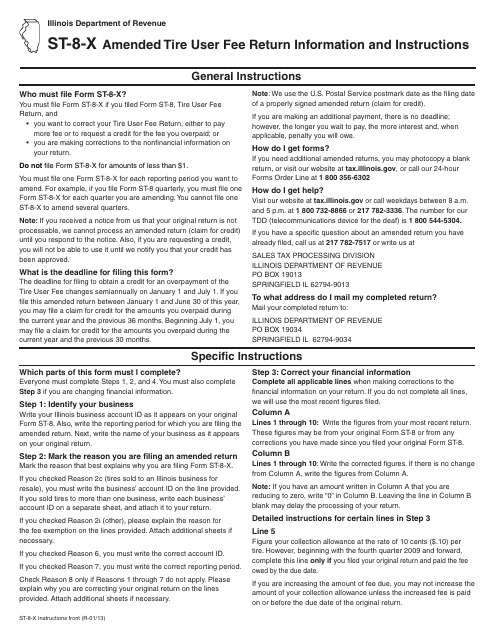

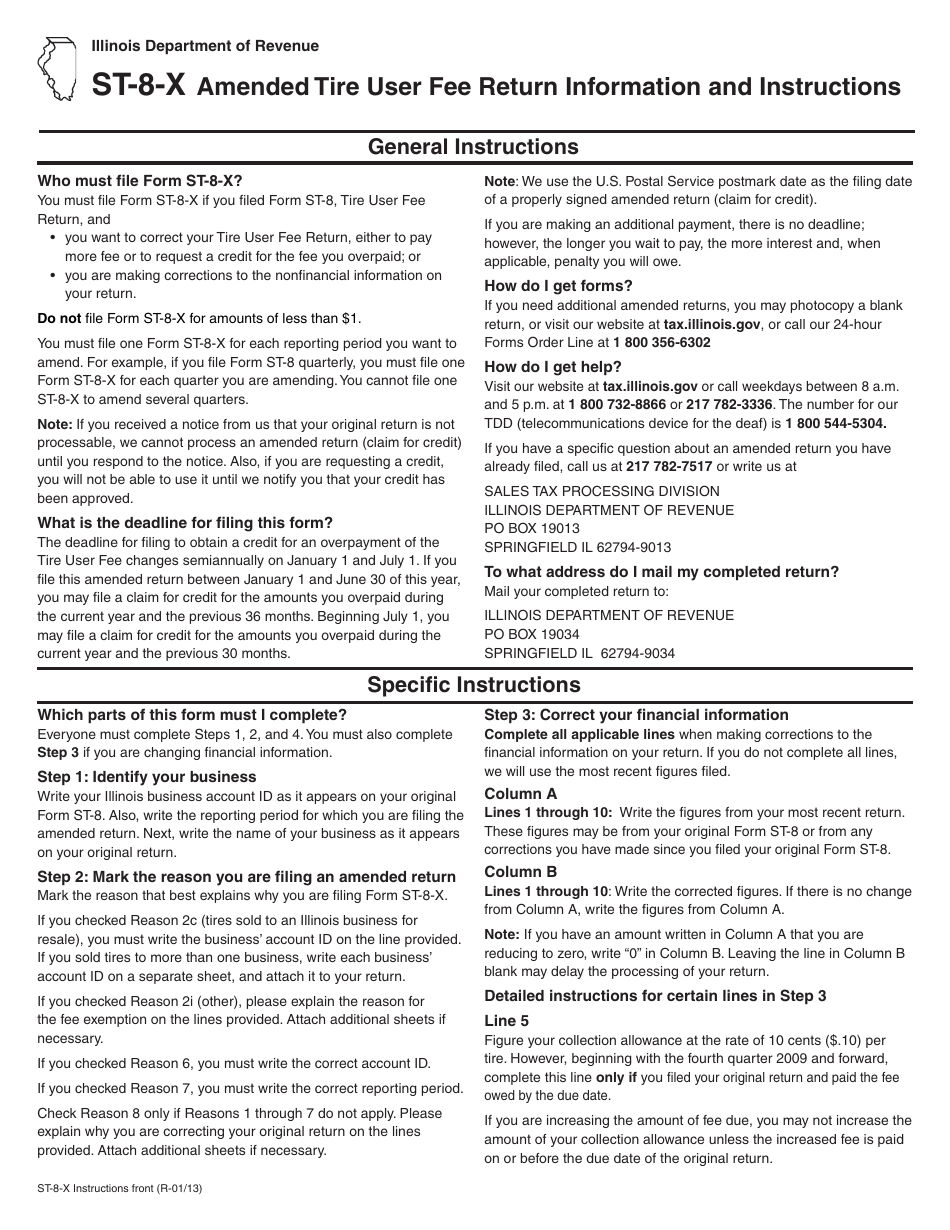

Instructions for Form ST-8-X Amended Tire User Fee Return - Illinois

This document contains official instructions for Form ST-8-X , Amended Tire User Fee Return - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form ST-8-X?

A: Form ST-8-X is the Amended Tire User Fee Return form in Illinois.

Q: Who should file Form ST-8-X?

A: Anyone who needs to amend their previously filed Tire User Fee Return in Illinois should file Form ST-8-X.

Q: What is the purpose of Form ST-8-X?

A: The purpose of Form ST-8-X is to report any changes or corrections to a previously filed Tire User Fee Return in Illinois.

Q: Is there a deadline for filing Form ST-8-X?

A: Yes, Form ST-8-X must be filed within 3 years from the due date of the original Tire User Fee Return or within 3 years from the date the return was filed, whichever is later.

Q: Are there any penalties for not filing Form ST-8-X?

A: Yes, failure to file Form ST-8-X or filing it late may result in penalties and interest.

Q: Is Form ST-8-X applicable in both Illinois and Canada?

A: No, Form ST-8-X is specific to Illinois and does not apply to Canada.

Q: What should I do if I made an error on my Tire User Fee Return in Illinois?

A: If you made an error on your Tire User Fee Return in Illinois, you should file Form ST-8-X to correct the error.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.