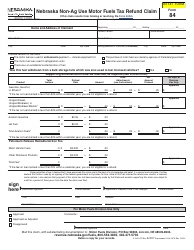

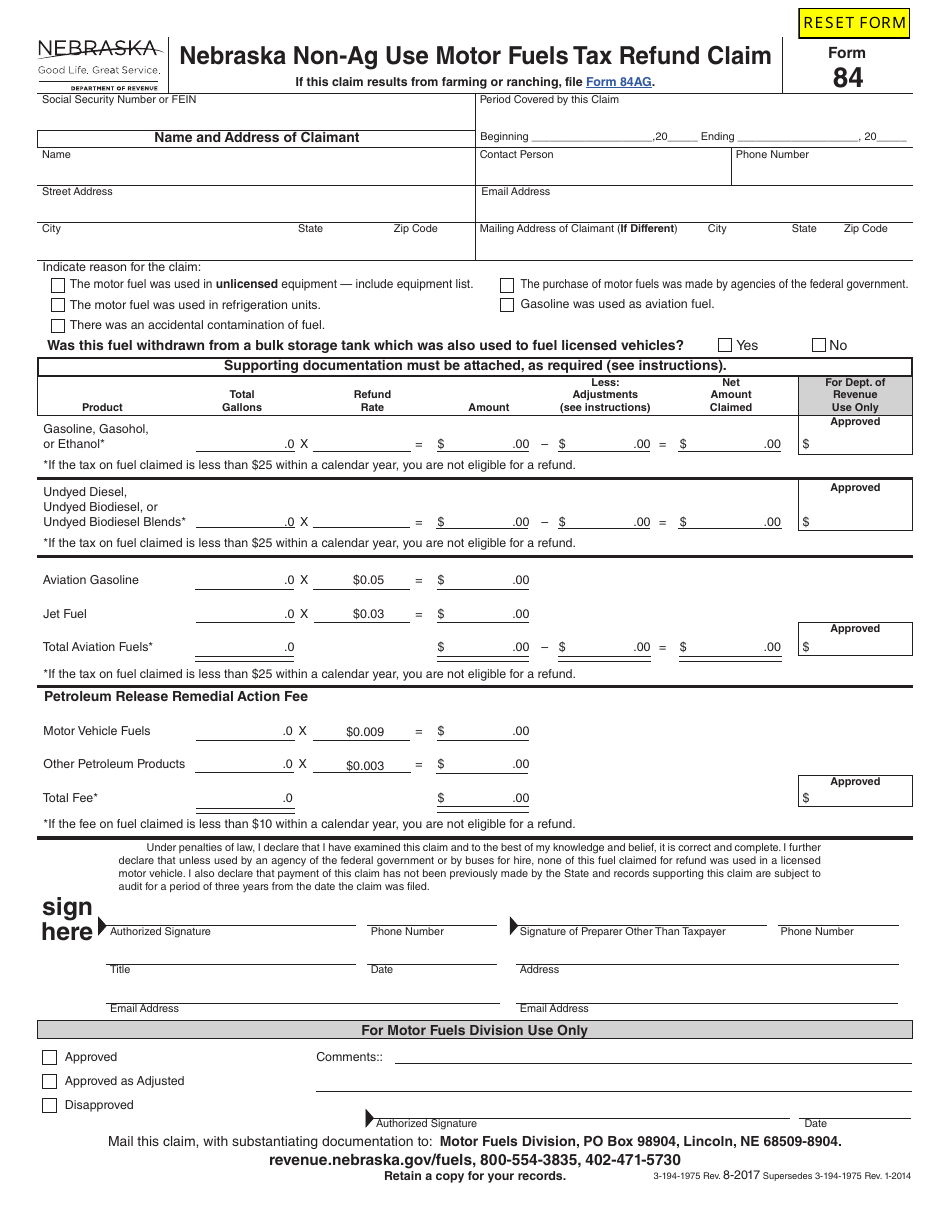

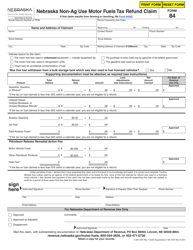

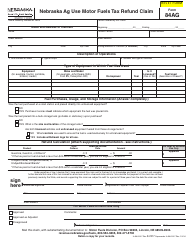

Form 84 Nebraska Non-ag Use Motor Fuels Tax Refund Claim - Nebraska

What Is Form 84?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 84 Nebraska?

A: Form 84 Nebraska is a Non-ag Use Motor Fuels Tax Refund Claim form for residents of Nebraska.

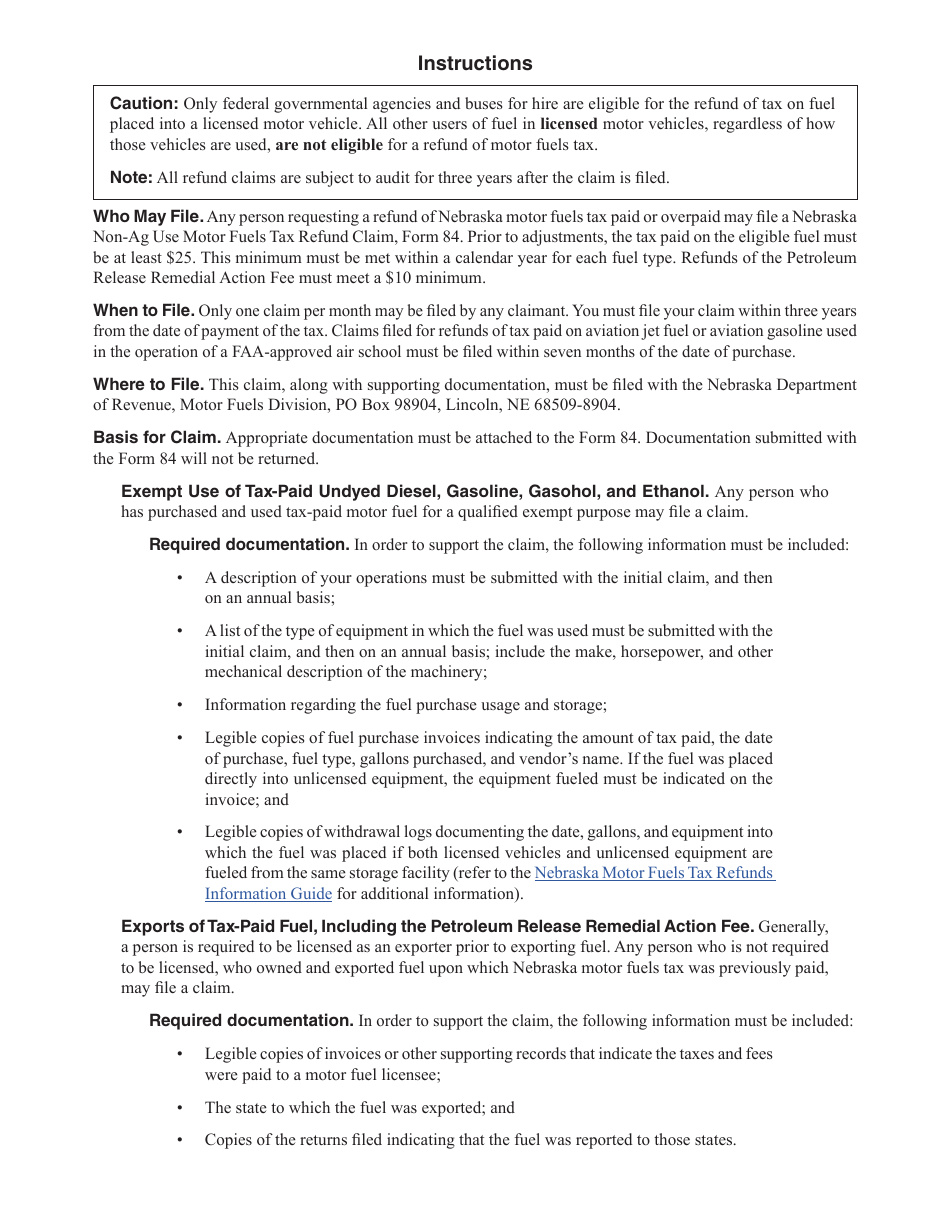

Q: Who can use Form 84 Nebraska?

A: Residents of Nebraska who have purchased non-agricultural motor fuels can use Form 84 Nebraska.

Q: What is the purpose of Form 84 Nebraska?

A: The purpose of Form 84 Nebraska is to claim a refund for the motor fuels tax paid on non-agricultural use.

Q: Are there any deadlines for filing Form 84 Nebraska?

A: Yes, Form 84 Nebraska must be filed within three years from the date of purchase of the non-agricultural motor fuels.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 84 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.