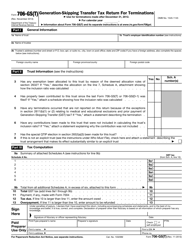

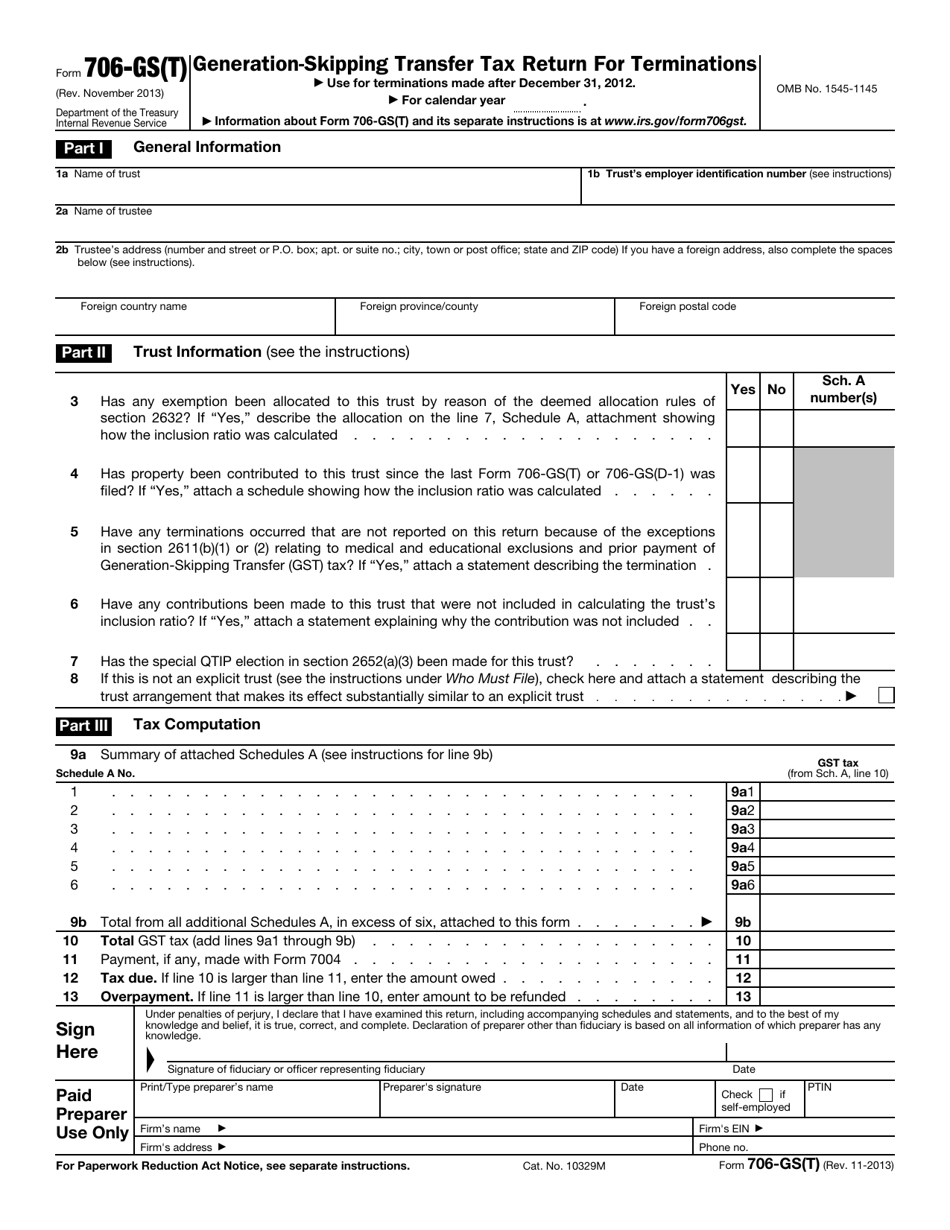

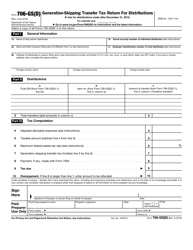

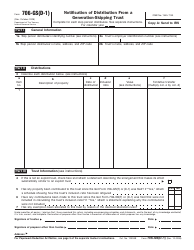

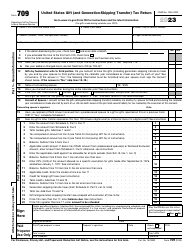

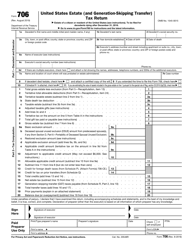

IRS Form 706-GS(T) Generation-Skipping Transfer Tax Return for Terminations

What Is IRS Form 706-GS(T)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2013. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 706-GS(T)?

A: IRS Form 706-GS(T) is the Generation-Skipping Transfer Tax Return for Terminations.

Q: Who needs to file IRS Form 706-GS(T)?

A: Individuals who have made generation-skipping transfers and need to report those transfers for tax purposes.

Q: What is generation-skipping transfer tax?

A: Generation-skipping transfer tax is a tax imposed on certain transfers to skip persons, typically grandchildren or unrelated individuals who are more than 37.5 years younger than the transferor.

Q: When do I need to file IRS Form 706-GS(T)?

A: IRS Form 706-GS(T) should be filed no later than nine months after the termination of the generation-skipping transfer.

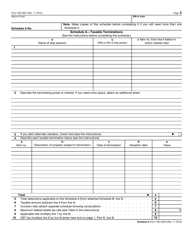

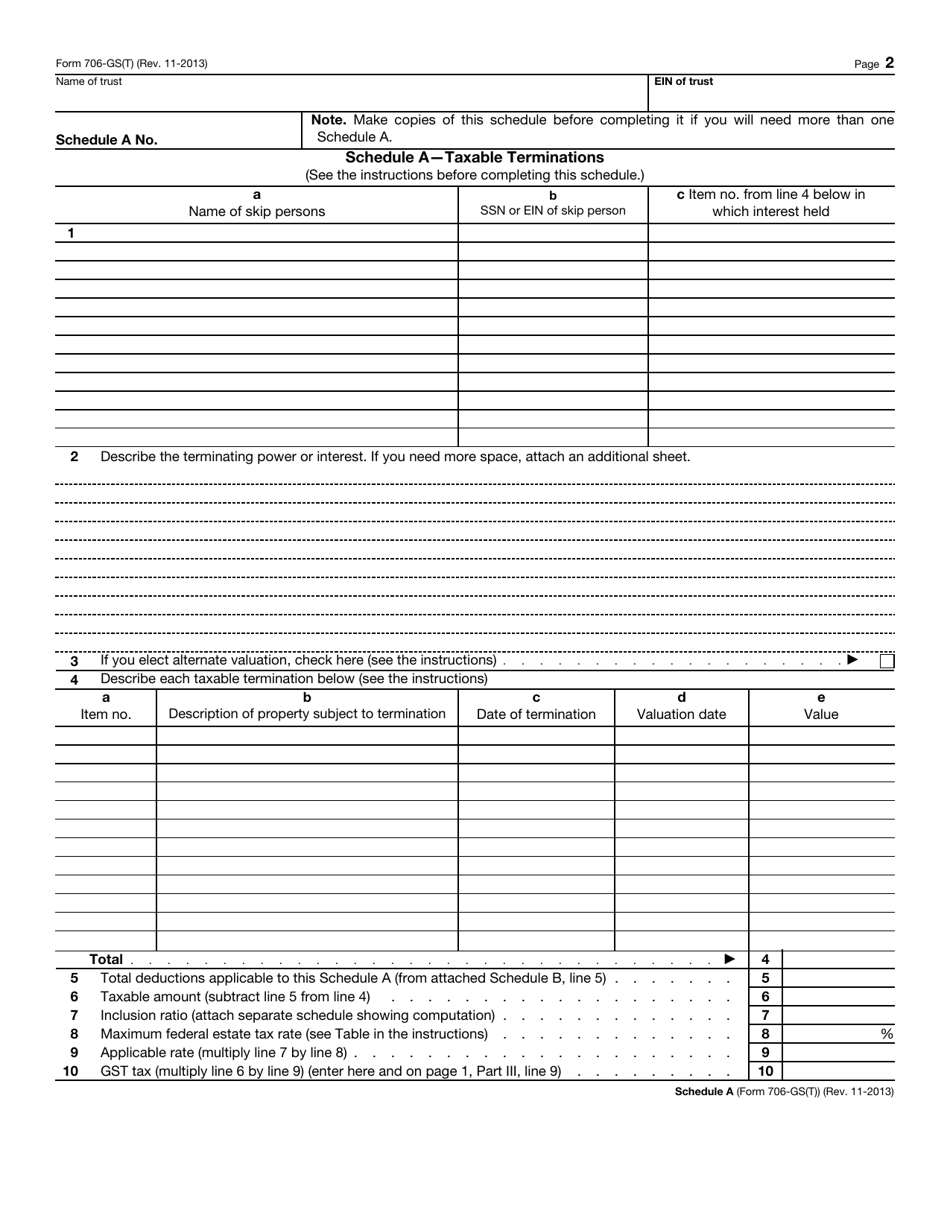

Q: What information is required to complete IRS Form 706-GS(T)?

A: To complete IRS Form 706-GS(T), you will need information about the generation-skipping transfer and the assets involved, as well as information about the transferor and the skip persons.

Q: Are there any penalties for not filing IRS Form 706-GS(T) on time?

A: Yes, there are penalties for not filing IRS Form 706-GS(T) on time, including potential interest charges and late filing penalties. It is important to file the form within the specified deadline.

Q: Can I file IRS Form 706-GS(T) electronically?

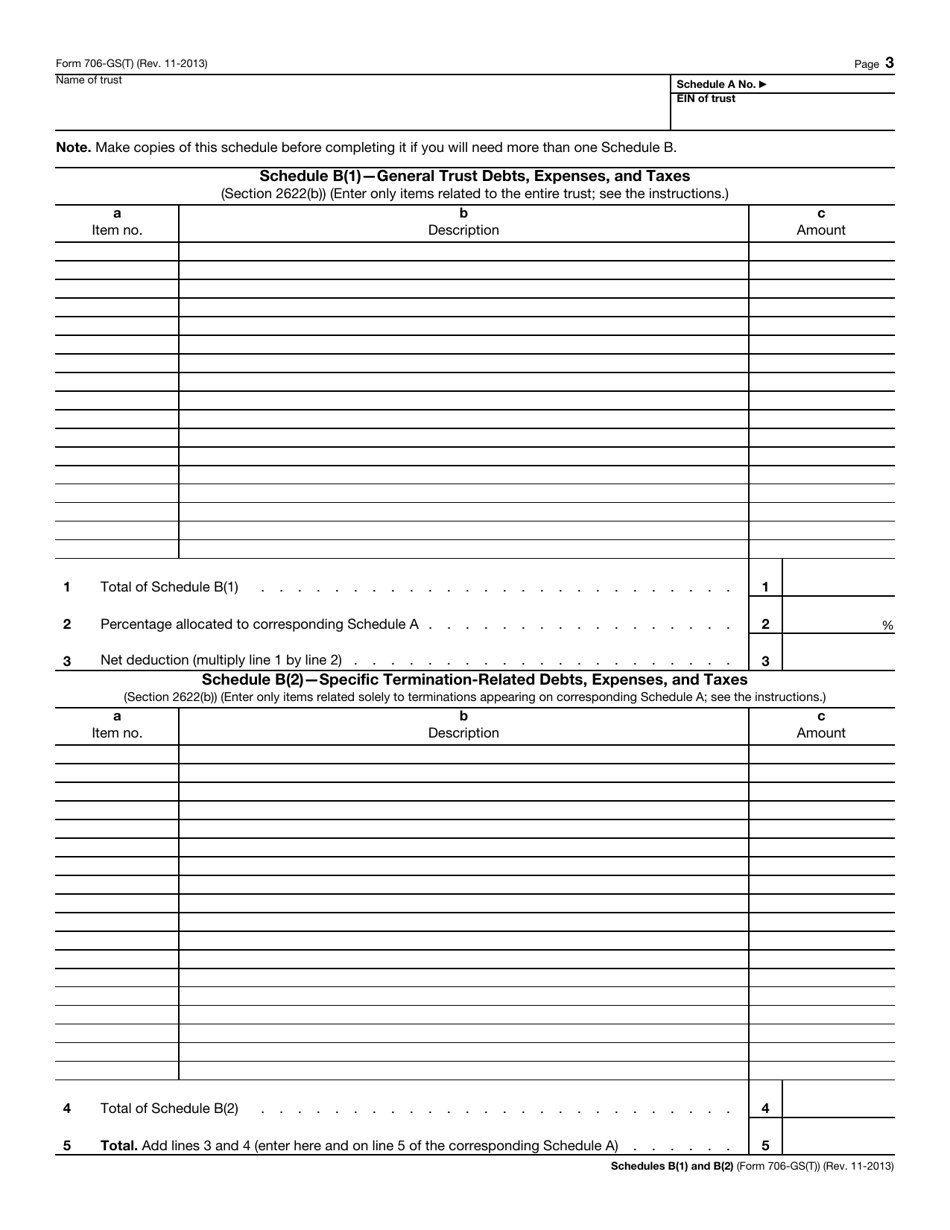

A: No, currently IRS Form 706-GS(T) cannot be filed electronically. It must be filed by mail.

Q: Do I need to attach any documents with IRS Form 706-GS(T)?

A: Yes, you may need to attach supporting documents such as appraisals, valuations, or other relevant documents to substantiate the information provided on the form.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 706-GS(T) through the link below or browse more documents in our library of IRS Forms.