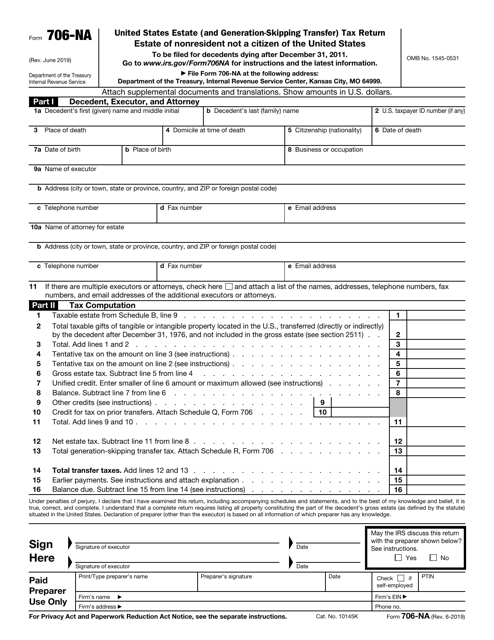

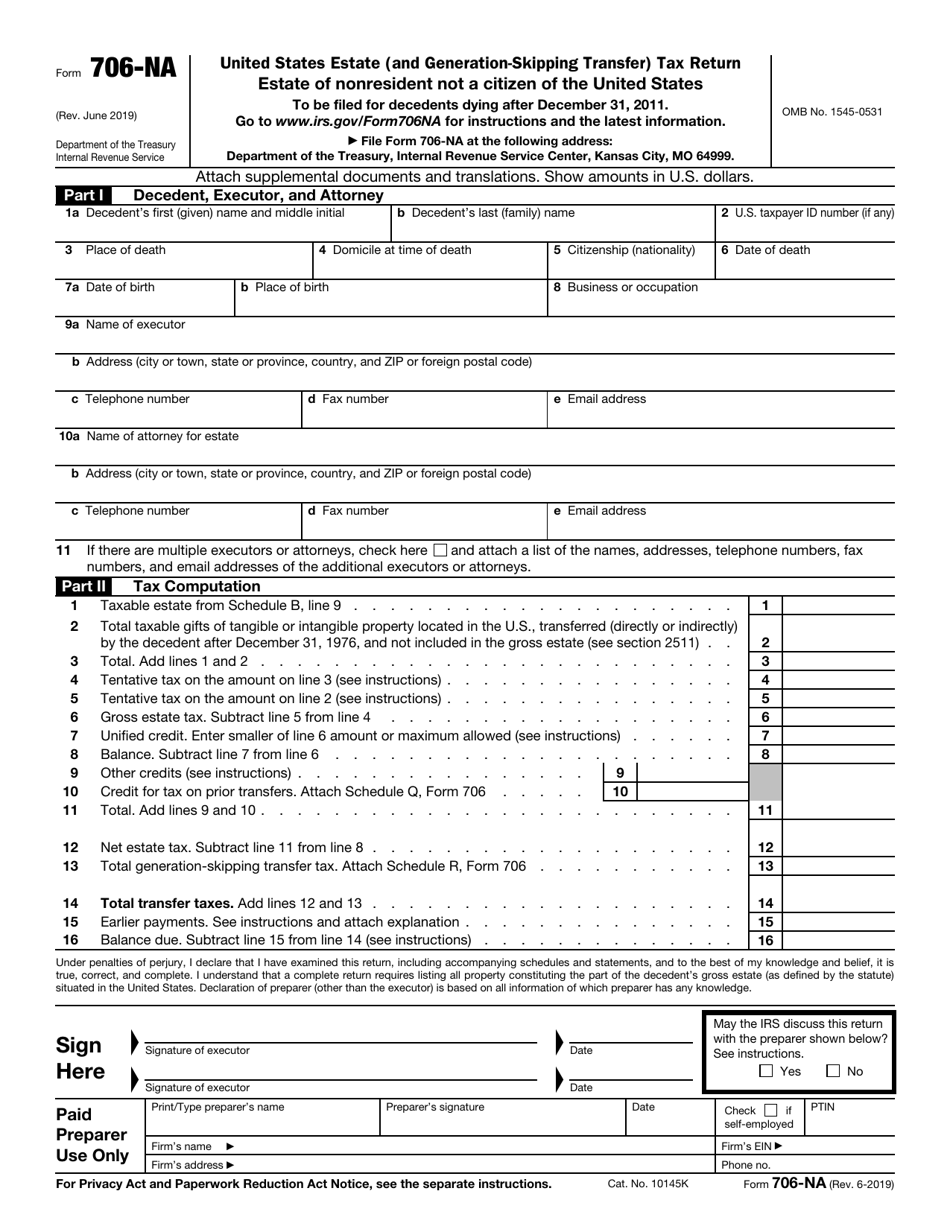

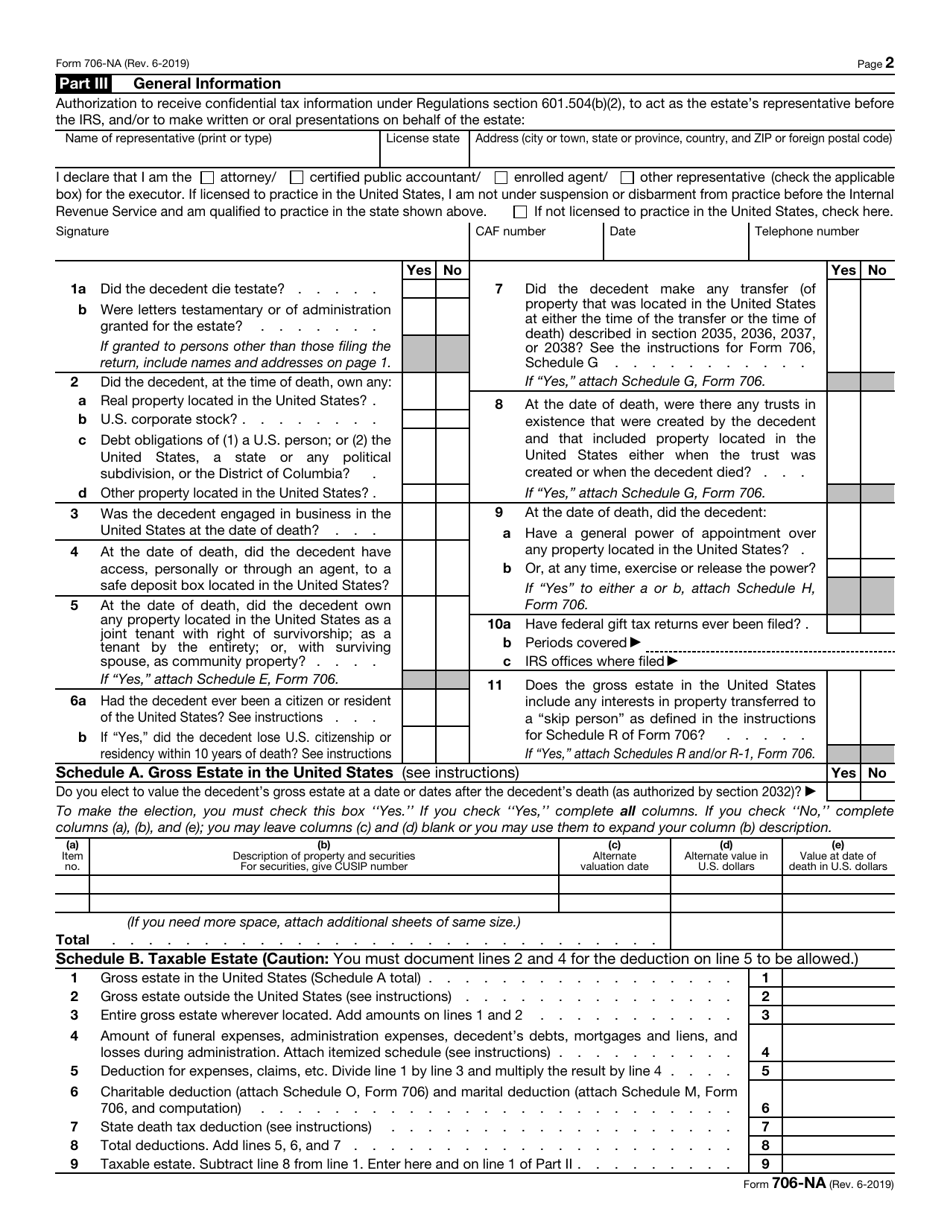

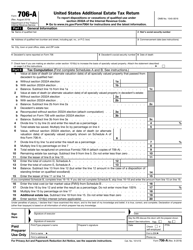

IRS Form 706-NA United States Estate (And Generation-Skipping Transfer) Tax Return Estate of Nonresident Not a Citizen of the United States

What Is IRS Form 706-NA?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 706-NA?

A: IRS Form 706-NA is the United States Estate (And Generation-Skipping Transfer) Tax Return for the Estate of Nonresident who is not a Citizen of the United States.

Q: Who needs to file IRS Form 706-NA?

A: Anyone who is the executor of the estate of a nonresident who is not a citizen of the United States and meets certain requirements may need to file IRS Form 706-NA.

Q: What is the purpose of IRS Form 706-NA?

A: The purpose of IRS Form 706-NA is to report and calculate the estate tax and generation-skipping transfer tax liability for the estate of a nonresident who is not a citizen of the United States.

Q: What information is required on IRS Form 706-NA?

A: IRS Form 706-NA requires information about the deceased individual, the estate's assets and liabilities, and the calculation of the estate tax and generation-skipping transfer tax.

Q: When is the deadline to file IRS Form 706-NA?

A: The deadline to file IRS Form 706-NA is generally within 9 months after the decedent's date of death, but extensions may be available.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 706-NA through the link below or browse more documents in our library of IRS Forms.