This version of the form is not currently in use and is provided for reference only. Download this version of

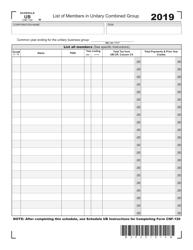

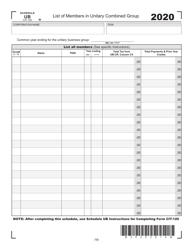

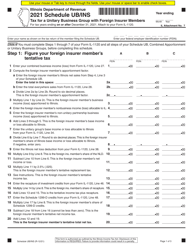

Instructions for Schedule UB

for the current year.

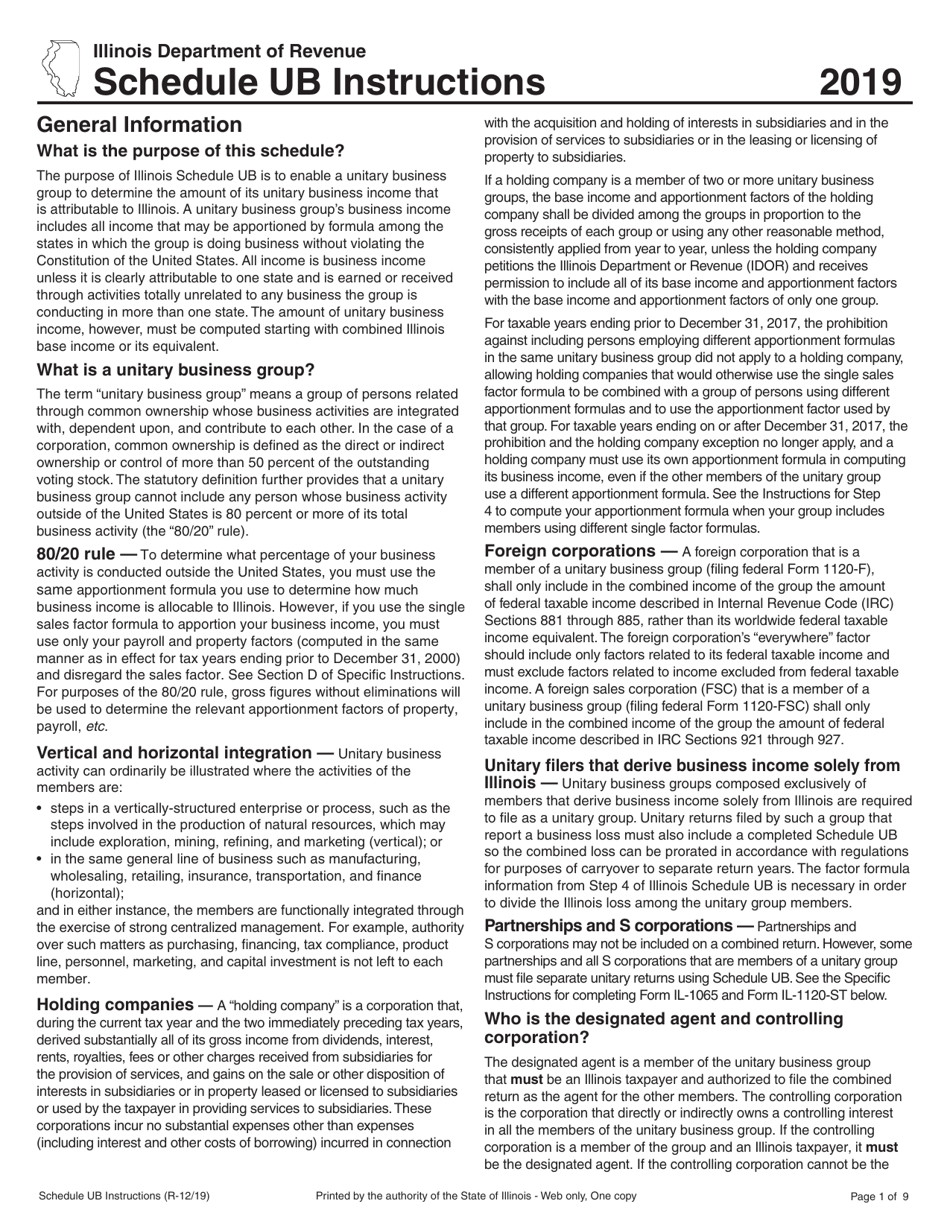

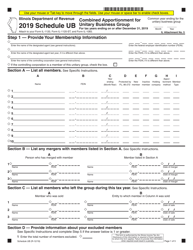

Instructions for Schedule UB Combined Apportionment for Unitary Business Group - Illinois

This document contains official instructions for Schedule UB , Combined Apportionment for Unitary Business Group - a form released and collected by the Illinois Department of Revenue.

FAQ

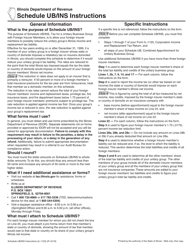

Q: What is Schedule UB?

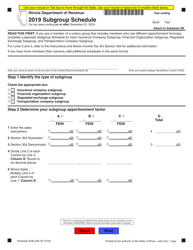

A: Schedule UB is a form used in Illinois to calculate the apportionment of income for a unitary business group.

Q: What is a unitary business group?

A: A unitary business group is a group of corporations that are connected through ownership and operate as a single business entity.

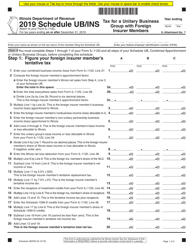

Q: What is apportionment of income?

A: Apportionment of income is the process of dividing the income of a business among different states based on the proportion of business activity conducted in each state.

Q: Why is apportionment necessary?

A: Apportionment is necessary to determine the amount of income that should be allocated to each state for tax purposes.

Q: What information is needed to complete Schedule UB?

A: To complete Schedule UB, you will need information on the business activities and income of each member of the unitary business group.

Q: Are there any specific guidelines for completing Schedule UB?

A: Yes, there are specific guidelines and instructions provided by the Illinois Department of Revenue that should be followed when completing Schedule UB.

Q: Is Schedule UB only applicable to Illinois?

A: Yes, Schedule UB is specific to the state of Illinois and is used for calculating the apportionment of income for businesses operating in Illinois.

Instruction Details:

- This 9-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.