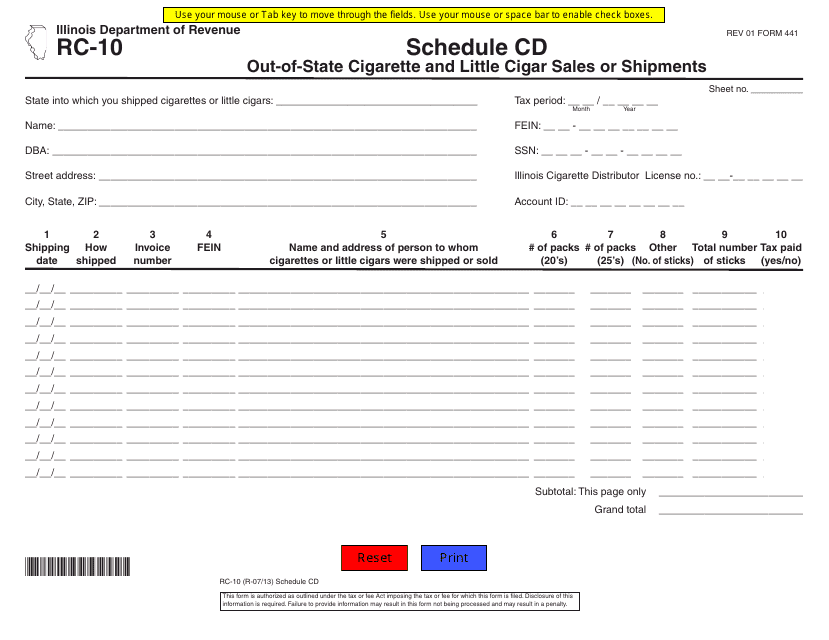

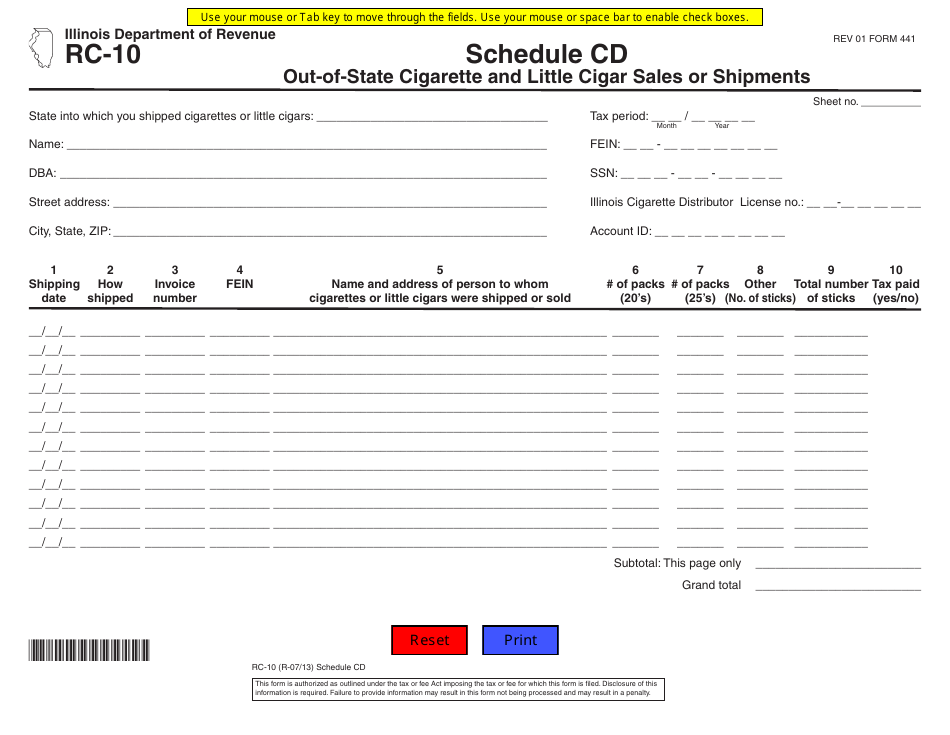

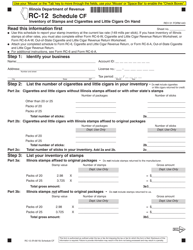

Form RC-10 Schedule CD Out-of-State Cigarette and Little Cigar Sales or Shipments - Illinois

What Is Form RC-10 Schedule CD?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RC-10 Schedule CD?

A: Form RC-10 Schedule CD is a form used in Illinois to report out-of-state cigarette and little cigar sales or shipments.

Q: Who needs to file Form RC-10 Schedule CD?

A: Retailers located in Illinois who make sales or shipments of cigarettes or little cigars to consumers outside of the state.

Q: Why do retailers need to file Form RC-10 Schedule CD?

A: Retailers need to file Form RC-10 Schedule CD to comply with Illinois law and report out-of-state sales or shipments.

Q: How often do retailers need to file Form RC-10 Schedule CD?

A: Retailers need to file Form RC-10 Schedule CD on a monthly basis.

Q: What information should be included in Form RC-10 Schedule CD?

A: Form RC-10 Schedule CD requires retailers to report the quantity of cigarettes or little cigars sold or shipped out-of-state, the price paid by the consumer, and other related information.

Q: Is there a deadline for filing Form RC-10 Schedule CD?

A: Yes, retailers must file Form RC-10 Schedule CD by the 20th day of the month following the month being reported.

Q: What happens if retailers fail to file Form RC-10 Schedule CD?

A: Failure to file Form RC-10 Schedule CD or filing false information can result in penalties and legal consequences.

Q: Are there any exemptions to filing Form RC-10 Schedule CD?

A: Yes, retailers who do not make any out-of-state sales or shipments of cigarettes or little cigars are exempt from filing Form RC-10 Schedule CD.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RC-10 Schedule CD by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.