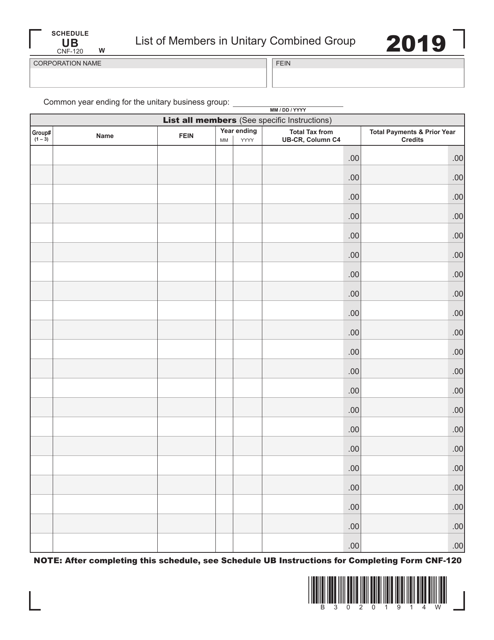

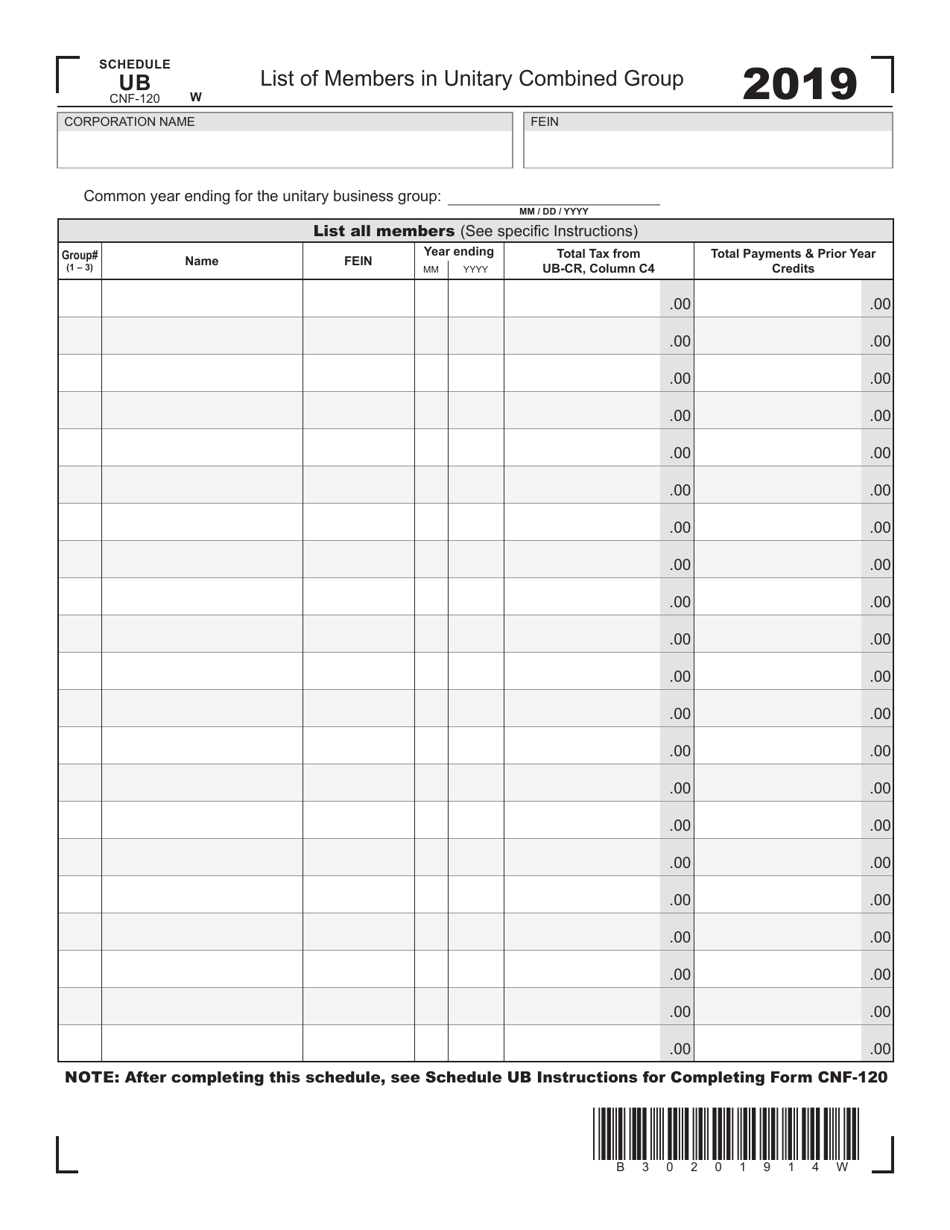

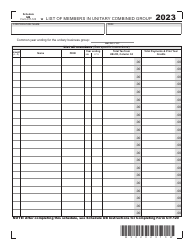

Form CNF-120 Schedule UB List of Members in Unitary Combined Group - West Virginia

What Is Form CNF-120 Schedule UB?

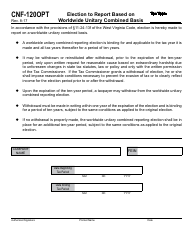

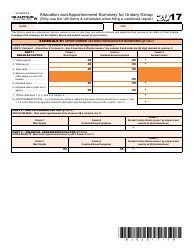

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form CNF-120, Corporation Net Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CNF-120 Schedule UB?

A: The CNF-120 Schedule UB is a form used in West Virginia to list the members of a unitary combined group.

Q: What is a unitary combined group?

A: A unitary combined group is a group of corporations that are engaged in a unitary business and are subject to combined reporting.

Q: Why do I need to file the CNF-120 Schedule UB?

A: The CNF-120 Schedule UB is required to be filed with the West Virginia Department of Revenue to report the members of your unitary combined group.

Q: How do I fill out the CNF-120 Schedule UB?

A: You will need to provide the names, federal employer identification numbers (FEINs), and percentage of ownership for each member of your unitary combined group.

Q: When is the due date for filing the CNF-120 Schedule UB?

A: The due date for filing the CNF-120 Schedule UB is generally the same as the due date for filing the West Virginia Corporation Net Income Tax Return.

Q: What if I have additional questions about the CNF-120 Schedule UB?

A: If you have additional questions about the CNF-120 Schedule UB, you can contact the West Virginia Department of Revenue for assistance.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CNF-120 Schedule UB by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.