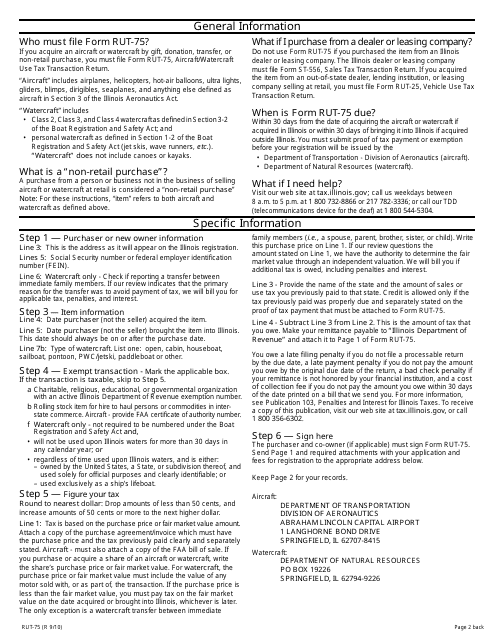

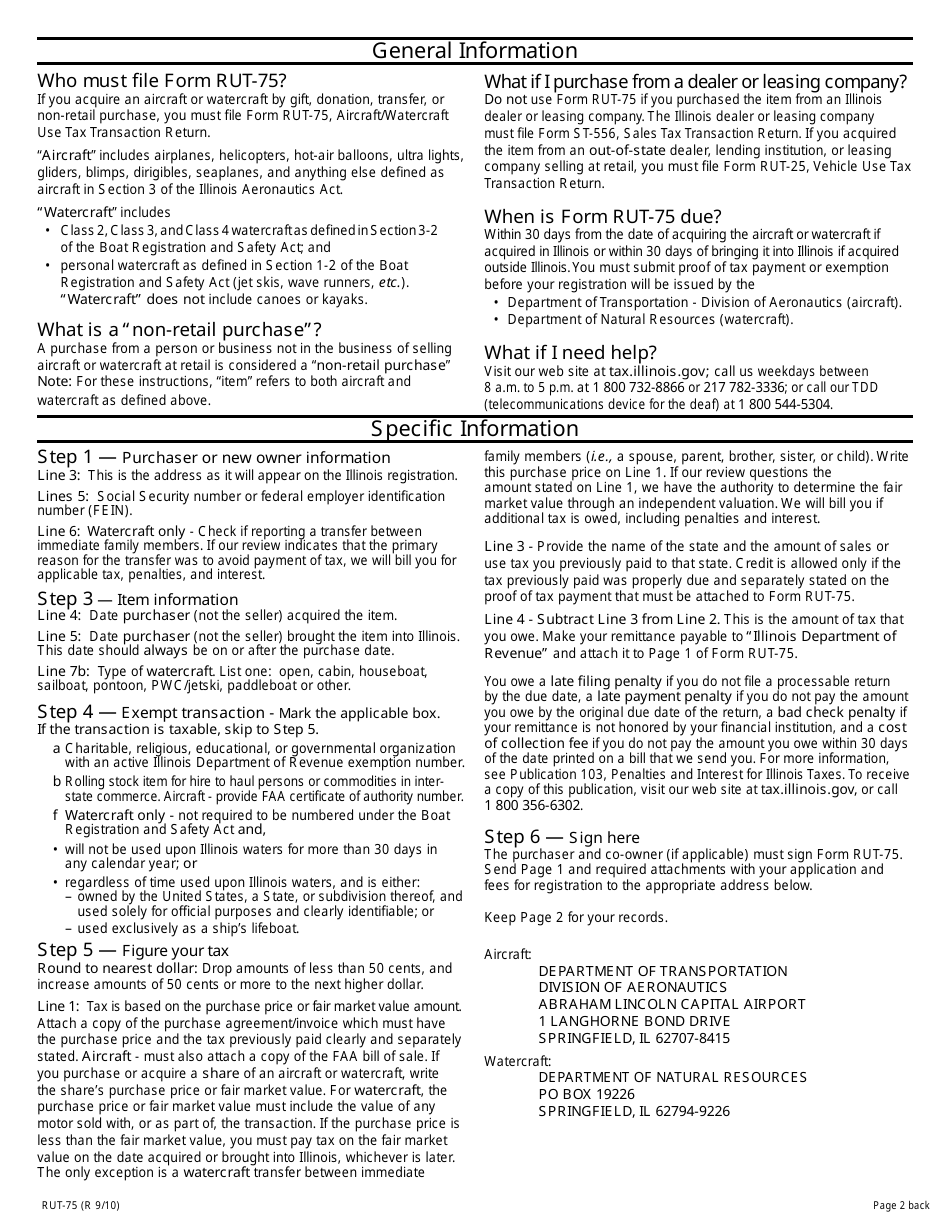

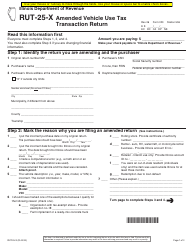

Instructions for Form RUT-75 Aircraft / Watercraft Use Tax Transaction Return - Illinois

This document contains official instructions for Form RUT-75 , Aircraft/Watercraft Use Tax Transaction Return - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form RUT-75?

A: Form RUT-75 is the Aircraft/Watercraft Use Tax Transaction Return used in Illinois.

Q: What is the purpose of Form RUT-75?

A: The purpose of Form RUT-75 is to report and pay the use tax on aircraft and watercraft purchased or acquired in Illinois for use or storage in the state.

Q: Who needs to file Form RUT-75?

A: Anyone who purchases or acquires an aircraft or watercraft in Illinois for use or storage in the state needs to file Form RUT-75.

Q: When should Form RUT-75 be filed?

A: Form RUT-75 should be filed within 30 days of the date of purchase or acquisition of the aircraft or watercraft.

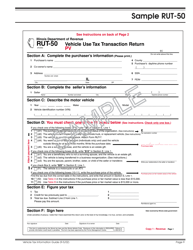

Q: What information is required on Form RUT-75?

A: Form RUT-75 requires information such as the purchaser's name and address, details of the aircraft or watercraft, the purchase price or fair market value, and the amount of use tax owed.

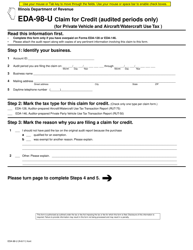

Q: Are there any exemptions to the use tax on aircraft and watercraft in Illinois?

A: Yes, certain exemptions apply, such as purchases made by government agencies or charitable organizations. These exemptions must be claimed on Form RUT-75.

Q: What happens if Form RUT-75 is not filed or if the use tax is not paid?

A: Failure to file Form RUT-75 or pay the use tax can result in penalties and interest being assessed by the Illinois Department of Revenue.

Q: Is there a fee for filing Form RUT-75?

A: There is no fee for filing Form RUT-75, but the use tax owed must be paid.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.