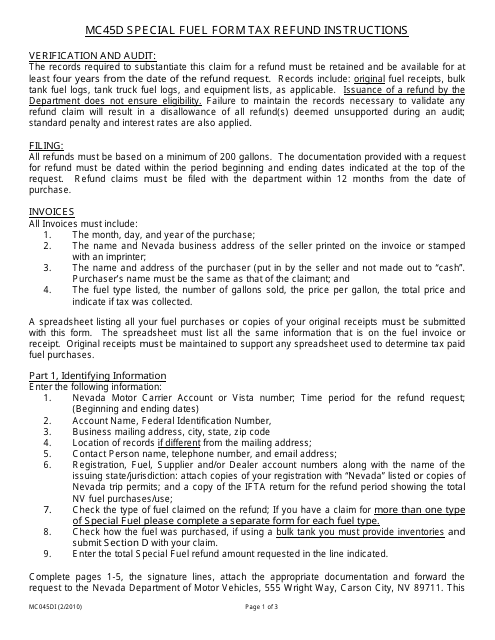

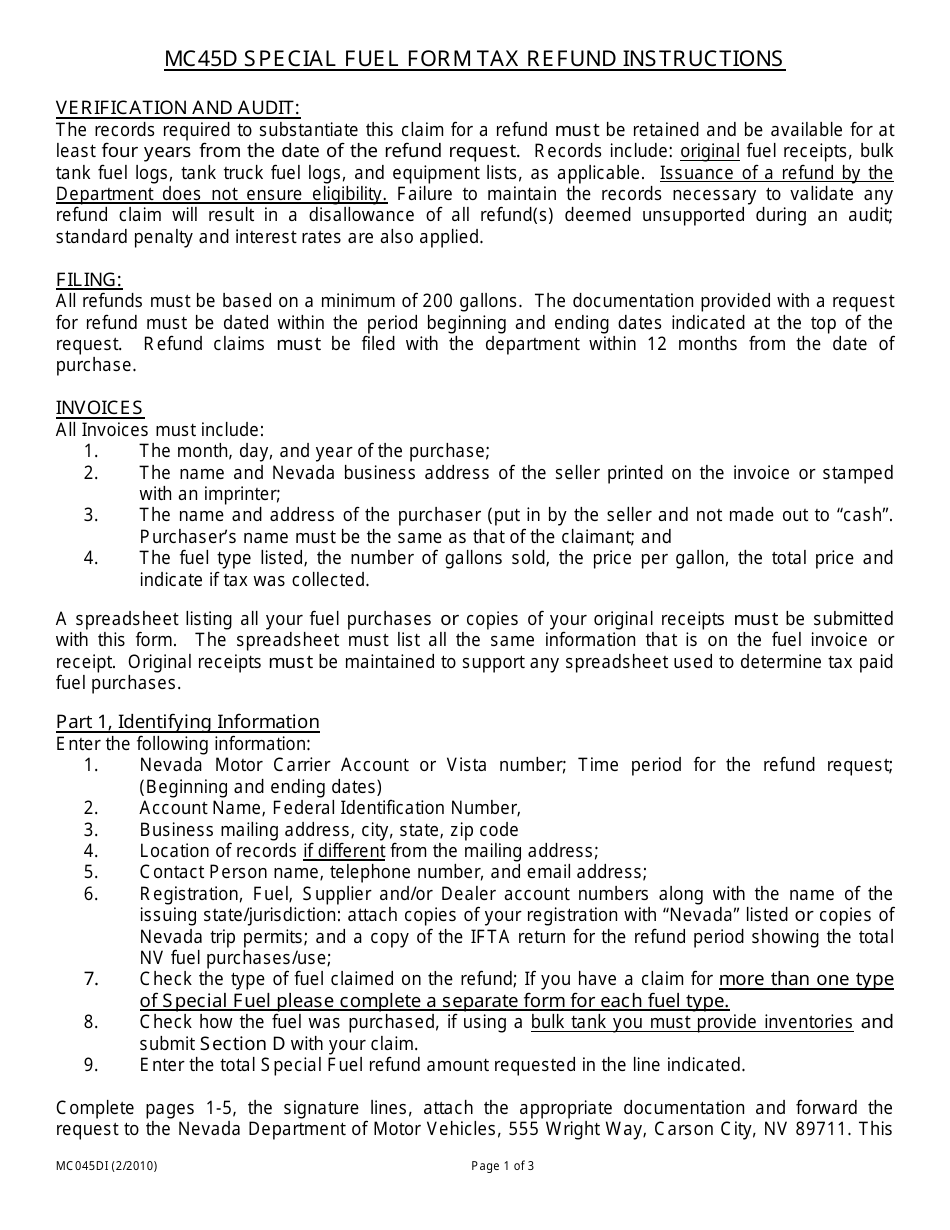

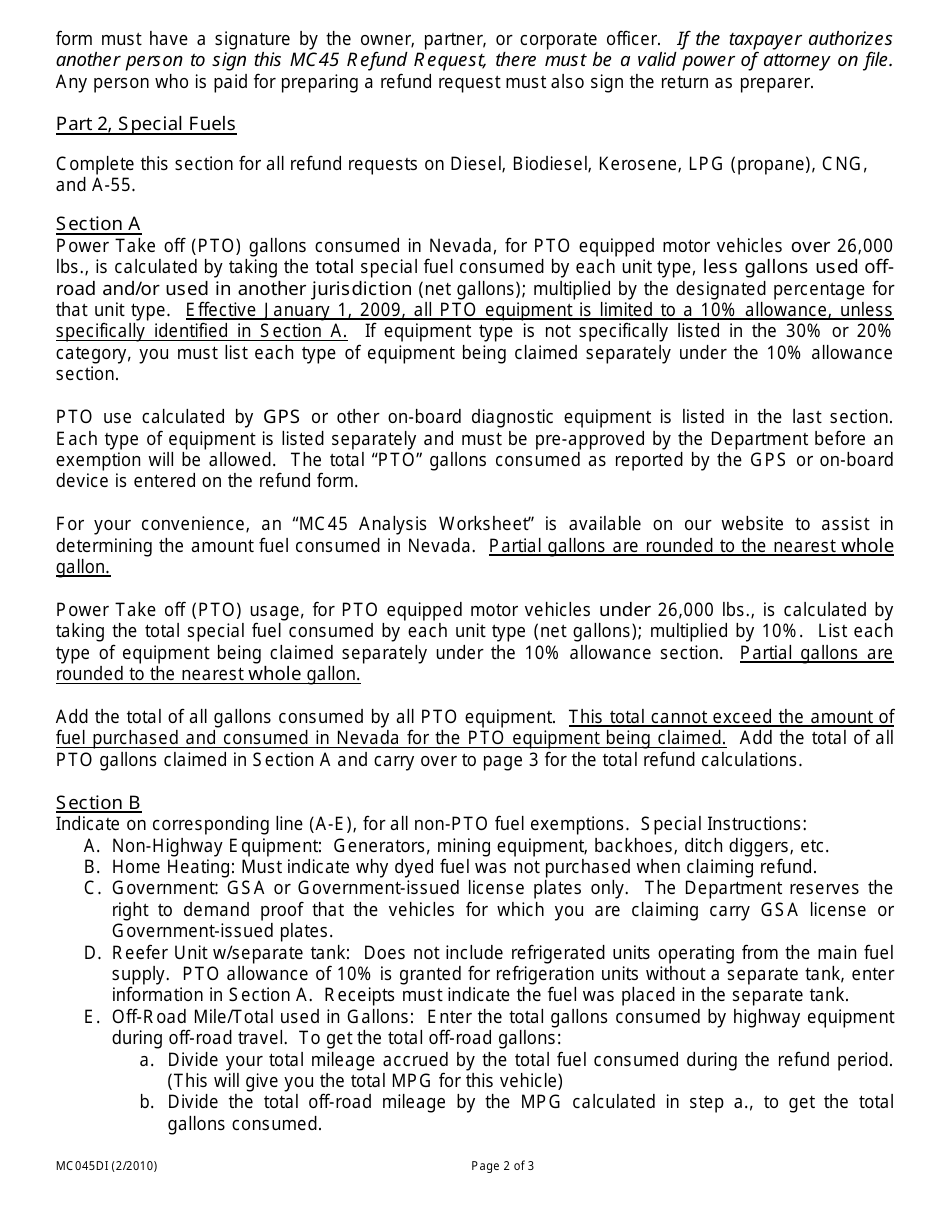

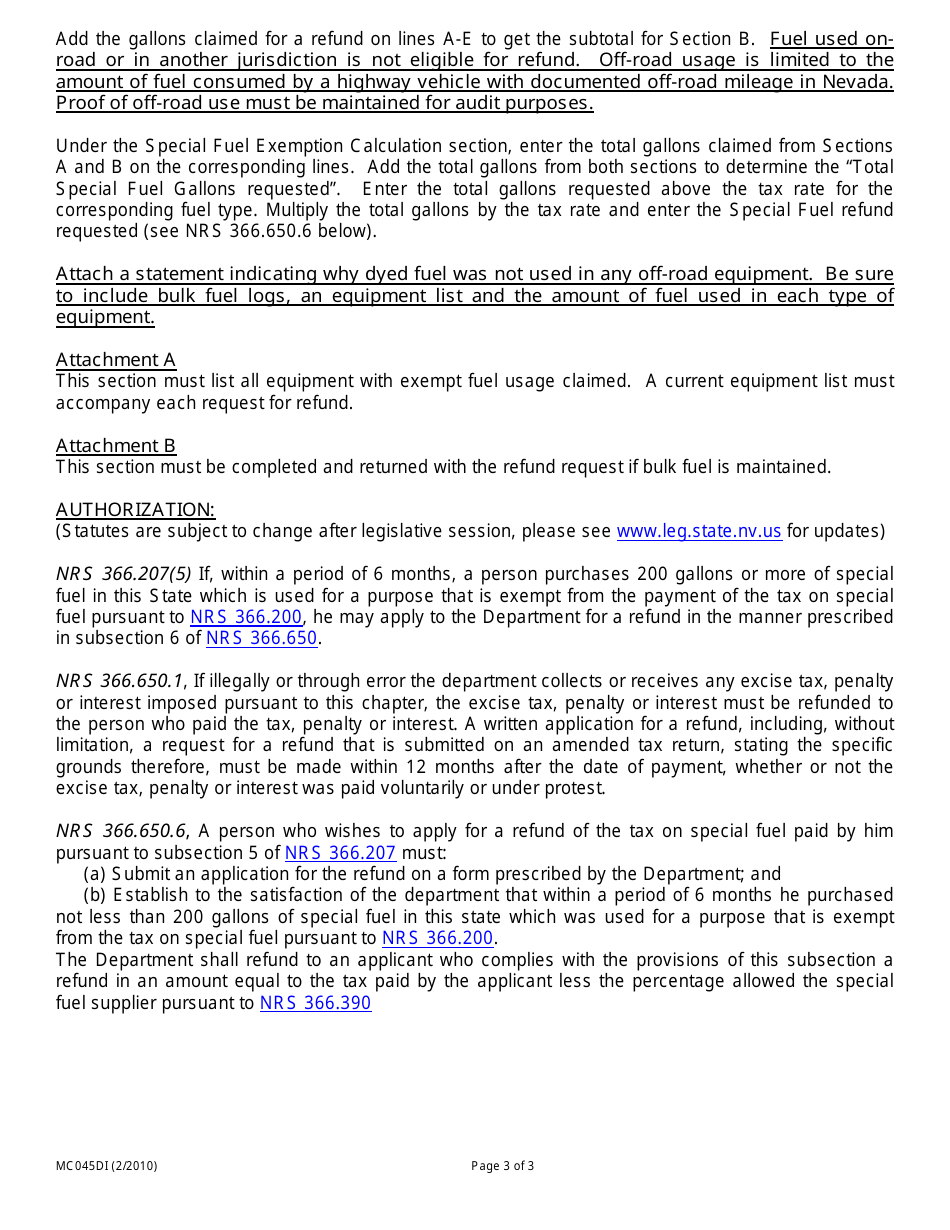

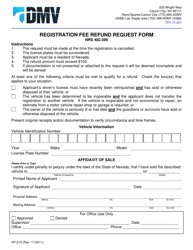

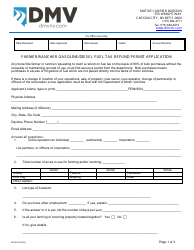

Instructions for Form MC045D Special Fuel Tax Refund Request - Nevada

This document contains official instructions for Form MC045D , Special Fuel Tax Refund Request - a form released and collected by the Nevada Department of Motor Vehicles. An up-to-date fillable Form MC045D is available for download through this link.

FAQ

Q: What is Form MC045D?

A: Form MC045D is a Special Fuel Tax Refund Request form in Nevada.

Q: What is a Special Fuel Tax Refund?

A: A Special Fuel Tax Refund is a reimbursement of taxes paid on special fuels.

Q: Who can request a Special Fuel Tax Refund in Nevada?

A: Any individual or business that has paid special fuel taxes in Nevada can request a refund.

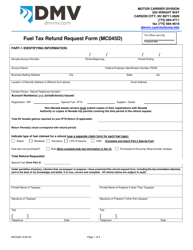

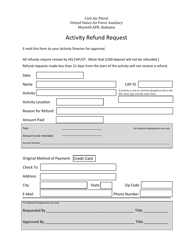

Q: What information is required on Form MC045D?

A: Form MC045D requires information such as the applicant's name, account number, tax period, and fuel usage details.

Q: When should I submit Form MC045D?

A: Form MC045D must be submitted within three months from the end of the tax period for which the refund is being requested.

Q: Is there a fee for filing Form MC045D?

A: No, there is no fee for filing Form MC045D.

Q: How long does it take to process a Special Fuel Tax Refund in Nevada?

A: The processing time for a Special Fuel Tax Refund in Nevada varies, but it typically takes several weeks to several months.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Nevada Department of Motor Vehicles.