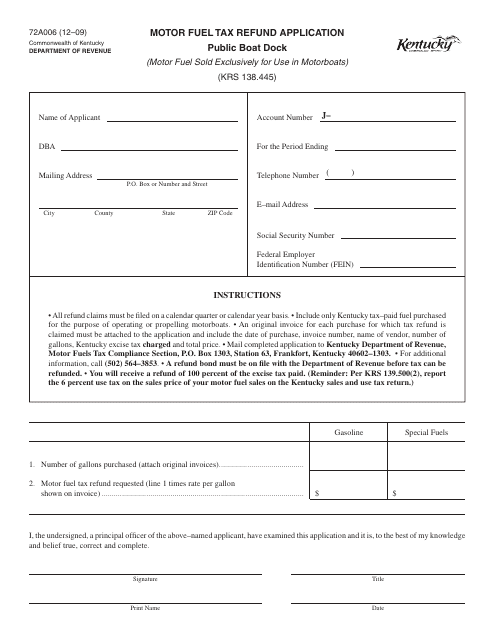

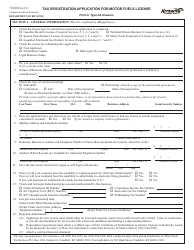

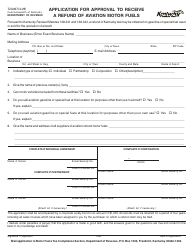

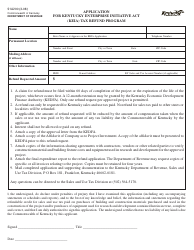

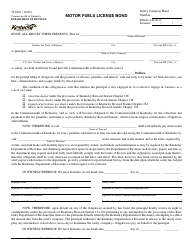

Form 72A006 Motor Fuel Tax Refund Application - Public Boat Dock - Kentucky

What Is Form 72A006?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

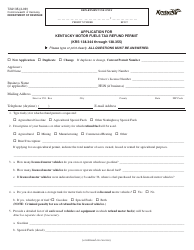

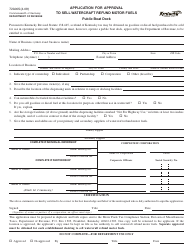

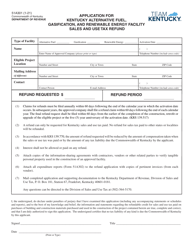

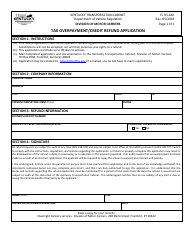

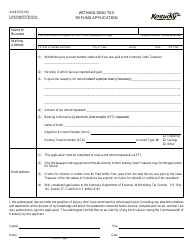

Q: What is Form 72A006?

A: Form 72A006 is the Motor Fuel Tax Refund Application for Public Boat Dock in Kentucky.

Q: Who is eligible to use Form 72A006?

A: Public boat docks in Kentucky are eligible to use Form 72A006 to claim a motor fuel tax refund.

Q: What is the purpose of Form 72A006?

A: The purpose of Form 72A006 is to request a refund of motor fuel tax paid by public boat docks in Kentucky.

Q: Are there any deadlines for submitting Form 72A006?

A: Yes, Form 72A006 must be submitted no later than six months from the end of the calendar quarter in which the fuel was purchased.

Q: What supporting documentation is required with Form 72A006?

A: Supporting documentation such as invoices, receipts, and proof of payment should be included with Form 72A006.

Q: How long does it take to process Form 72A006?

A: The processing time for Form 72A006 can vary, but it typically takes several weeks to receive a refund.

Q: Is there a fee to file Form 72A006?

A: No, there is no fee to file Form 72A006.

Q: Who can I contact for more information about Form 72A006?

A: For more information about Form 72A006, you can contact the Kentucky Department of Revenue.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A006 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.