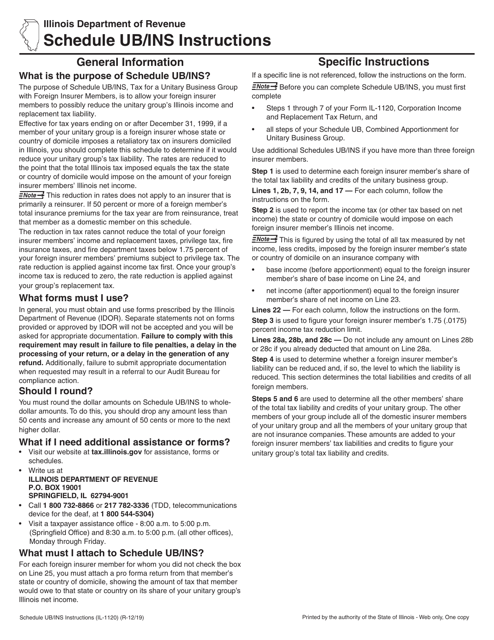

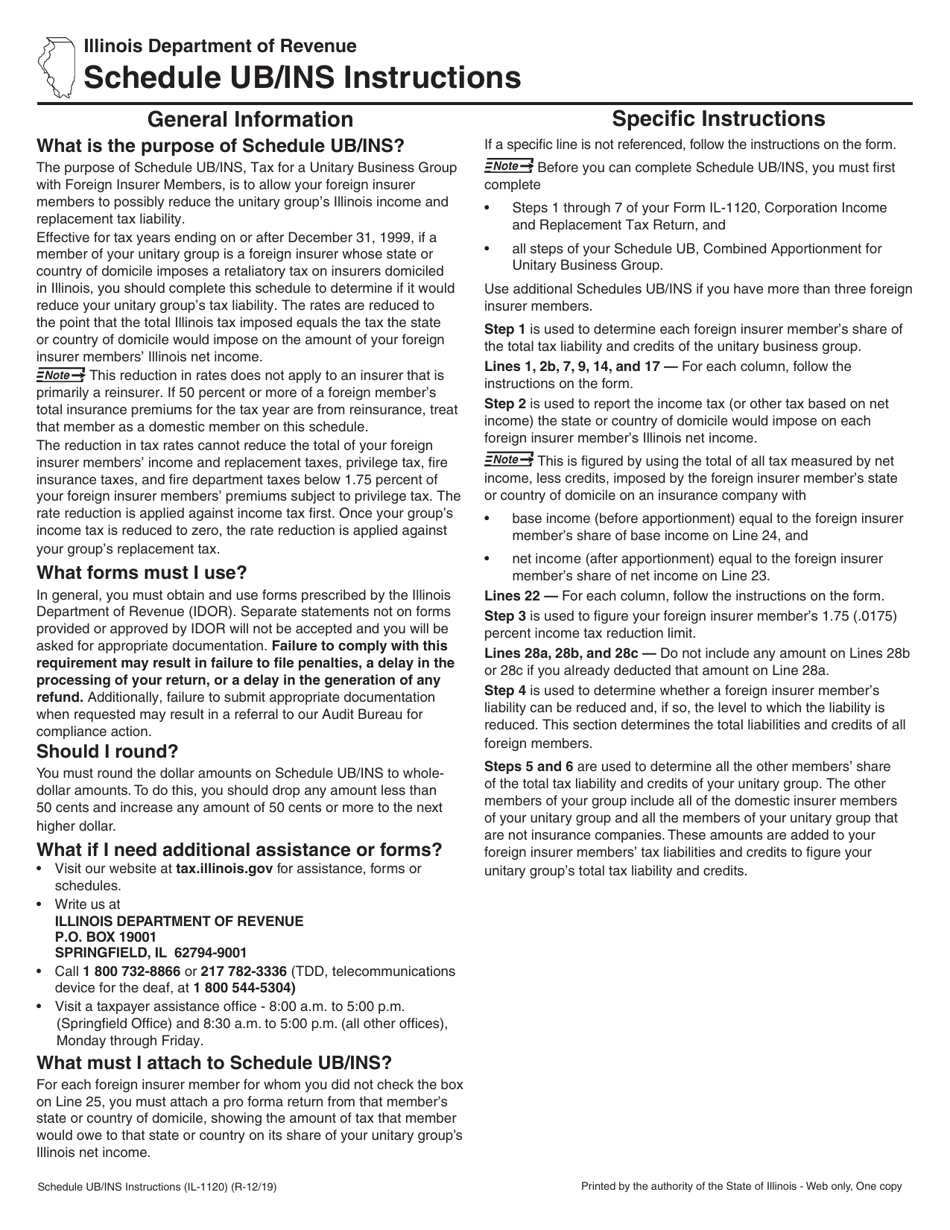

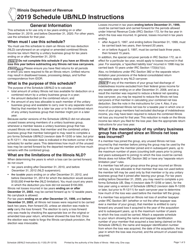

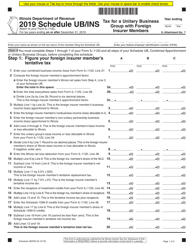

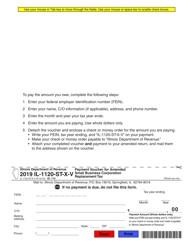

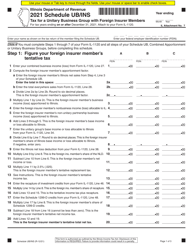

Instructions for Form IL-1120 Schedule UB / INS Tax for a Unitary Business Group With Foreign Insurer Members - Illinois

This document contains official instructions for Form IL-1120 Schedule UB/INS, Tax for a Foreign Insurer Members - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form IL-1120 Schedule UB/INS?

A: Form IL-1120 Schedule UB/INS is a tax form used in Illinois for a unitary business group with foreign insurer members.

Q: What is a unitary business group?

A: A unitary business group refers to a group of corporations that are engaged in a unitary business, meaning they are interdependent and function as a single entity.

Q: Who needs to file Form IL-1120 Schedule UB/INS?

A: Individuals and corporations who are part of a unitary business group with foreign insurer members in Illinois need to file this form.

Q: What is the purpose of Form IL-1120 Schedule UB/INS?

A: The purpose of this form is to calculate and report the tax liability for a unitary business group with foreign insurer members in Illinois.

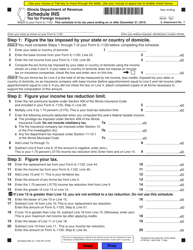

Q: What information is required on Form IL-1120 Schedule UB/INS?

A: The form requires various information related to the unitary business group and its foreign insurer members, including income, deductions, and apportionment factors.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.