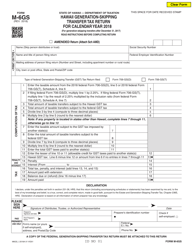

Instructions for IRS Form 706-GS (T) Generation-Skipping Transfer Tax Return for Terminations

This document contains official instructions for IRS Form 706-GS (T) , Generation-Skipping Transfer Tax Return for Terminations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is Form 706-GS (T)?

A: Form 706-GS (T) is the Generation-Skipping Transfer Tax Return for Terminations.

Q: Who needs to file Form 706-GS (T)?

A: Form 706-GS (T) needs to be filed by the executor of a terminating trust or by a trustee of a trust required to file the return.

Q: What is the Generation-Skipping Transfer Tax?

A: The Generation-Skipping Transfer Tax is a tax imposed on certain transfers that are made directly to a skip person or to a trust for the benefit of one or more skip persons.

Q: What is a skip person?

A: A skip person is generally someone who is at least two generations below the generation of the transferor.

Q: When is Form 706-GS (T) due?

A: Form 706-GS (T) is due nine months after the termination of the trust or the date of the distribution, whichever is earlier.

Q: What information is required to complete Form 706-GS (T)?

A: You will need information about the trust, the transferor, the skip persons, and the calculation of the generation-skipping transfer tax.

Q: Are there any penalties for not filing Form 706-GS (T) on time?

A: Yes, there may be penalties for failing to file Form 706-GS (T) on time, including late-filing penalties and interest on any unpaid tax amounts.

Q: Can I file Form 706-GS (T) electronically?

A: Currently, Form 706-GS (T) cannot be filed electronically. It must be filed by mail or in person.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.