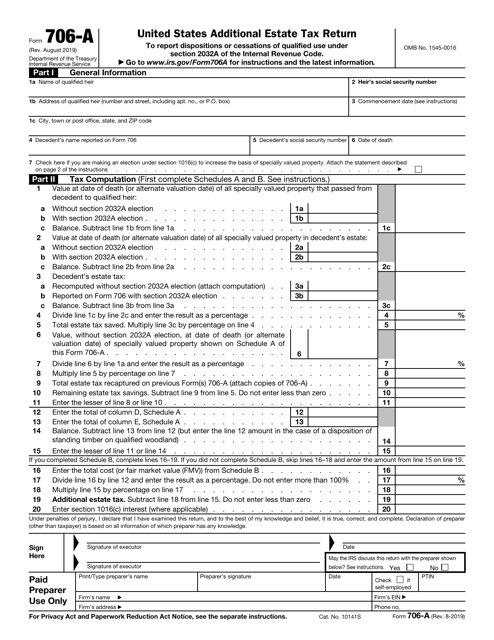

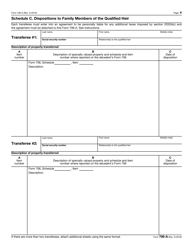

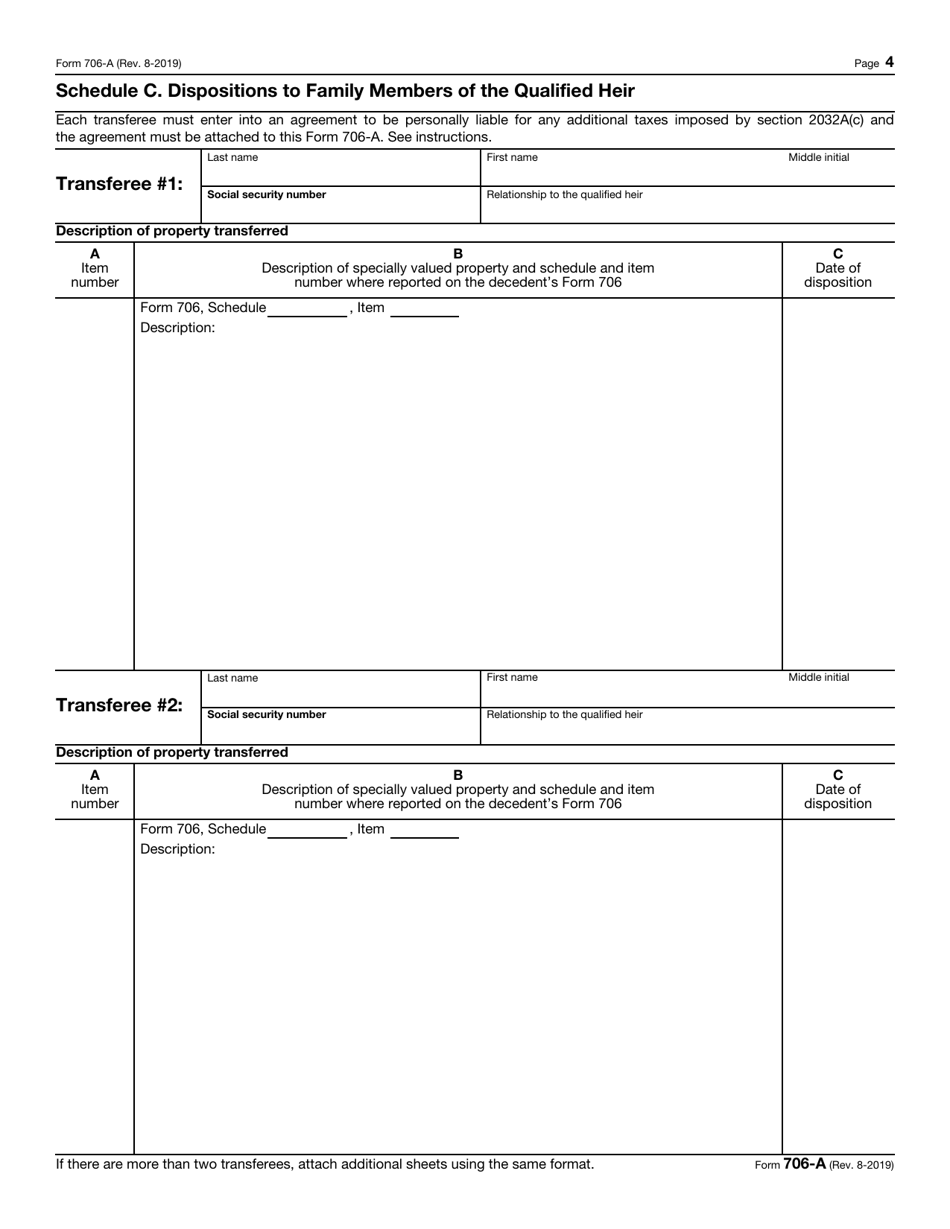

IRS Form 706-A United States Additional Estate Tax Return

What Is IRS Form 706-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 706-A?

A: IRS Form 706-A is the United States Additional Estate Tax Return.

Q: Who needs to file IRS Form 706-A?

A: IRS Form 706-A is filed by individuals or estates to report and pay additional estate tax.

Q: What is the purpose of IRS Form 706-A?

A: The purpose of IRS Form 706-A is to calculate and report any additional estate tax owed.

Q: When is IRS Form 706-A due?

A: IRS Form 706-A is due within nine months after the decedent's date of death.

Q: Are there any penalties for filing IRS Form 706-A late?

A: Yes, there are penalties for filing IRS Form 706-A late, such as late filing and late payment penalties.

Form Details:

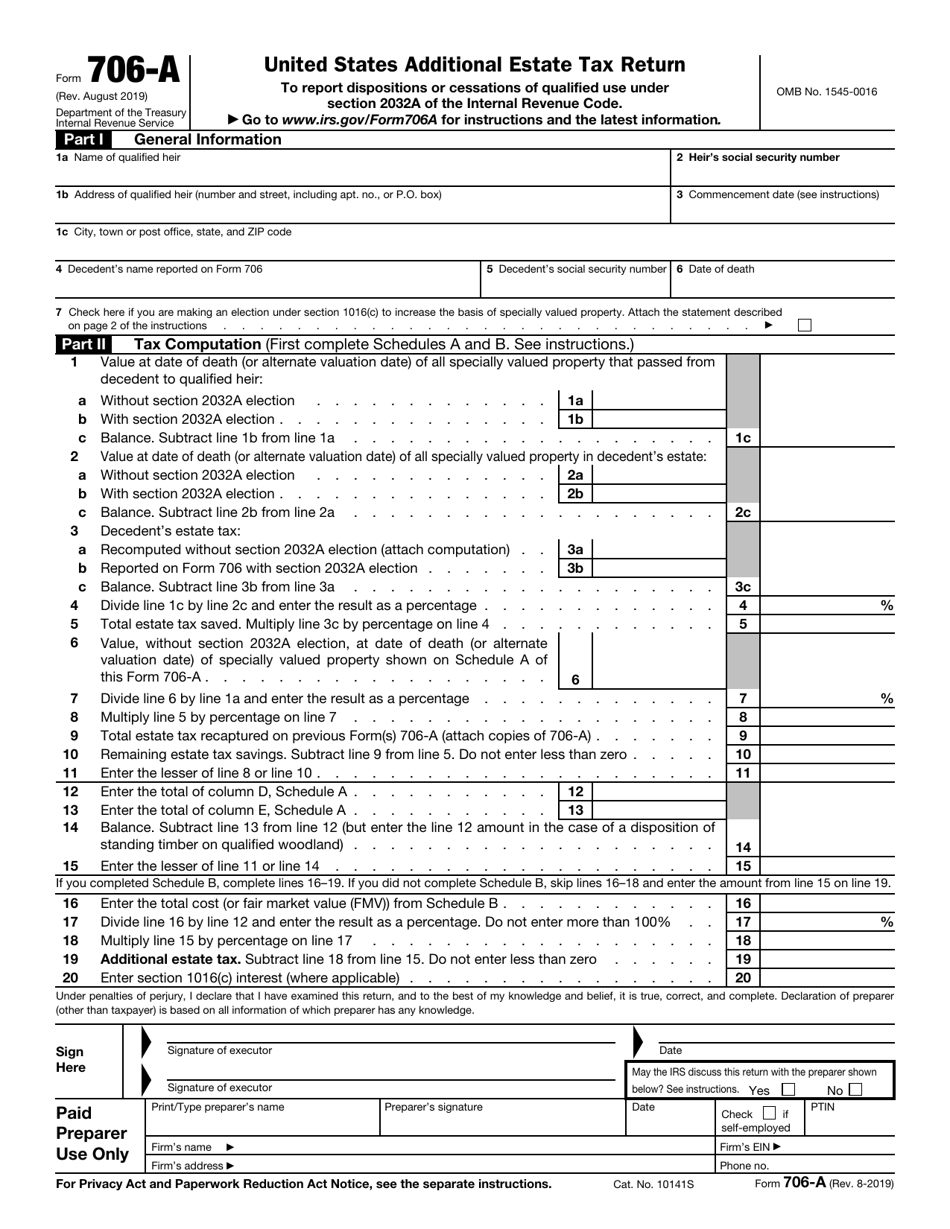

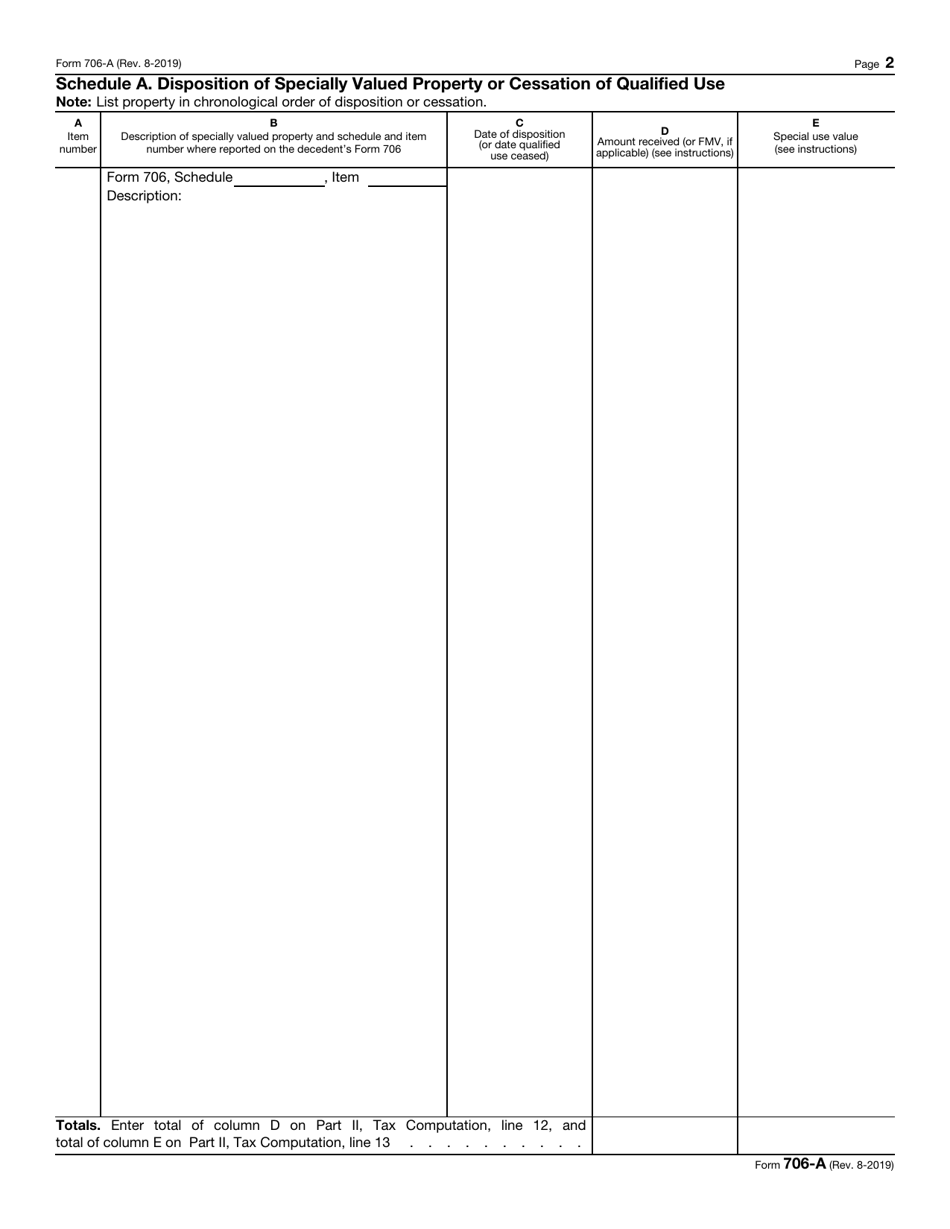

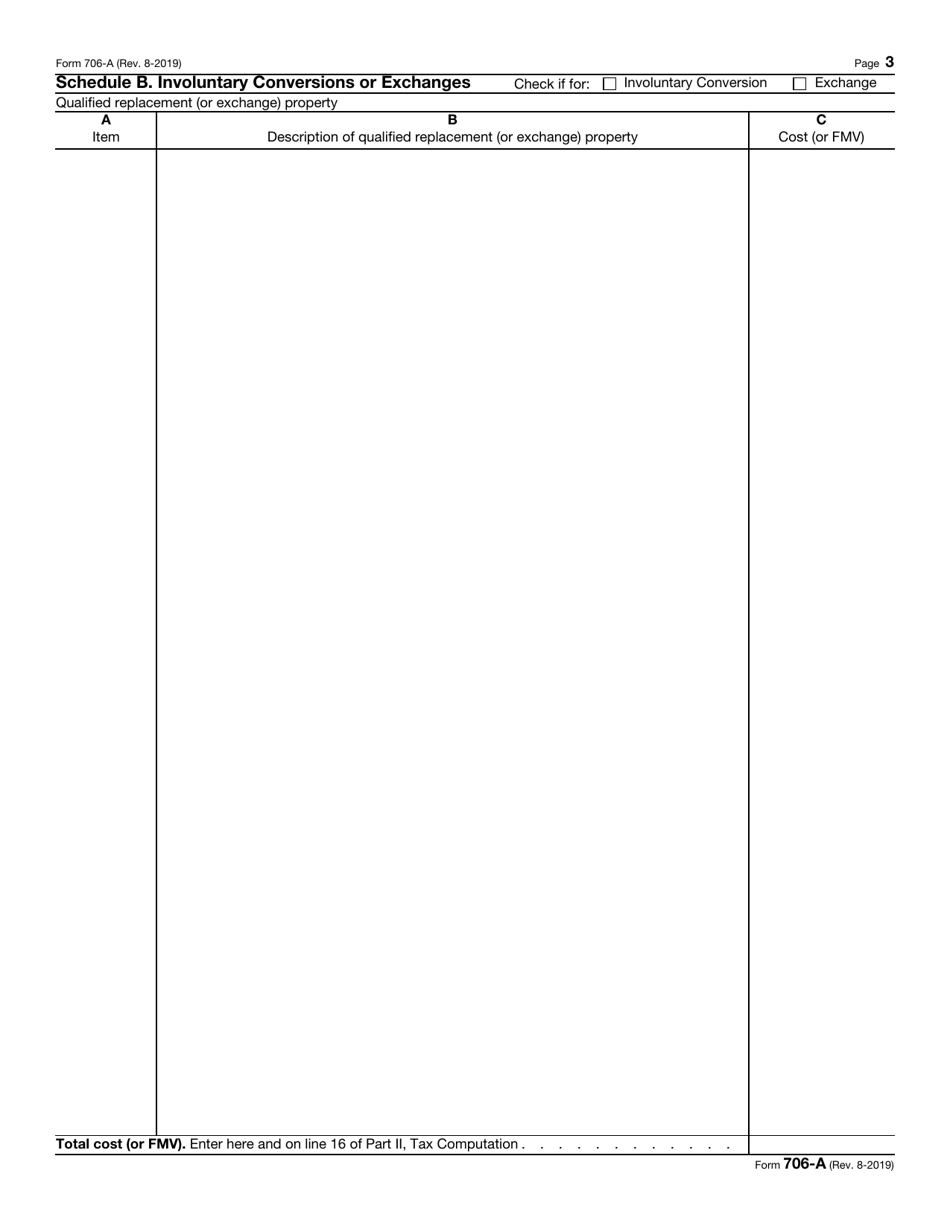

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 706-A through the link below or browse more documents in our library of IRS Forms.