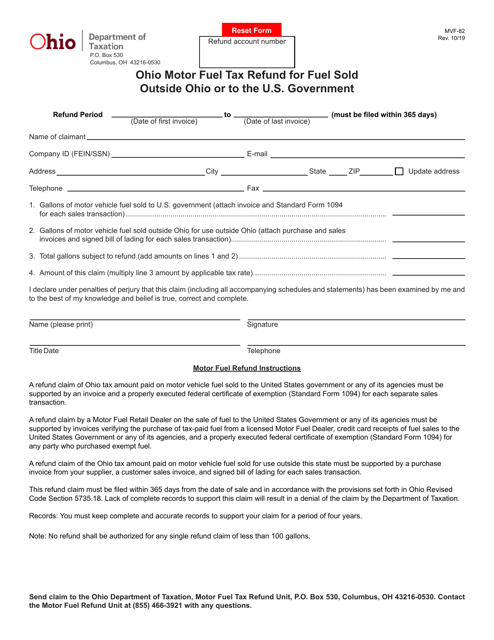

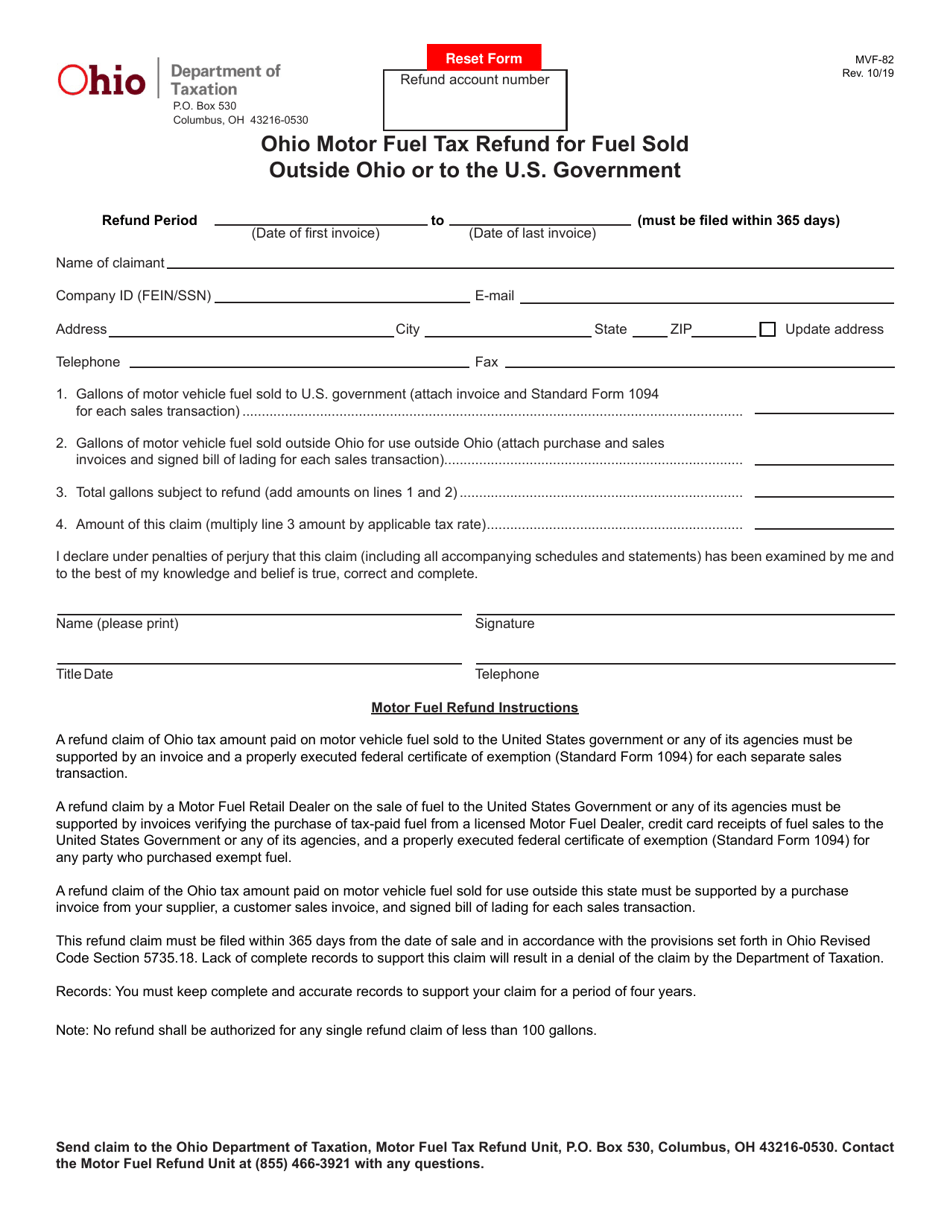

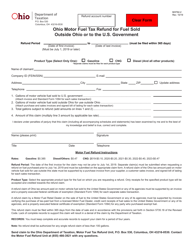

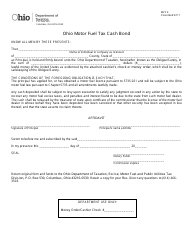

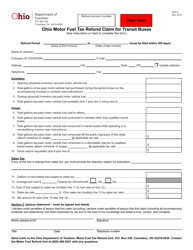

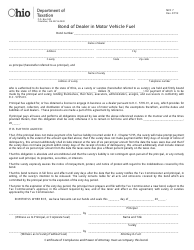

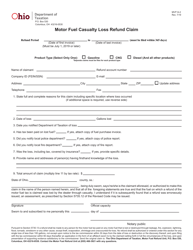

Form MVF-82 Ohio Motor Fuel Tax Refund for Fuel Sold Outside Ohio or to the U.S. Government - Ohio

What Is Form MVF-82?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MVF-82?

A: Form MVF-82 is a tax refund form for motor fuel sold outside Ohio or to the U.S. Government.

Q: Who can use Form MVF-82?

A: Anyone who sells motor fuel outside Ohio or to the U.S. Government can use Form MVF-82 to claim a tax refund.

Q: What is the purpose of Form MVF-82?

A: The purpose of Form MVF-82 is to apply for a refund of motor fuel tax paid on fuel sold outside Ohio or to the U.S. Government.

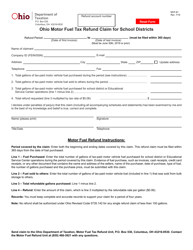

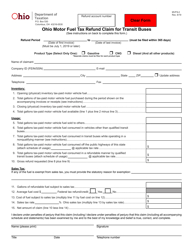

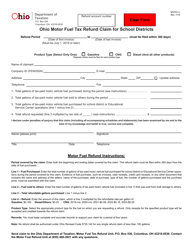

Q: How do I fill out Form MVF-82?

A: You must provide information about your business, the amount of fuel sold, and other required details. Follow the instructions on the form carefully.

Q: Is there a deadline for filing Form MVF-82?

A: Yes, Form MVF-82 must be filed by the last day of the first month following the end of each quarter.

Q: Can I file Form MVF-82 electronically?

A: No, Form MVF-82 must be filed by mail. Be sure to keep a copy of the form and any supporting documentation.

Q: Is there a fee to file Form MVF-82?

A: No, there is no fee to file Form MVF-82.

Q: What should I do if I have questions about Form MVF-82?

A: If you have any questions about Form MVF-82, you can contact the Ohio Department of Taxation for assistance.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MVF-82 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.