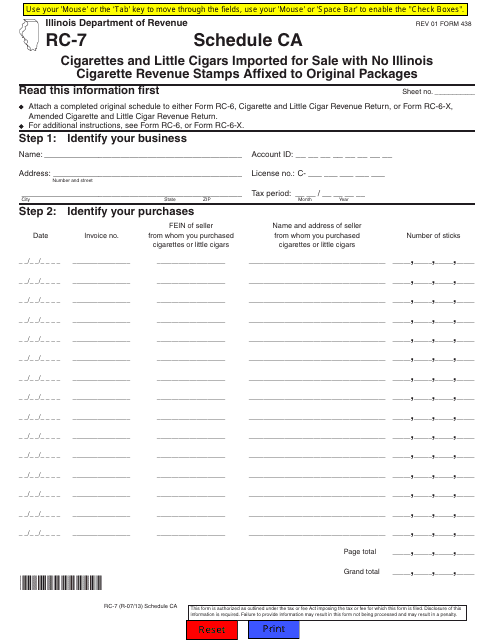

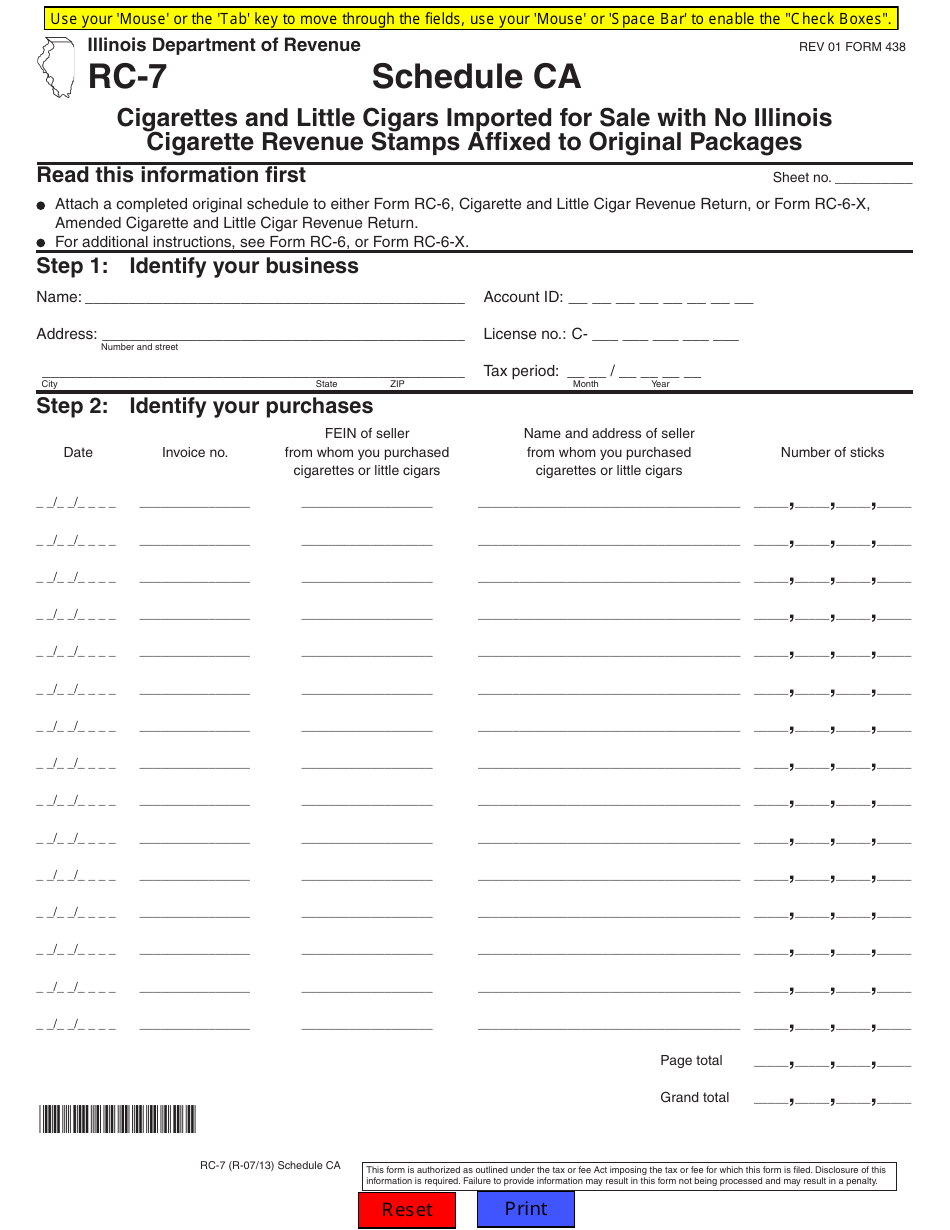

Form RC-7 Schedule CA Cigarettes and Little Cigars Imported for Sale With No Illinois Cigarette Revenue Stamps Affixed to Original Packages - Illinois

What Is Form RC-7 Schedule CA?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RC-7 Schedule CA?

A: Form RC-7 Schedule CA is a form used in Illinois to report cigarettes and little cigars imported for sale with no Illinois cigarette revenue stamps affixed to original packages.

Q: How is Form RC-7 Schedule CA used?

A: Form RC-7 Schedule CA is used to report the importation of cigarettes and little cigars into Illinois for sale when the packages do not have Illinois cigarette revenue stamps.

Q: What is the purpose of Form RC-7 Schedule CA?

A: The purpose of Form RC-7 Schedule CA is to ensure that proper taxes are paid on cigarettes and little cigars sold in Illinois.

Q: When should Form RC-7 Schedule CA be filed?

A: Form RC-7 Schedule CA should be filed on a monthly basis and is due by the 20th day of the following month.

Q: Who is required to file Form RC-7 Schedule CA?

A: Any person or business that imports cigarettes and little cigars into Illinois for sale without Illinois cigarette revenue stamps affixed to the original packages is required to file Form RC-7 Schedule CA.

Q: Are there any penalties for not filing Form RC-7 Schedule CA?

A: Yes, failure to file Form RC-7 Schedule CA or filing false or incomplete information may result in penalties, including fines and imprisonment.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RC-7 Schedule CA by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.