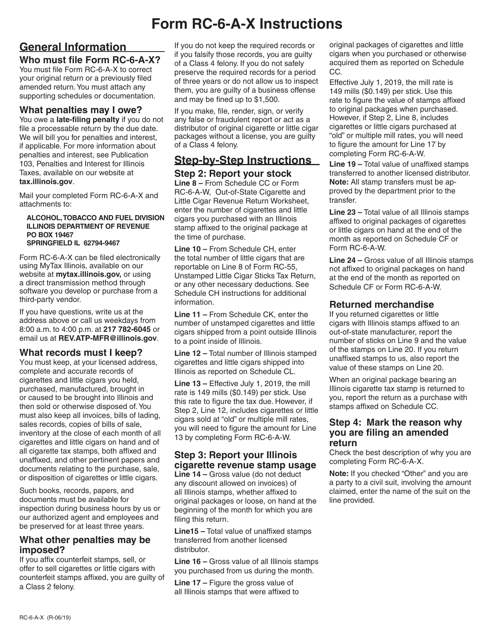

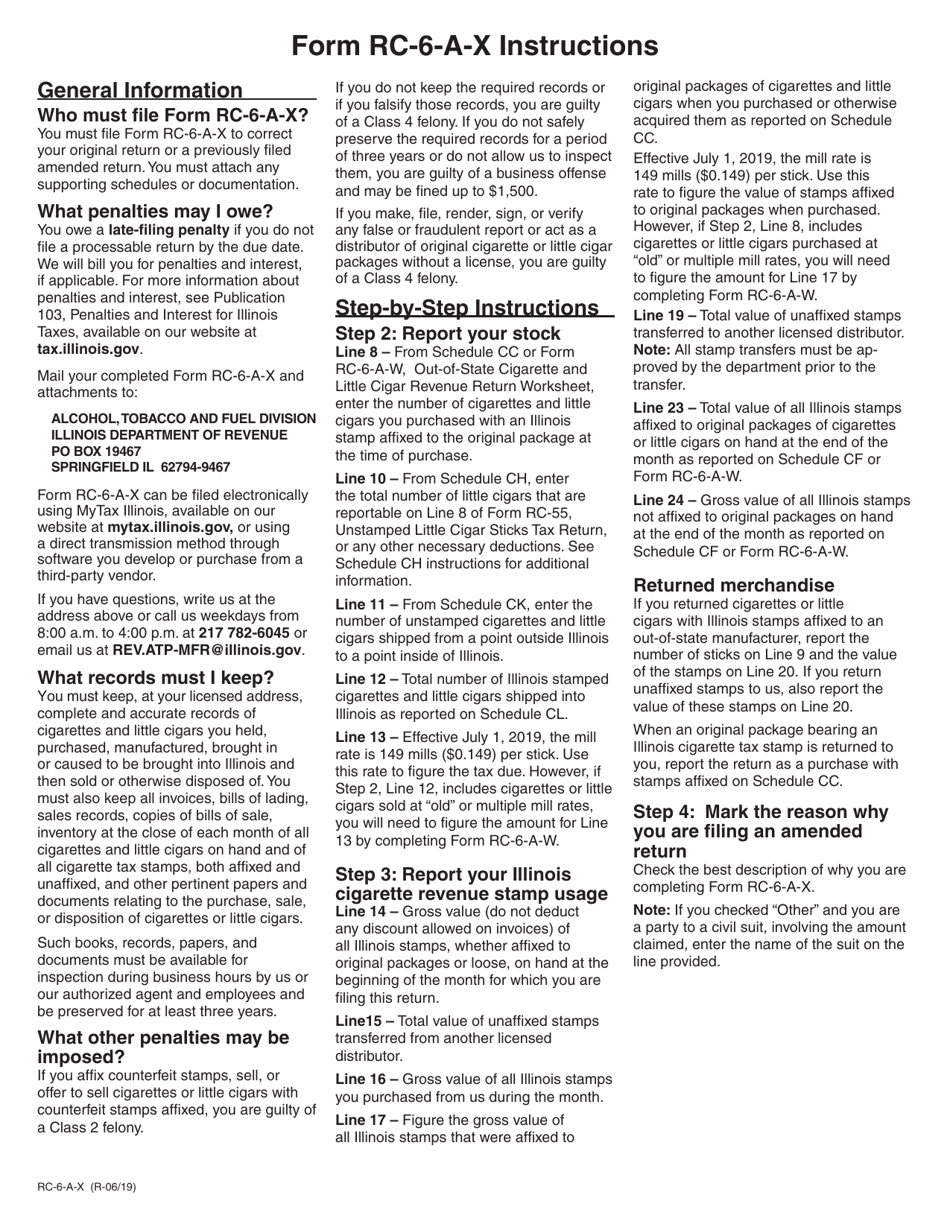

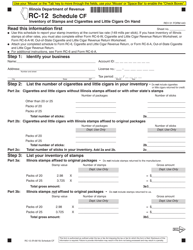

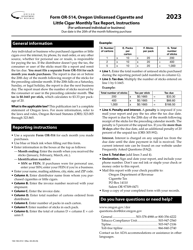

Instructions for Form RC-6-A-X, 435 Amended Out-of-State Cigarette and Little Cigar Revenue Return - Illinois

This document contains official instructions for Form RC-6-A-X , and Form 435 . Both forms are released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form RC-6-A-X?

A: Form RC-6-A-X is a form used to amend an out-of-state cigarette and little cigar revenue return in Illinois.

Q: Who needs to file Form RC-6-A-X?

A: Anyone who needs to amend an out-of-state cigarette and little cigar revenue return in Illinois needs to file Form RC-6-A-X.

Q: What is the purpose of Form RC-6-A-X?

A: The purpose of Form RC-6-A-X is to correct any errors or make changes to a previously filed out-of-state cigarette and little cigar revenue return in Illinois.

Q: When is Form RC-6-A-X due?

A: The due date for Form RC-6-A-X varies and is determined by the Illinois Department of Revenue.

Q: Is there a penalty for filing Form RC-6-A-X late?

A: Yes, there may be penalties for filing Form RC-6-A-X late. It is important to file the form before the deadline to avoid any potential penalties.

Q: Can I e-file Form RC-6-A-X?

A: Yes, you can e-file Form RC-6-A-X if you prefer.

Q: Are there any additional documents required to file Form RC-6-A-X?

A: The Illinois Department of Revenue may require additional documents to be filed along with Form RC-6-A-X. It is important to check the instructions and requirements provided by the department.

Q: What should I do if I have questions or need assistance with Form RC-6-A-X?

A: If you have questions or need assistance with Form RC-6-A-X, you should contact the Illinois Department of Revenue for guidance and support.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.