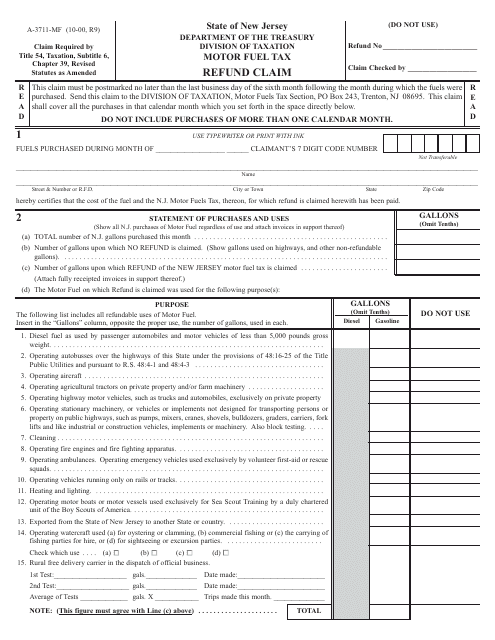

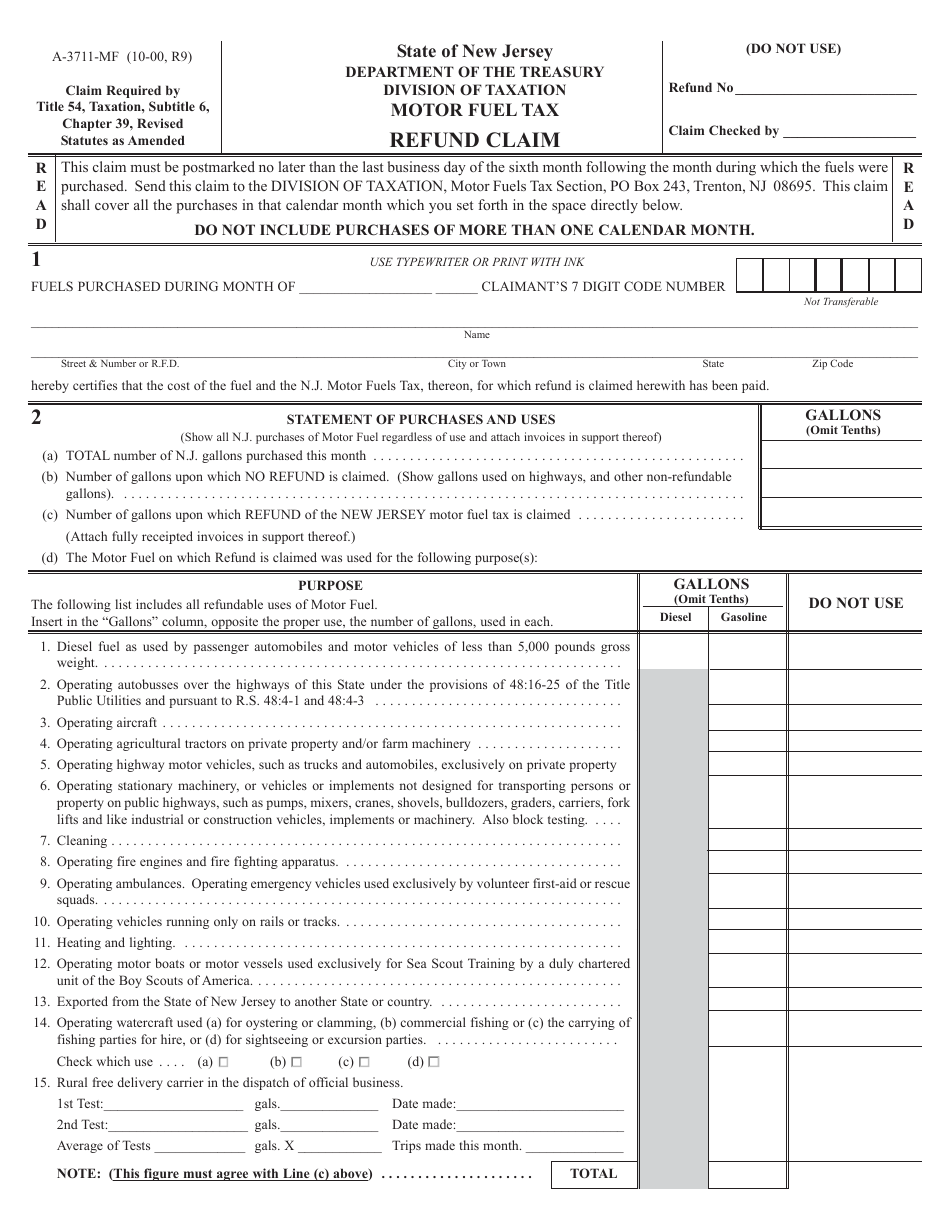

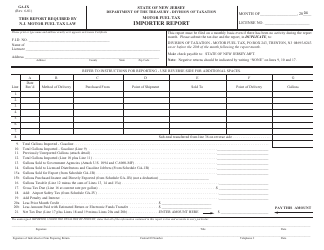

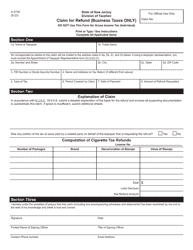

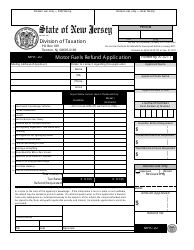

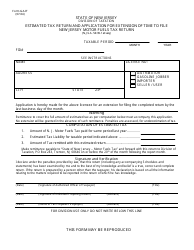

Form A-3711-MF Motor Fuel Tax Refund Claim - New Jersey

What Is Form A-3711-MF?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-3711-MF?

A: Form A-3711-MF is a Motor Fuel Tax Refund Claim form used in New Jersey.

Q: What is the purpose of Form A-3711-MF?

A: The purpose of Form A-3711-MF is to claim a refund of motor fueltax paid in New Jersey.

Q: Who can use Form A-3711-MF?

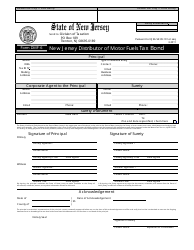

A: The form can be used by individuals, businesses, and government entities who have paid motor fuel tax in New Jersey.

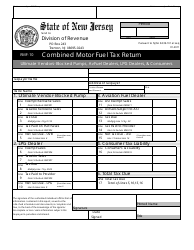

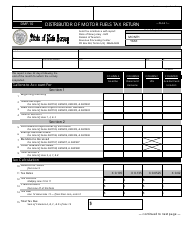

Q: What information is required on Form A-3711-MF?

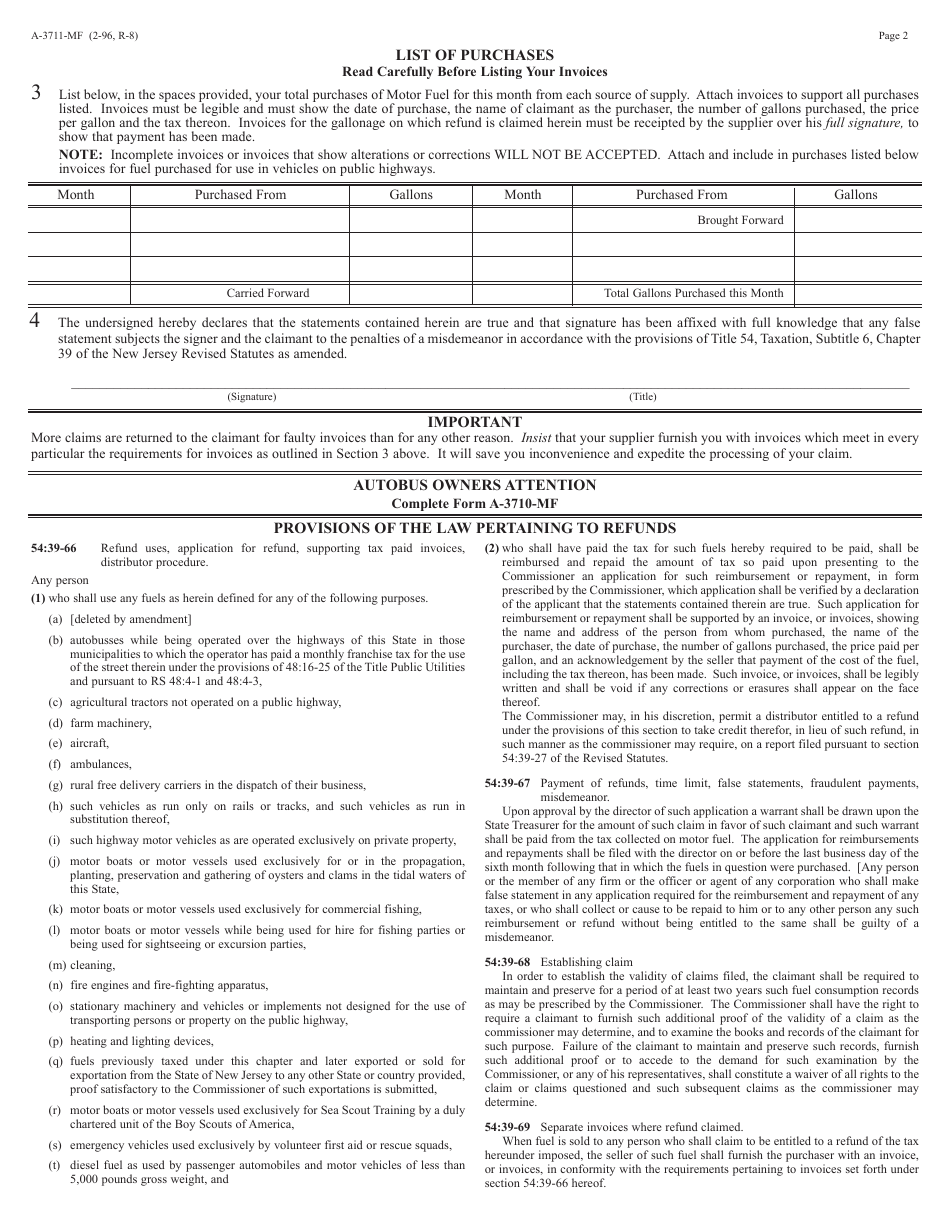

A: The form requires information such as name, address, fuel type, gallons purchased, and evidence of tax paid.

Q: Is there a deadline for filing Form A-3711-MF?

A: Yes, the form must be filed within four years from the end of the calendar year in which the tax was paid.

Q: How long does it take to receive a refund after submitting Form A-3711-MF?

A: The processing time for refunds can vary, but it generally takes about 12 weeks to receive a refund.

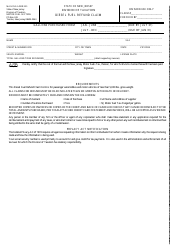

Q: Are there any penalties for filing a fraudulent claim using Form A-3711-MF?

A: Yes, filing a fraudulent claim can result in penalties, including fines and imprisonment.

Form Details:

- Released on October 1, 2000;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-3711-MF by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.