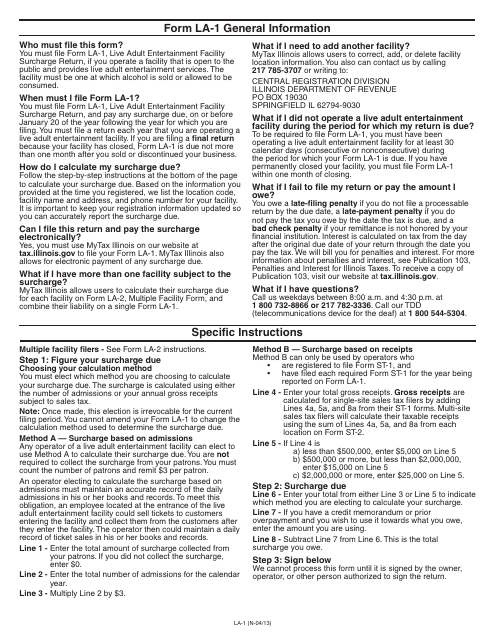

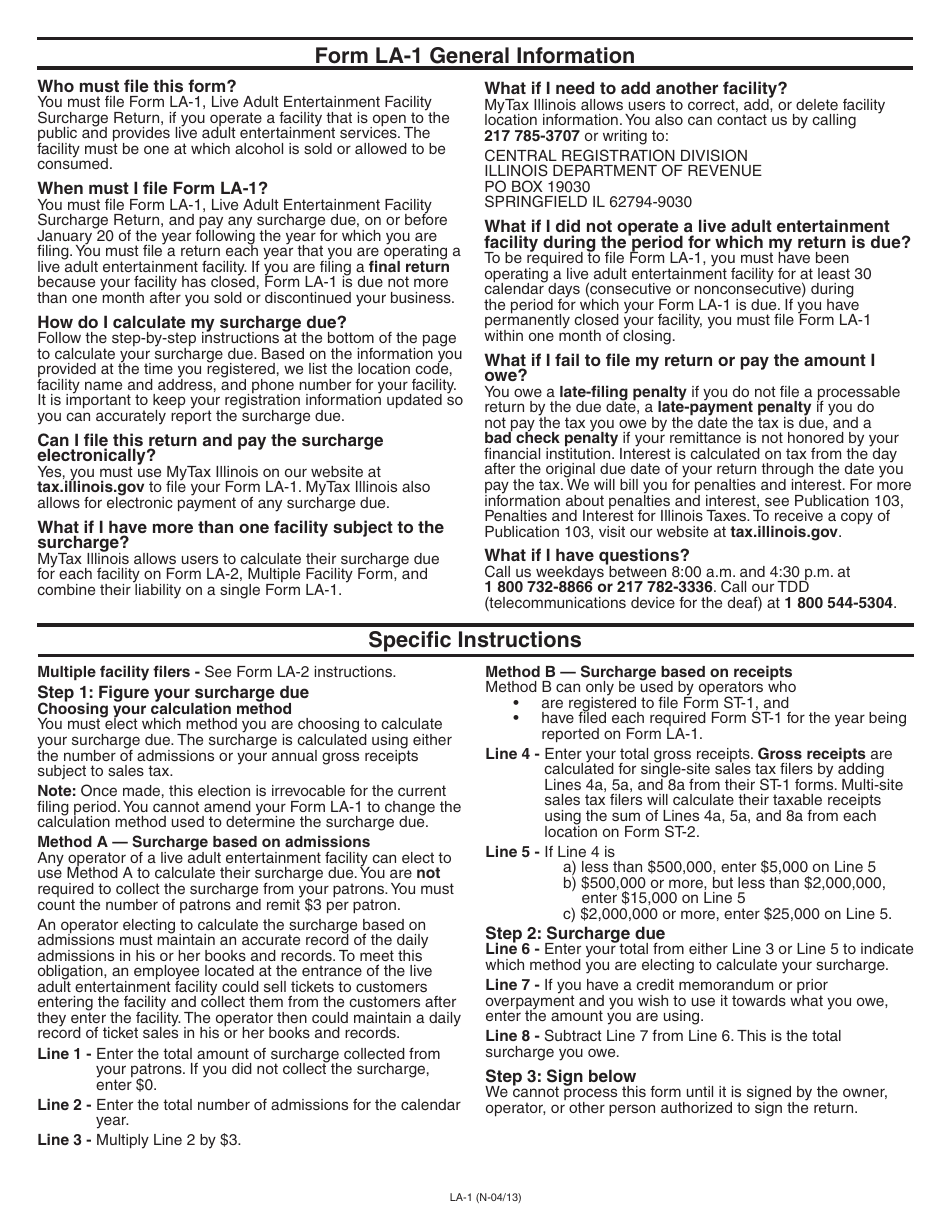

Instructions for Form LA-1 Live Adult Entertainment Facility Surcharge Return - Illinois

This document contains official instructions for Form LA-1 , Live Adult Entertainment Facility Surcharge Return - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form LA-1?

A: Form LA-1 is the Live Adult Entertainment Facility Surcharge Return.

Q: Who needs to file Form LA-1?

A: Adult entertainment facilities operating in Illinois need to file Form LA-1.

Q: What is the purpose of Form LA-1?

A: Form LA-1 is used to report and pay the Live Adult Entertainment Facility Surcharge.

Q: When is Form LA-1 due?

A: Form LA-1 is due on a quarterly basis, with the deadline falling on the last day of the month following the end of the quarter.

Q: How can I file Form LA-1?

A: Form LA-1 can be filed electronically using MyTax Illinois or by mailing a paper copy to the Illinois Department of Revenue.

Q: Are there any penalties for late filing or payment?

A: Yes, there are penalties for late filing or payment of the Live Adult Entertainment Facility Surcharge.

Q: Are there any exemptions or deductions available?

A: No, there are no exemptions or deductions available for the Live Adult Entertainment Facility Surcharge.

Q: What should I do if I have more questions or need assistance?

A: If you have further questions or need assistance, you should contact the Illinois Department of Revenue directly.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.