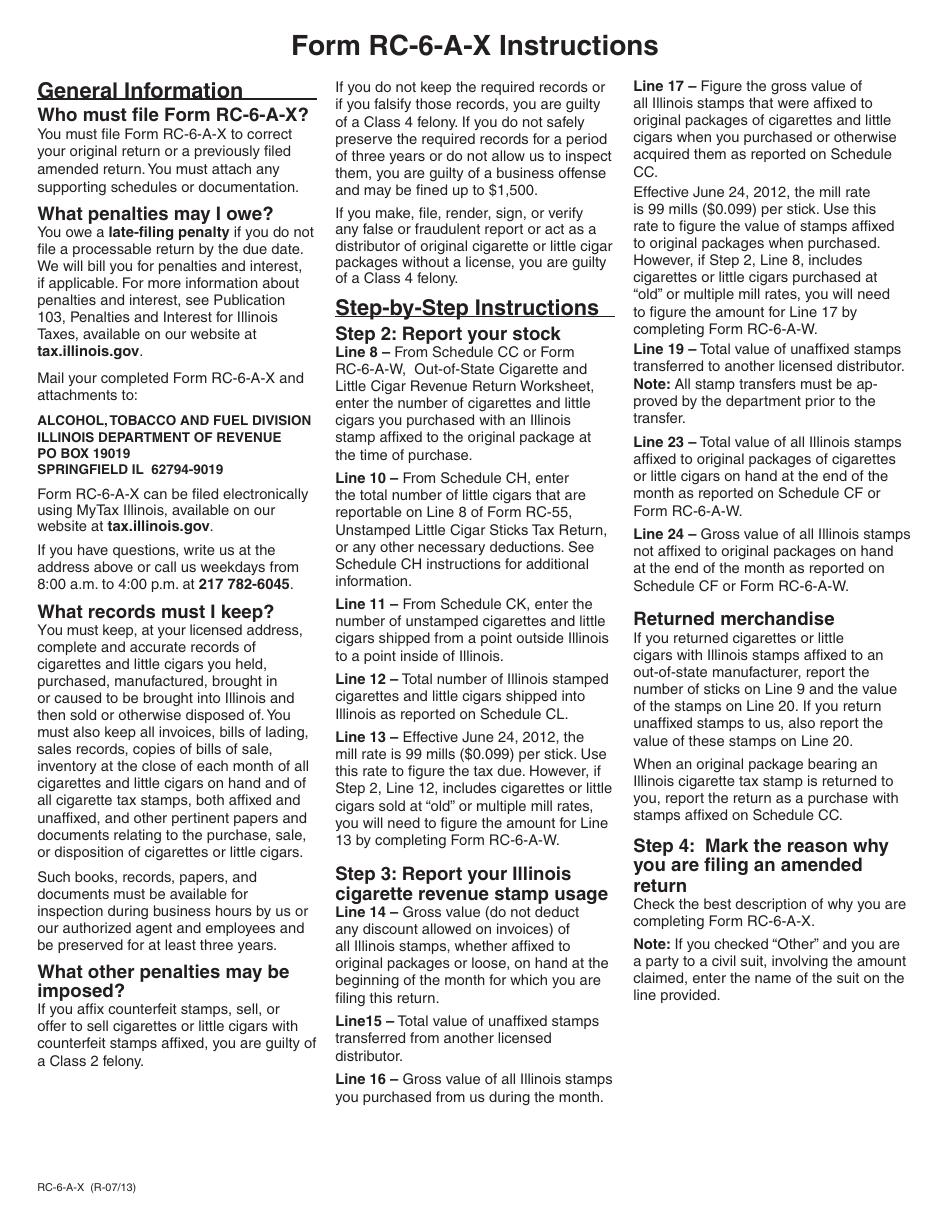

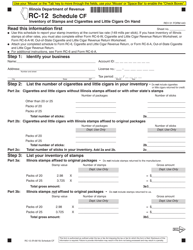

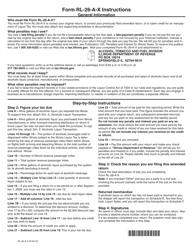

Instructions for Form RC-6-A-X Amended Out-of-State Cigarette and Little Cigar Revenue Return - Illinois

This document contains official instructions for Form RC-6-A-X , Amended Out-of-State Cigarette and Little Cigar Revenue Return - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form RC-6-A-X?

A: Form RC-6-A-X is the Amended Out-of-State Cigarette and Little Cigar Revenue Return for the state of Illinois.

Q: Who needs to file Form RC-6-A-X?

A: Any individual or business that sells cigarettes or little cigars out-of-state and wants to amend their revenue return in Illinois needs to file this form.

Q: What is the purpose of Form RC-6-A-X?

A: The purpose of this form is to report any changes or corrections to your original out-of-state cigarette and little cigar revenue return in Illinois.

Q: Are there any penalties for not filing Form RC-6-A-X?

A: Yes, failing to file or filing late can result in penalties and interest being assessed by the Illinois Department of Revenue.

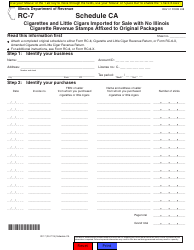

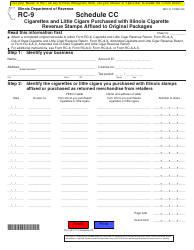

Q: What information do I need to complete Form RC-6-A-X?

A: You will need information from your original out-of-state cigarette and little cigar revenue return, as well as any new or corrected information you are reporting.

Q: Can I amend my return more than once using Form RC-6-A-X?

A: Yes, you can use Form RC-6-A-X to amend your return multiple times if necessary.

Q: Is there a fee to file Form RC-6-A-X?

A: No, there is no fee to file Form RC-6-A-X with the Illinois Department of Revenue.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.