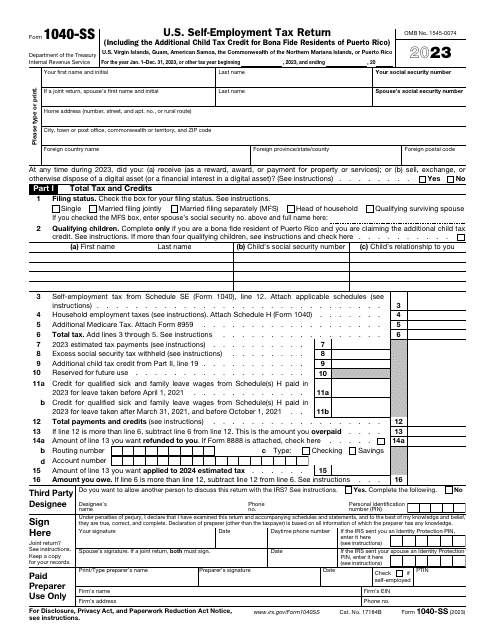

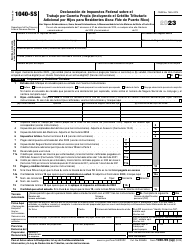

IRS Form 1040-SS U.S. Self-employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

What Is Form 1040-SS?

IRS Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico) is a document used to report your self-employment net earnings to the United States.

This form can be used only by residents of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa who do not need to submit a United States Income tax return. You must fill it out only if your (or your spouse's, if filing jointly) self-employment income is $400 or more, as well as if your income as a church employee is $108.28 or more.

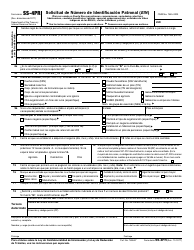

The IRS 1040-SS Form was issued by the Internal Revenue Service (IRS) and was last revised in 2023 . Download the latest fillable version of the document below. Puerto Rico residents can file Form 1040 (PR), Self-Employment Tax Return available in Spanish.

How to Fill Out 1040-SS Form?

Fill out the IRS Form 1040-SS using the following guide:

- Type or print your and your spouse's (if filing jointly) personal information, including name, address, and SSN in the top part of the form;

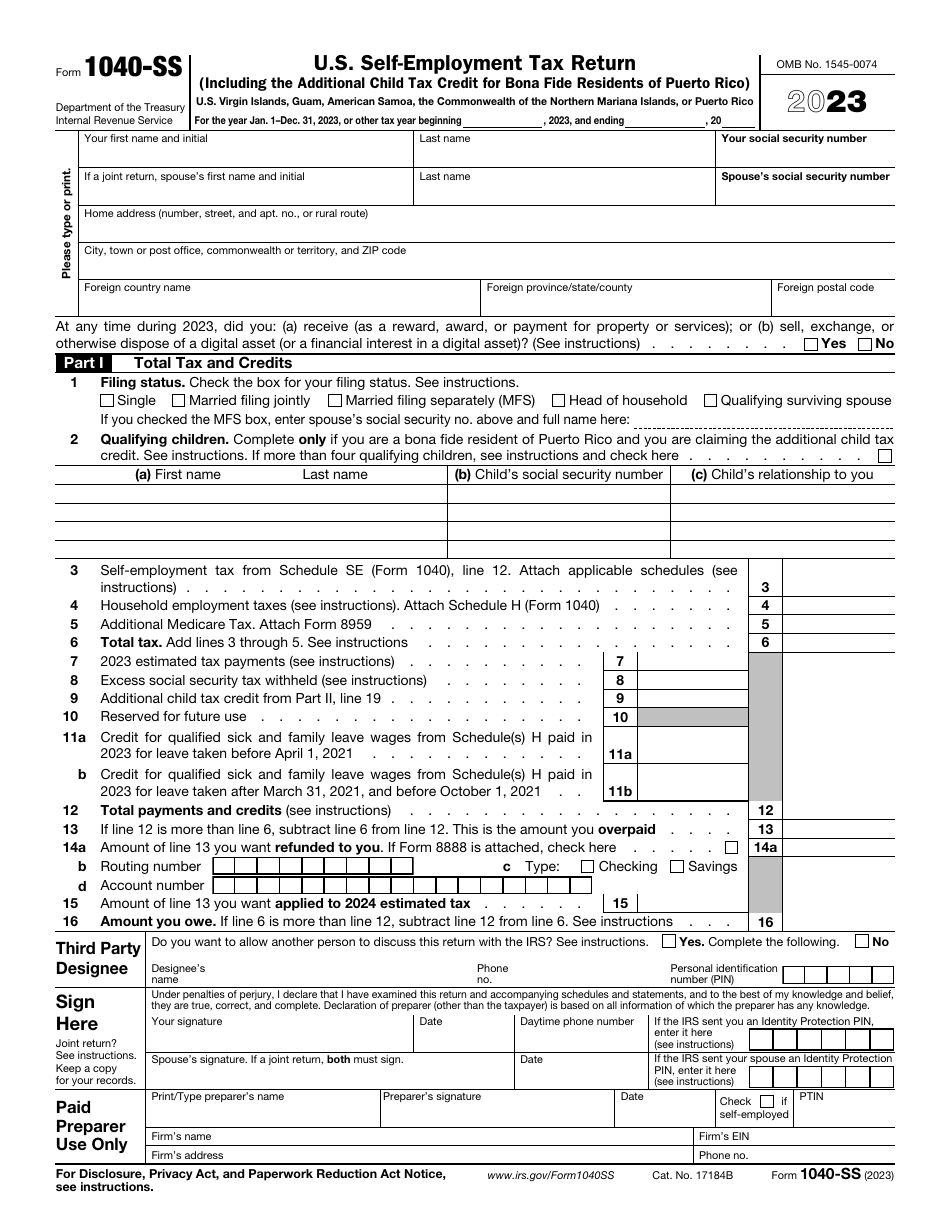

- Part I. Total Tax and Credits. Use this part to specify your filing status and to calculate total tax and credits. Fill out most fields of this part after completing Parts II through VI;

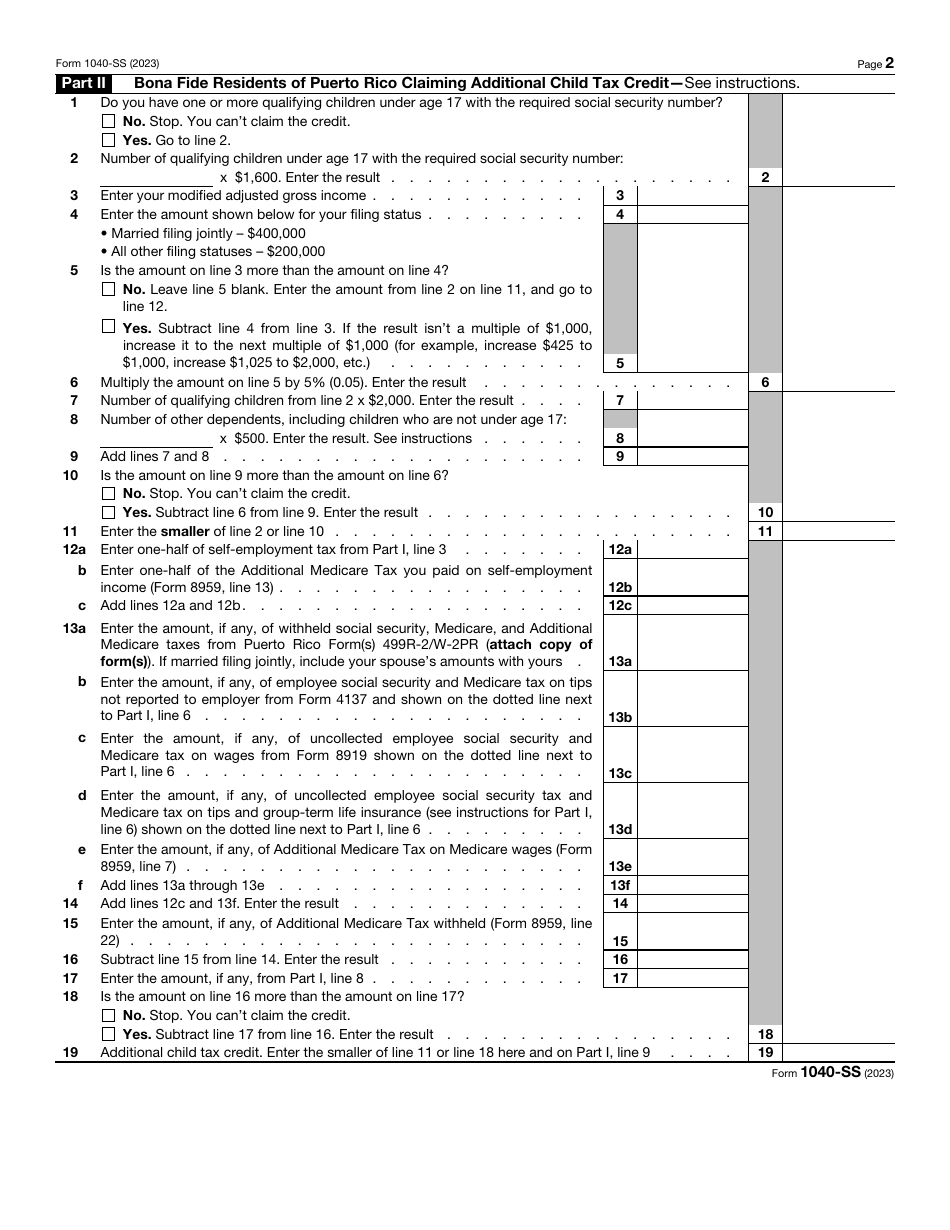

- Part II. Bona Fide Residents of Puerto Rico Claiming Additional Child Tax Credit. Fill out this form if you were a bona fide resident of Puerto Rico at the tax year you report and you qualify to claim the additional child tax credit (you have at least three qualifying children);

- Part III. Profit or Loss from Farming. Fill out Sections A and B if you use the cash accounting method. For the Accrual method, complete Sections B and C, and line 11 from Section A;

- Part IV. Profit or Loss from Business (Sole Proprietorship). Calculate your income and expenses by filling out Sections A and B. Check Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship) instructions for more detailed information;

- Part V. Self-Employment Tax. If you file the form jointly with your spouse, both of you must fill out a separate Part V. If you report income as a church employee, read Form 1040-SS Instructions file before completing this part;

- Part VI. Optional Methods to Figure Net Earnings. If filing jointly with a spouse, each of you has to fill out a separate Part VI.

The form is not valid until you sign it. If you file the self-employment tax return jointly with your spouse, both of you must sign it.

IRS Form 1040-SS Instructions

File your self-employment tax return form by April 15 if you are filing on a calendar year basis. If you file on a fiscal year basis, the due date is the 15th day of the 4th month after the fiscal year closes. Bonafide residents of Puerto Rico can ask for a 6-month extension by submitting the paper or electronic version of Form 4868. Residents of Guam, American Samoa, the USVI, and the CNMI can apply for a filing extension with the same form or can receive an automatic 2-month extension to file the return form and to pay tax if they are outside the United States and Puerto Rico on the due date. After that, they may apply for an additional 4-month extension to file the form if needed. The 1040-SS tax return form can be submitted by mail only. The mailing addresses are provided in the IRS Instructions for Form 1040-SS. Find detailed instructions on the IRS website.

If you do not file the form by the due date, the penalty will be about 5% of the amount due for each month, unless you have a valid reason. If you do, attach the statement with the proper explanations to your self-employment tax return.

IRS 1040-SS Related Forms:

- Form 1040, U.S. Individual Income Tax Return;

- Form 1040-C, U.S. Departing Alien Income Tax Return;

- Form 1040-NR, U.S. Nonresident Alien Income Tax Return;

- Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens with No Dependents;

- Form 1040-V, Payment Voucher;

- Form 1040-X, Amended U.S. Individual Income Tax Return;

- Form 1040-ES, Estimated Tax for Individuals;

- Form 4029, Application for Exemption from Social Security and Medicare Taxes and Waiver of Benefits;

- Form 4361, Application for Exemption from Self-Employment Tax for Use by Ministers, Members of Religious Orders and Christian Science Practitioners;

- Schedule E (Form 1040), Supplemental Income and Loss;

- Schedule F (Form 1040), Profit or Loss from Farming.