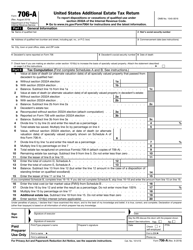

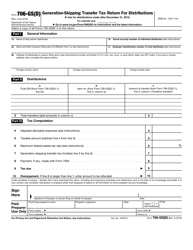

Instructions for IRS Form 706-A United States Additional Estate Tax Return

This document contains official instructions for IRS Form 706-A , United States Additional Estate Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 706-A?

A: IRS Form 706-A is the United States Additional Estate Tax Return.

Q: Who needs to file IRS Form 706-A?

A: You need to file IRS Form 706-A if the estate is subject to additional estate tax.

Q: What is the purpose of IRS Form 706-A?

A: The purpose of IRS Form 706-A is to calculate and report the additional estate tax due.

Q: What information is required on IRS Form 706-A?

A: IRS Form 706-A requires information about the decedent, the estate assets, deductions, and transfers.

Q: When is the deadline to file IRS Form 706-A?

A: The deadline to file IRS Form 706-A is within 9 months after the date of the decedent's death.

Q: Are there any penalties for late filing of IRS Form 706-A?

A: Yes, there are penalties for late filing of IRS Form 706-A.

Q: Do I need to include any supporting documents with IRS Form 706-A?

A: Yes, you may need to include supporting documents such as appraisals, valuations, and a copy of the decedent's will.

Q: Who should I contact if I have questions about IRS Form 706-A?

A: You can contact the IRS directly or consult with a tax professional if you have questions about IRS Form 706-A.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.