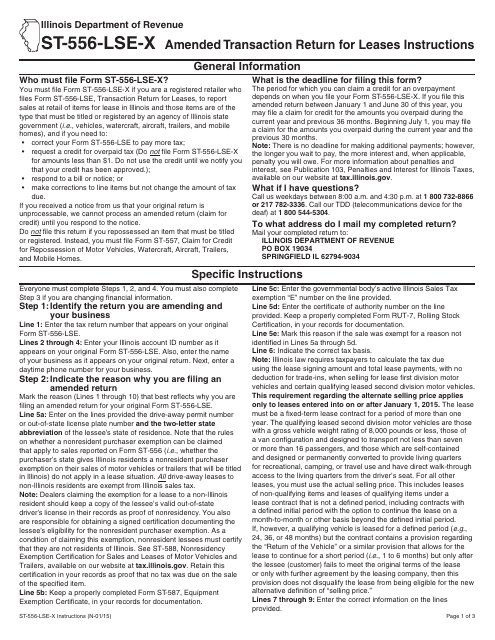

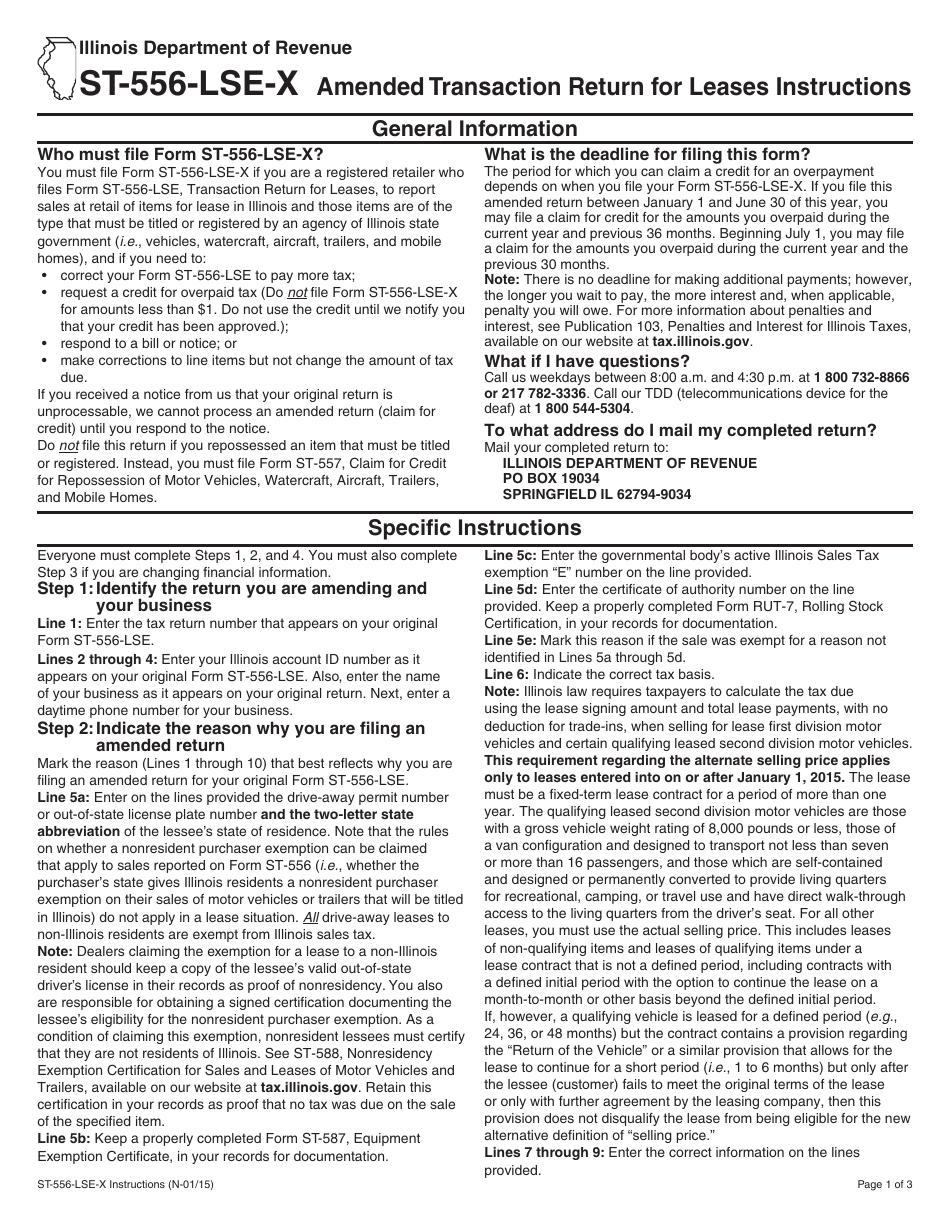

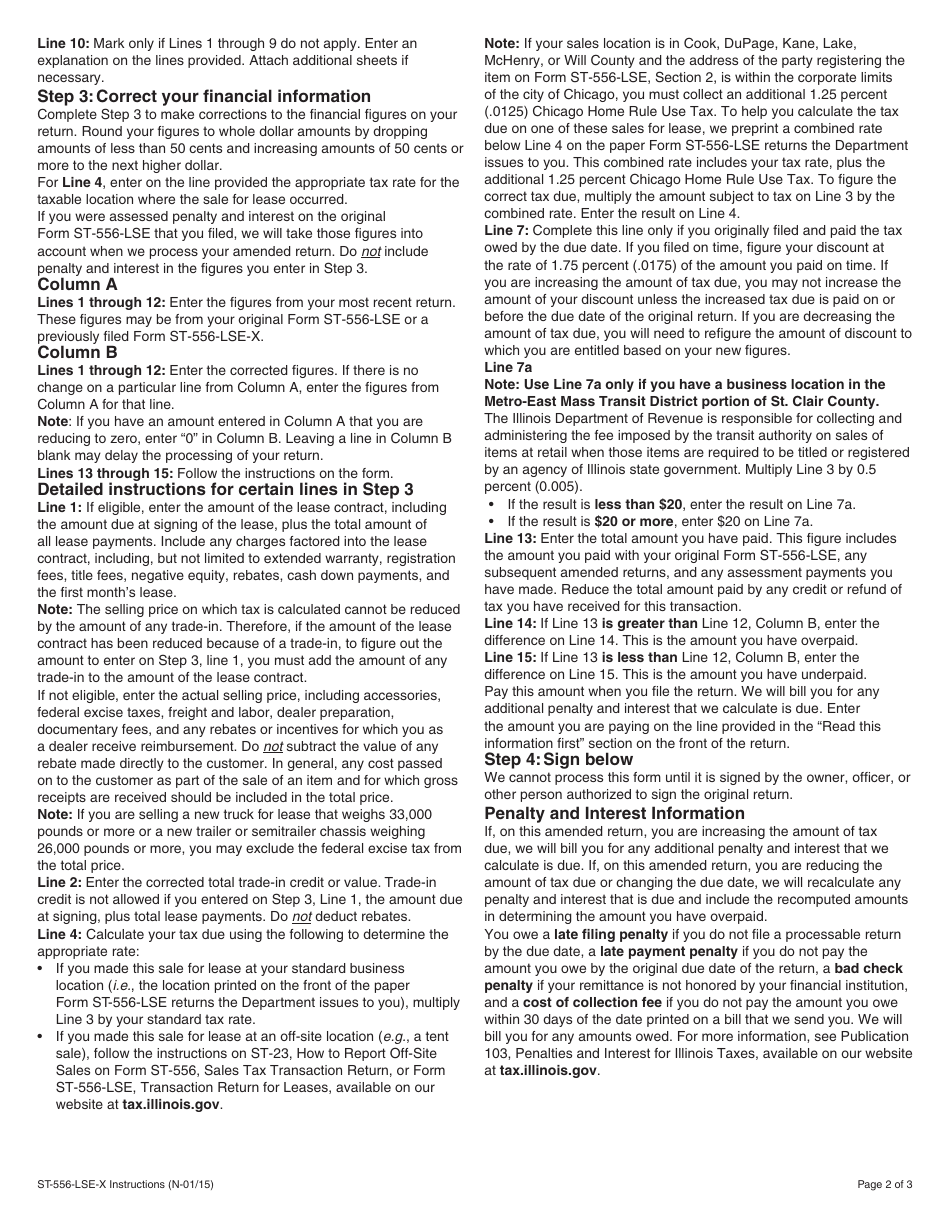

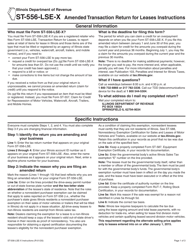

Instructions for Form ST-556-LSE-X Amended Transaction Return for Leases - Illinois

This document contains official instructions for Form ST-556-LSE-X , Amended Transaction Return for Leases - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form ST-556-LSE-X?

A: Form ST-556-LSE-X is a transaction return form for leases in the state of Illinois.

Q: What is the purpose of Form ST-556-LSE-X?

A: The purpose of Form ST-556-LSE-X is to report amended lease transactions in Illinois.

Q: Who needs to file Form ST-556-LSE-X?

A: Anyone who needs to report amended lease transactions in Illinois must file Form ST-556-LSE-X.

Q: When should Form ST-556-LSE-X be filed?

A: Form ST-556-LSE-X should be filed within 20 days of the amended lease transaction.

Q: Are there any penalties for not filing Form ST-556-LSE-X?

A: Yes, there are penalties for failing to file or filing late. It is important to submit the form on time to avoid these penalties.

Q: Is Form ST-556-LSE-X specific to Illinois?

A: Yes, Form ST-556-LSE-X is specific to lease transactions in the state of Illinois.

Q: Can Form ST-556-LSE-X be filed electronically?

A: Yes, Form ST-556-LSE-X can be filed electronically through the Illinois Department of Revenue's e-services portal.

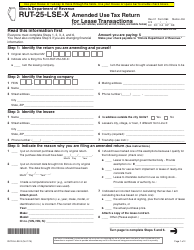

Q: What information is required on Form ST-556-LSE-X?

A: The form requires information about the lessor and lessee, lease details, and any changes to the transaction being amended.

Q: Do I need to include supporting documents with Form ST-556-LSE-X?

A: It is not necessary to attach supporting documents when filing Form ST-556-LSE-X, but you should keep them for your records in case of an audit.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.