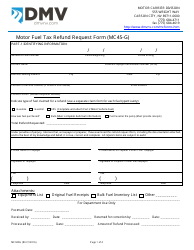

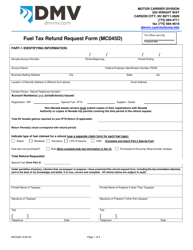

Instructions for Form MC045GI Motor Fuel Tax Refund Request Form - Nevada

This document contains official instructions for Form MC045GI , Motor Fuel Tax Refund Request Form - a form released and collected by the Nevada Department of Motor Vehicles.

FAQ

Q: What is Form MC045GI?

A: Form MC045GI is the Motor Fuel Tax Refund Request Form used in Nevada.

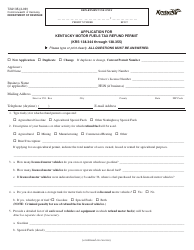

Q: Who can use Form MC045GI?

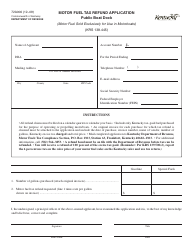

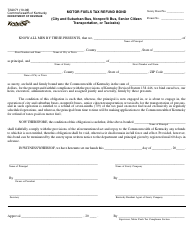

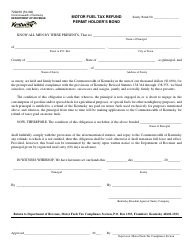

A: Motor fuel distributors, dealers, and users in Nevada can use Form MC045GI.

Q: What is the purpose of Form MC045GI?

A: The purpose of Form MC045GI is to request a refund of motor fueltax paid in Nevada.

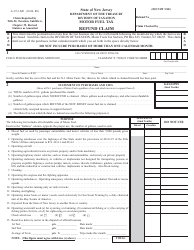

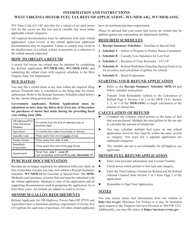

Q: How do I fill out Form MC045GI?

A: To fill out Form MC045GI, provide your contact information, details of the motor fuel purchase, and any supporting documentation required.

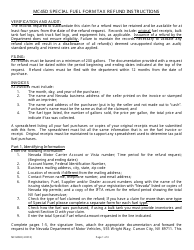

Q: When should I submit Form MC045GI?

A: Form MC045GI should be submitted within the specified time frame mentioned in the instructions or as per the Nevada Department of Taxation's guidelines.

Q: Is there a fee for submitting Form MC045GI?

A: There may be an administrative fee associated with submitting Form MC045GI. Refer to the instructions or contact the Nevada Department of Taxation for more information.

Q: Is there a deadline for filing Form MC045GI?

A: Yes, Form MC045GI must be filed by the deadline specified by the Nevada Department of Taxation or as mentioned in the instructions.

Q: What supporting documents should I include with Form MC045GI?

A: You may be required to attach copies of invoices, bills of lading, or other supporting documents related to the motor fuel purchases with Form MC045GI.

Q: Who should I contact for assistance with Form MC045GI?

A: For assistance with Form MC045GI, you can contact the Nevada Department of Taxation or refer to the instructions provided with the form.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Nevada Department of Motor Vehicles.