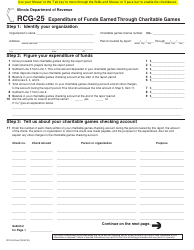

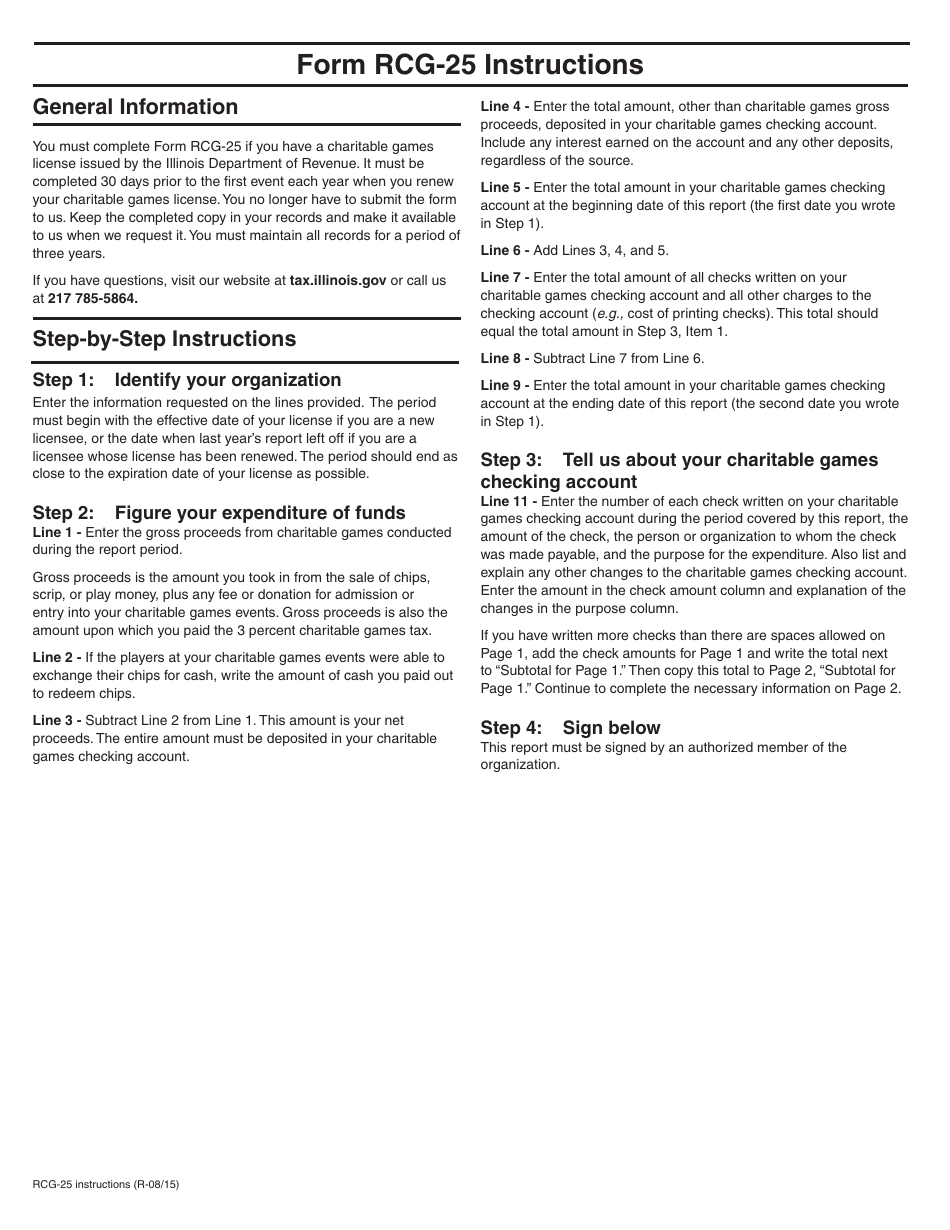

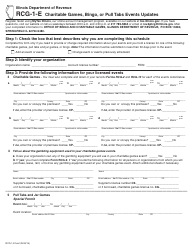

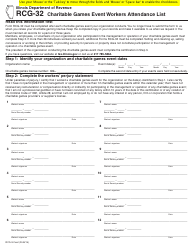

Instructions for Form RCG-25 Expenditure of Funds Earned Through Charitable Games - Illinois

This document contains official instructions for Form RCG-25 , Expenditure of Funds Earned Through Charitable Games - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form RCG-25 is available for download through this link.

FAQ

Q: What is Form RCG-25?

A: Form RCG-25 is a form used in Illinois for reporting the expenditure of funds earned through charitable games.

Q: Who needs to file Form RCG-25?

A: Any organization that has earned funds through charitable games in Illinois and has expenditures to report.

Q: What information is required on Form RCG-25?

A: Form RCG-25 requires information about the organization, the funds earned, and a breakdown of the expenditures.

Q: When is Form RCG-25 due?

A: Form RCG-25 is due annually, within 45 days after the end of the organization's fiscal year.

Q: What happens if I don't file Form RCG-25?

A: Failure to file Form RCG-25 or filing it late may result in penalties or the loss of the organization's charitable gaming license.

Q: Are there any fees associated with filing Form RCG-25?

A: There are no fees associated with filing Form RCG-25.

Q: Can I amend Form RCG-25 if I made a mistake?

A: Yes, you can file an amended Form RCG-25 if you made a mistake or need to update the information.

Q: Who can I contact for help with Form RCG-25?

A: You can contact the Illinois Department of Revenue for assistance with Form RCG-25.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.