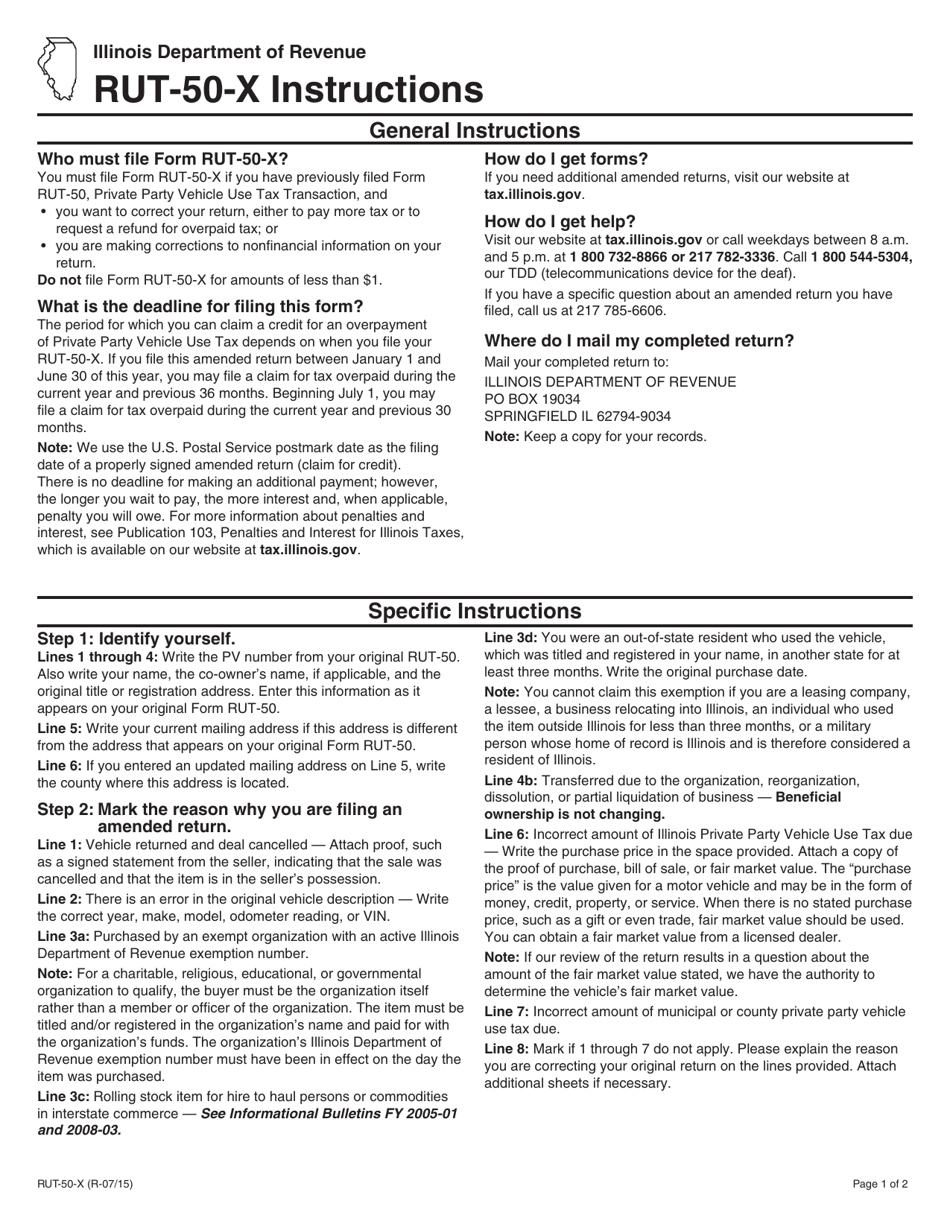

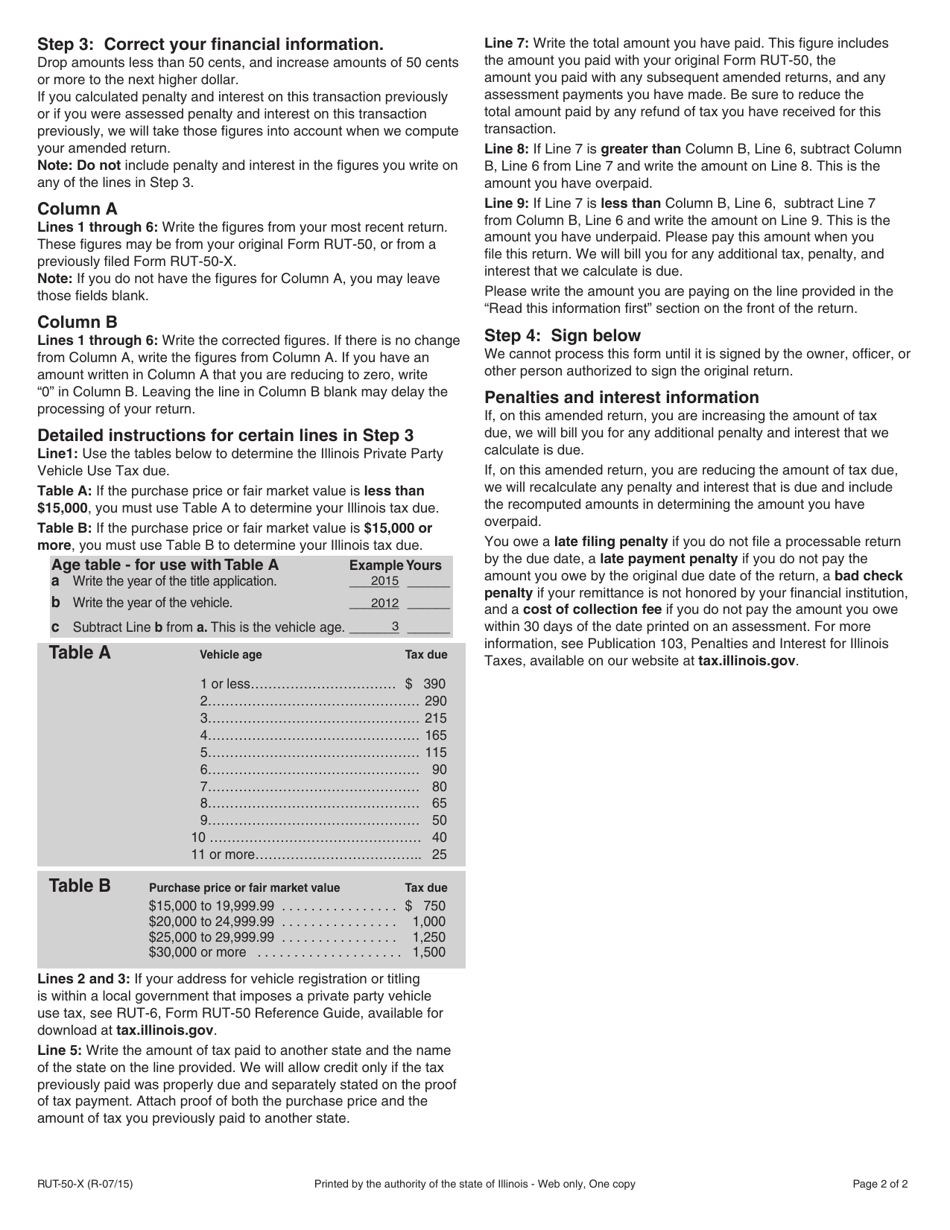

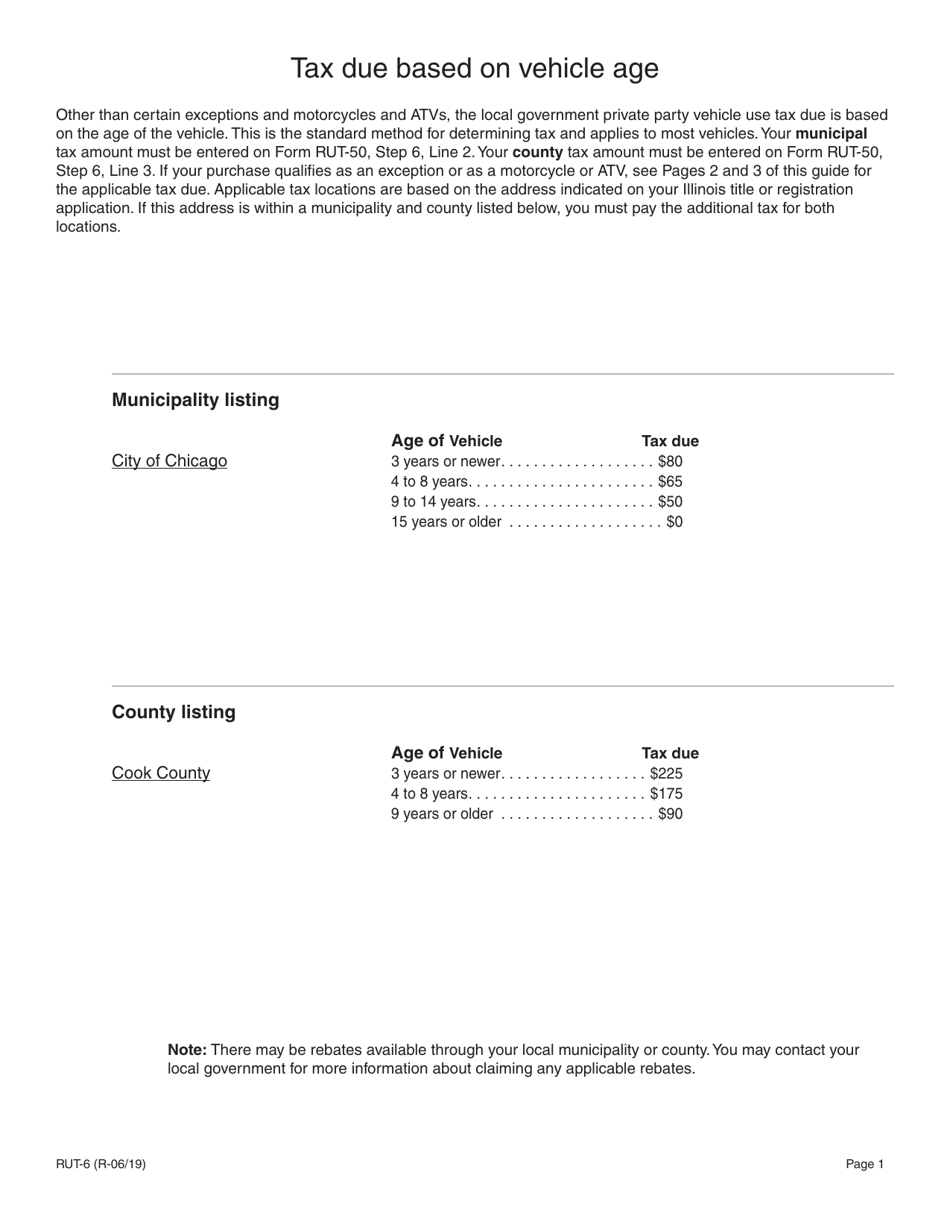

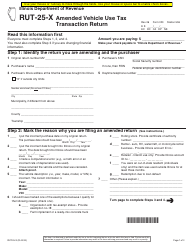

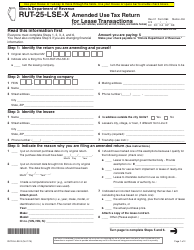

Instructions for Form RUT-50-X, 485 Amended Private Party Vehicle Tax Transaction Return - Illinois

This document contains official instructions for Form RUT-50-X , and Form 485 . Both forms are released and collected by the Illinois Department of Revenue. An up-to-date fillable Form RUT-50-X is available for download through this link.

FAQ

Q: What is Form RUT-50-X?

A: Form RUT-50-X is the Amended Private Party Vehicle Tax Transaction Return in Illinois.

Q: Who should file Form RUT-50-X?

A: Form RUT-50-X should be filed by individuals who need to amend their private party vehicle tax transaction return in Illinois.

Q: What is the purpose of Form RUT-50-X?

A: The purpose of Form RUT-50-X is to correct any errors or omissions made on the original private party vehicle tax transaction return.

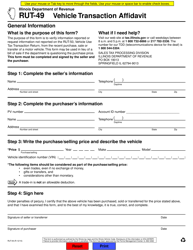

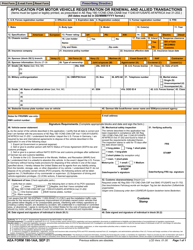

Q: What information is required on Form RUT-50-X?

A: Form RUT-50-X requires information such as the buyer's name and address, seller's name and address, vehicle information, and details of the transaction.

Q: Are there any filing fees for Form RUT-50-X?

A: No, there are no filing fees for Form RUT-50-X.

Q: What should I do if I make a mistake on Form RUT-50-X?

A: If you make a mistake on Form RUT-50-X, you should file an amended return with the correct information.

Q: Is there a deadline for filing Form RUT-50-X?

A: Yes, Form RUT-50-X must be filed within 20 days of discovering the error or omission on the original return.

Q: What happens after filing Form RUT-50-X?

A: After filing Form RUT-50-X, the Illinois Department of Revenue will review the amended return and process any necessary adjustments or refunds.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.