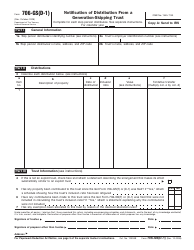

Instructions for IRS Form 706-GS(D) Generation-Skipping Transfer Tax Return for Distributions

This document contains official instructions for IRS Form 706-GS(D) , Generation-Skipping Transfer Tax Return for Distributions - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 706-GS(D) is available for download through this link.

FAQ

Q: What is IRS Form 706-GS(D)?

A: IRS Form 706-GS(D) is the Generation-Skipping Transfer Tax Return for Distributions.

Q: Who needs to file IRS Form 706-GS(D)?

A: Those making distributions from a generation-skipping trust or allocating generation-skipping transfer tax exemption need to file this form.

Q: What is the purpose of IRS Form 706-GS(D)?

A: The purpose of this form is to determine and report the generation-skipping transfer tax liability.

Q: When is IRS Form 706-GS(D) due?

A: Form 706-GS(D) is typically due on the same date as Form 706, which is nine months after the decedent's date of death.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.