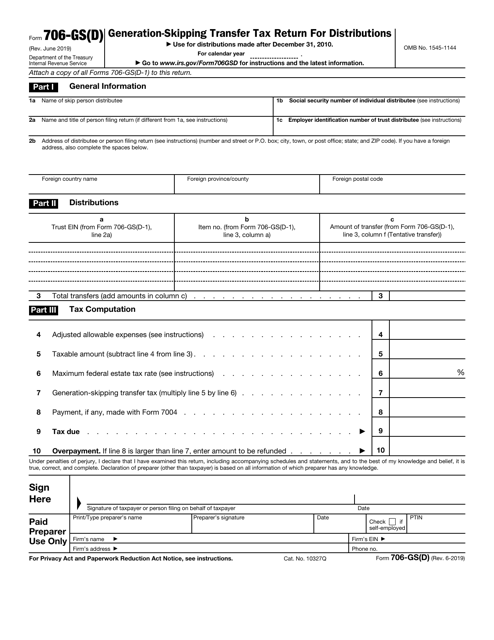

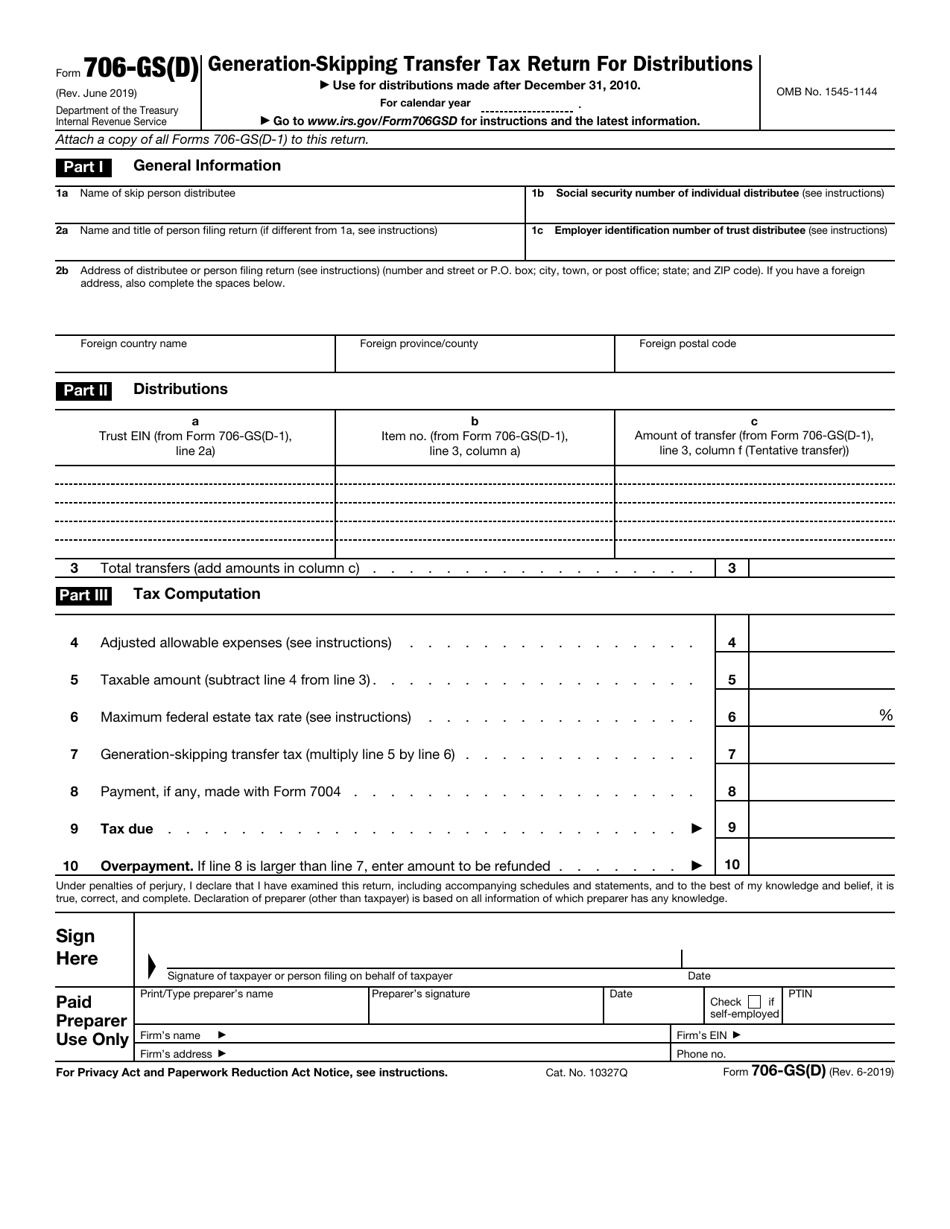

IRS Form 706-GS(D) Generation-Skipping Transfer Tax Return for Distributions

What Is IRS Form 706-GS(D)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 706-GS(D)?

A: IRS Form 706-GS(D) is the Generation-Skipping Transfer Tax Return for Distributions.

Q: Who needs to file IRS Form 706-GS(D)?

A: Individuals or entities who made generation-skipping transfers or received distributions from generation-skipping trusts need to file IRS Form 706-GS(D).

Q: What is the purpose of IRS Form 706-GS(D)?

A: The purpose of IRS Form 706-GS(D) is to report generation-skipping transfers and calculate the generation-skipping transfer tax.

Q: What is a generation-skipping transfer?

A: A generation-skipping transfer is a transfer of property made to a person who is more than one generation younger than the transferor.

Q: How do I file IRS Form 706-GS(D)?

A: IRS Form 706-GS(D) can be filed by mail to the address provided in the form's instructions or electronically through the IRS e-file system.

Q: When is the deadline to file IRS Form 706-GS(D)?

A: The deadline to file IRS Form 706-GS(D) is generally nine months after the date of distribution or transfer.

Q: Are there any penalties for not filing IRS Form 706-GS(D) on time?

A: Yes, failure to file IRS Form 706-GS(D) on time may result in penalties and interest charges.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 706-GS(D) through the link below or browse more documents in our library of IRS Forms.