Motor Fuel Tax Templates

Are you looking for information about motor fuel taxes? Look no further! We have all the resources you need to understand and navigate the complex world of motor fuel taxes.

Motor fuel taxes, also known as motor fuels tax, play a crucial role in funding transportation infrastructure and maintaining our roadways. These taxes are imposed on the sale or use of motor fuels such as gasoline, diesel, and alternative fuels.

Our comprehensive collection of motor fuel tax documents includes a variety of forms and schedules that cover different aspects of motor fuel tax compliance. For instance, you can find forms to report your motor fuel tax liabilities, claim refunds, and disclose any diversion corrections or disbursements related to motor fuels tax.

One of the documents you might find useful is the "Form R-5402 Schedule D Motor Fuel Tax Multiple Schedule of State Diversion Corrections" from the state of Louisiana. This form helps businesses accurately report any adjustments or corrections related to the diversion of motor fuel tax revenue.

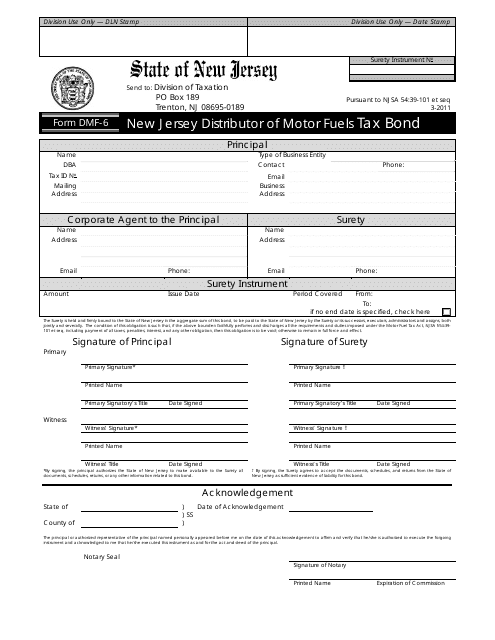

If you're operating in New Jersey, you'll want to explore the "Form DMF-6 New Jersey Distributor of Motor Fuels Tax Bond." This form is essential for distributors of motor fuels in New Jersey as it serves as a guarantee of compliance with motor fuels tax requirements.

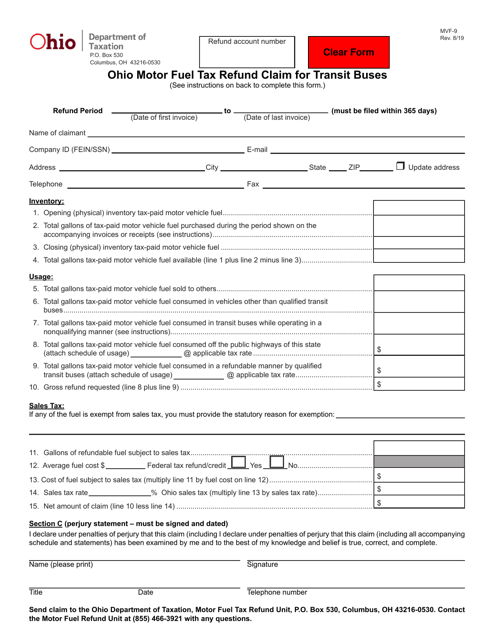

For Ohio-based businesses operating transit buses, the "Form MVF-9 Ohio Motor Fuel Tax Refund Claim for Transit Buses" is a valuable resource. This form allows eligible businesses to claim a refund on the motor fuel taxes paid on fuel used for transit buses.

Tennessee-based wholesalers can take advantage of the "Form PET375 (RV-R0009501) Wholesaler Claim for Refund of Motor Fuel Taxes." This form enables wholesalers to claim a refund on motor fuel taxes paid on fuel that was exported or used for specific exempt purposes.

Kansas business owners dealing with special fuel disbursements will benefit from the "Form MF-52B (SPECIAL FUEL) Motor Fuel Tax Multiple Schedule of Disbursements Special Fuel." This form is designed to report disbursements of special fuel and helps maintain accurate records for motor fuel tax compliance purposes.

At Templateroller.com, we understand the importance of motor fuel taxes and the challenges they can present. Our extensive collection of motor fuel tax documents, including various forms and schedules, makes it easier for businesses to stay compliant and make accurate filings. Whether you're looking for forms to report, claim refunds, or disclose corrections, our motor fuel tax document collection has you covered.

Documents:

99

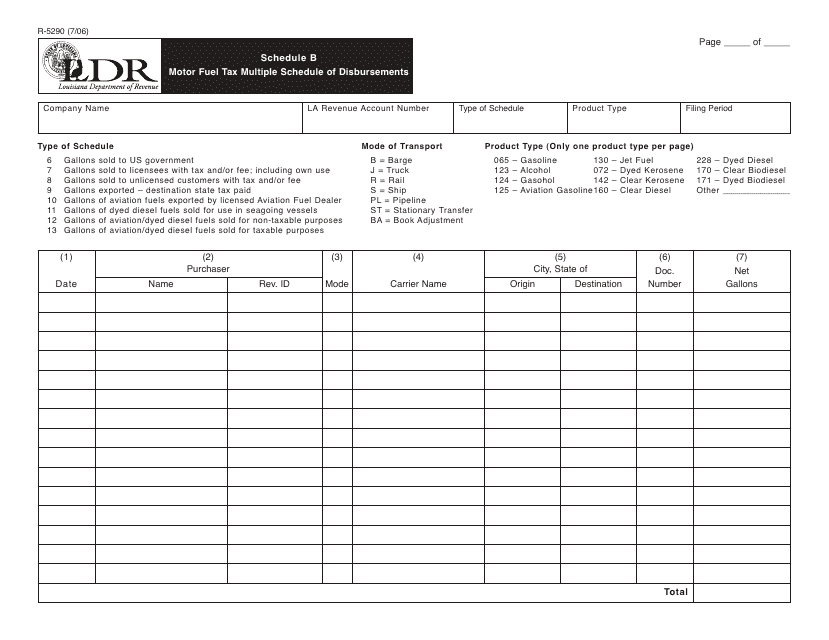

This form is used for reporting multiple schedules of disbursements for motor fuel tax in the state of Louisiana.

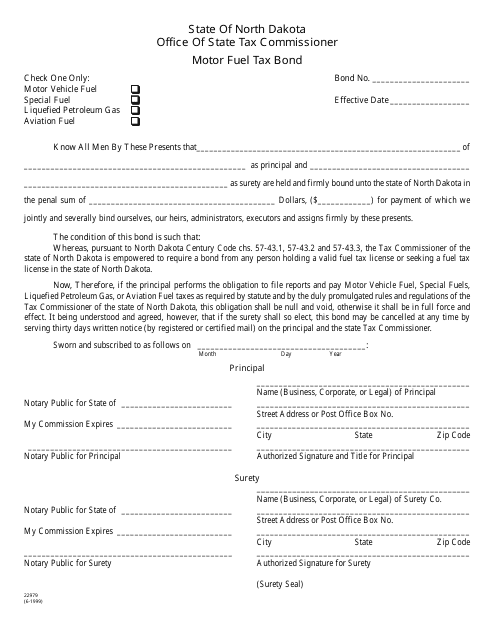

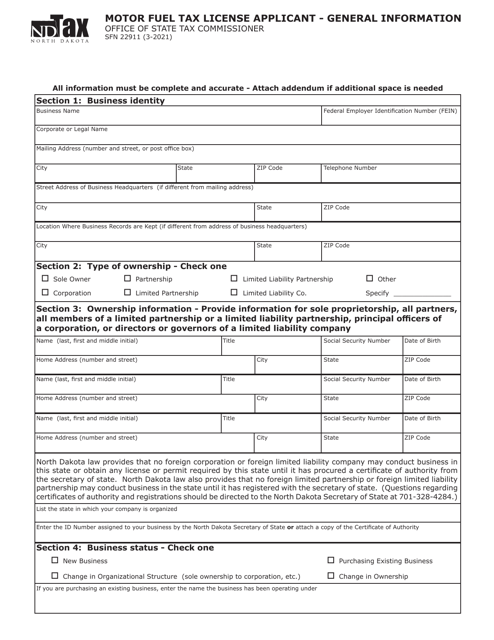

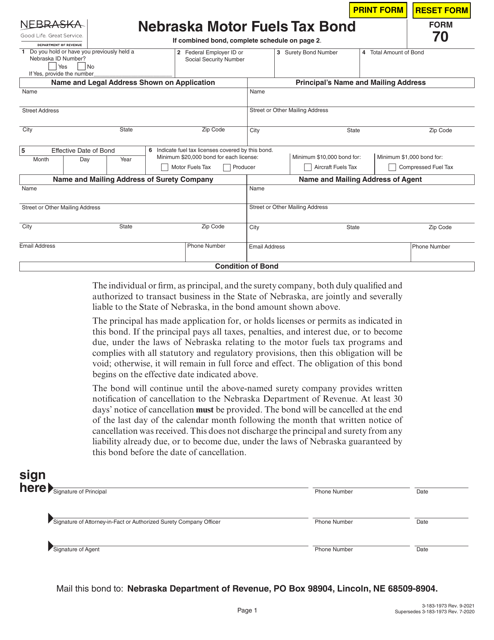

This Form is used for obtaining a motor fuel tax bond in North Dakota.

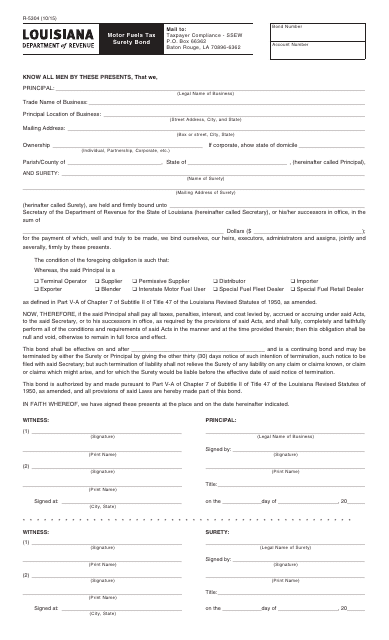

This document is used for obtaining a surety bond for motor fuels tax in the state of Louisiana. The bond ensures payment of taxes related to the sale or use of motor fuels.

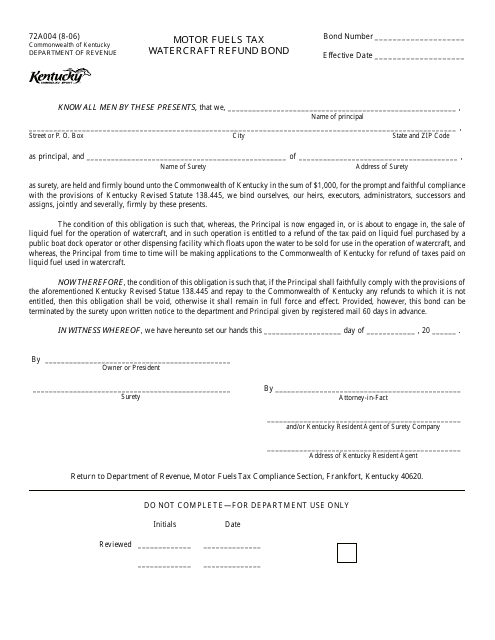

This Form is used for obtaining a refund bond for motor fuels tax paid on watercraft in Kentucky.

This form is used for reporting multiple schedules of gasoline receipts for motor fuel tax purposes in the state of New Jersey.

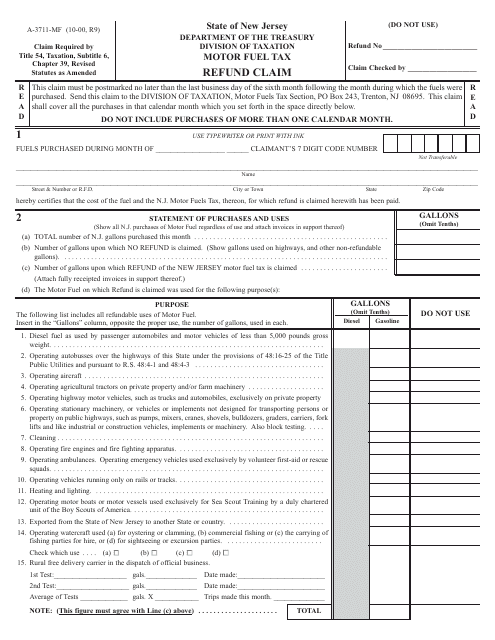

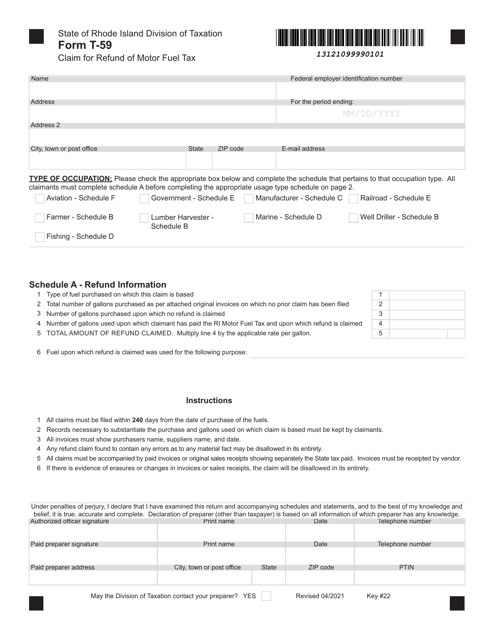

This form is used for claiming a refund on motor fuel tax in the state of New Jersey.

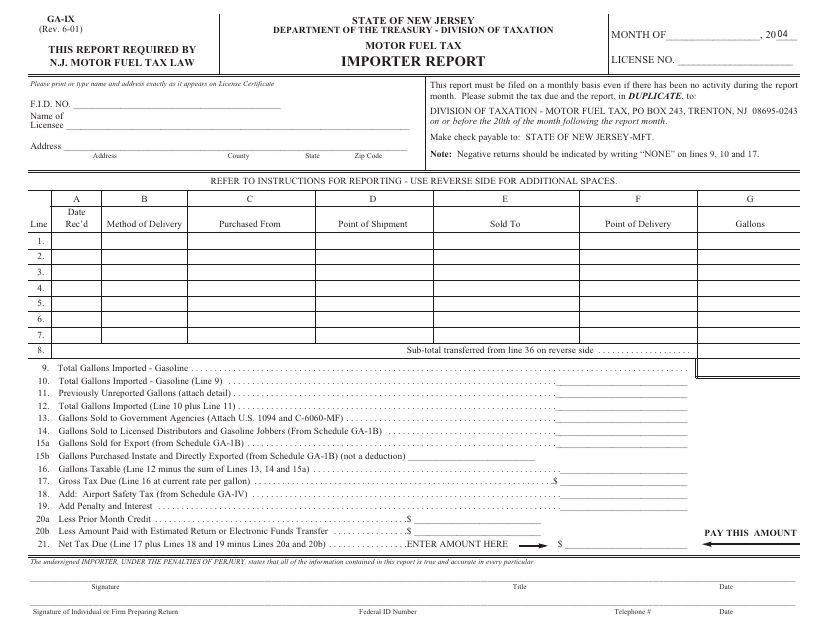

This Form is used for reporting motor fuel imports in New Jersey for tax purposes.

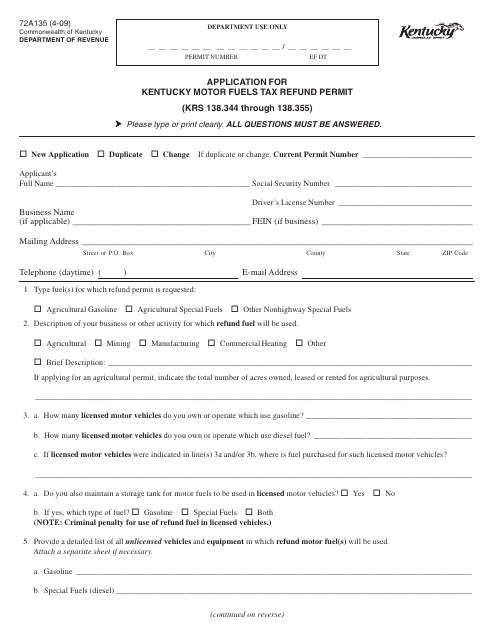

This form is used for applying for a Kentucky Motor Fuels Tax Refund Permit, which allows individuals or businesses to request a refund for taxes paid on motor fuels in Kentucky.

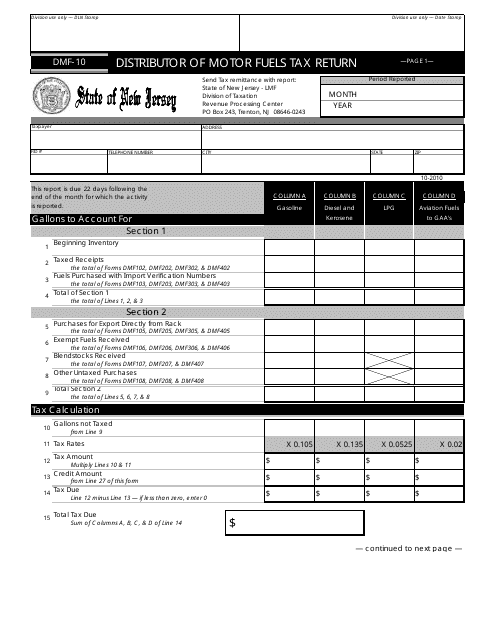

This form is used for filing the Motor Fuels Tax Return for distributors in the state of New Jersey.

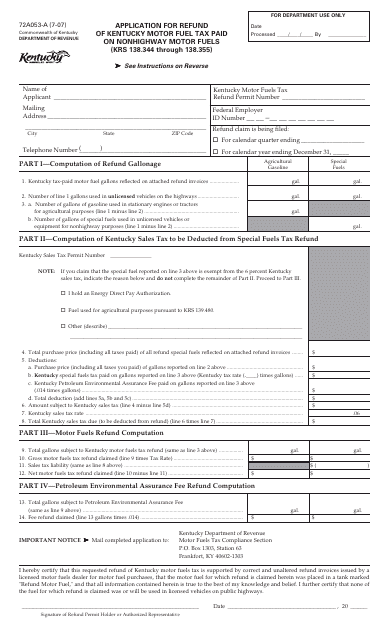

This Form is used for applying for a refund of Kentucky motor fuel tax paid on nonhighway motor fuels in the state of Kentucky.

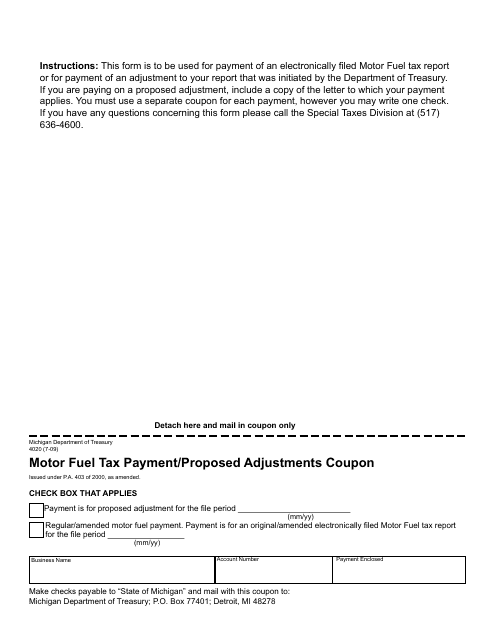

This Form is used for making motor fuel tax payments and proposing adjustments in Michigan.

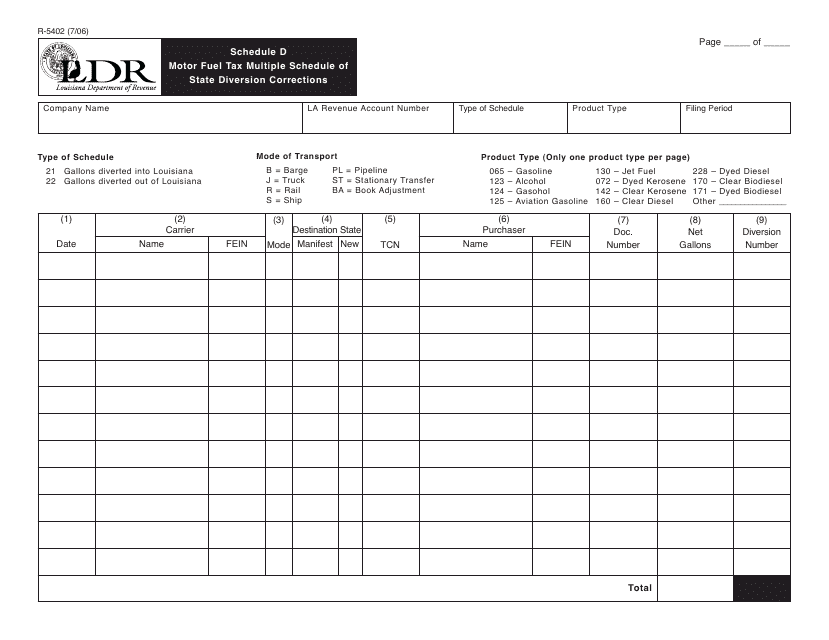

This form is used for reporting and correcting any errors or discrepancies in the motor fuel tax diversion amounts for multiple locations within the state of Louisiana.

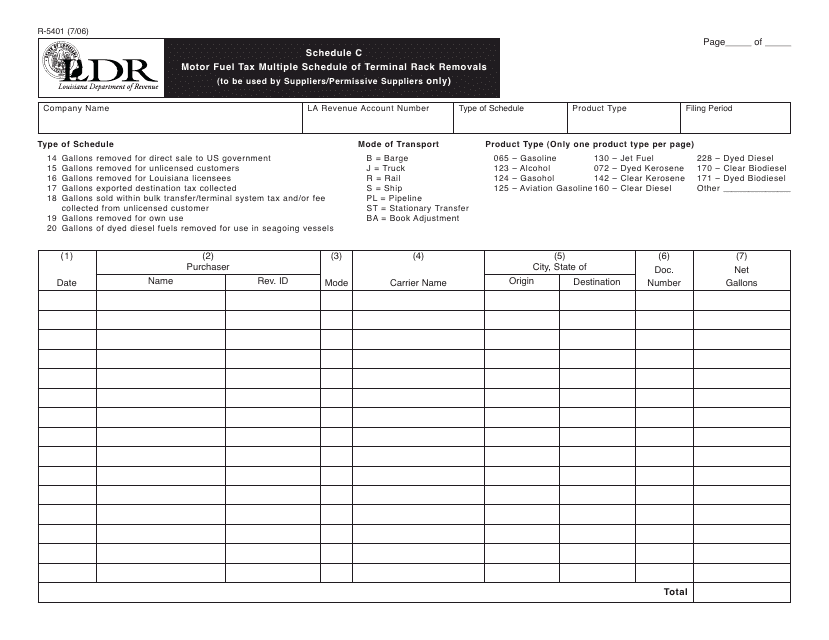

This document is used for reporting multiple terminal rack removals of motor fuel in Louisiana for tax purposes.

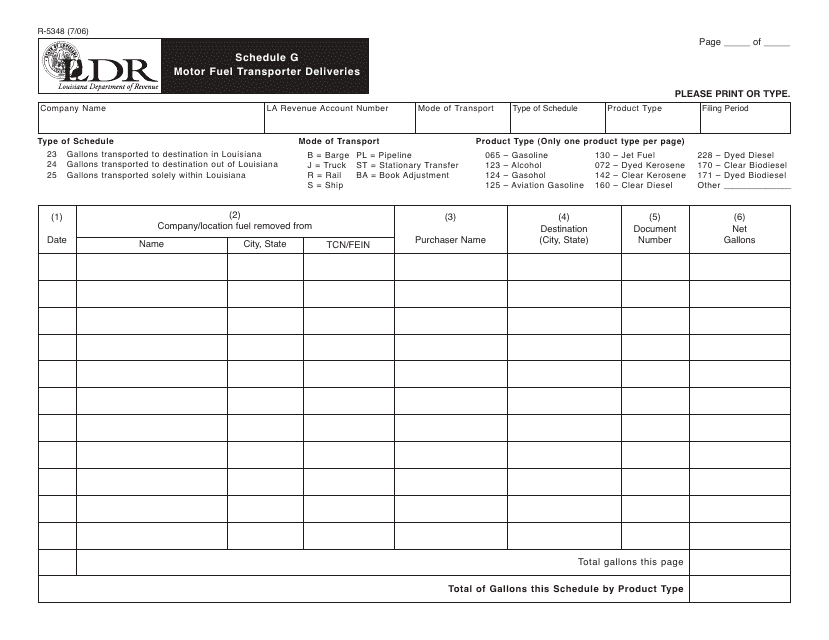

This form is used for reporting motor fuel deliveries by transporters in Louisiana. It is required for compliance with state regulations.

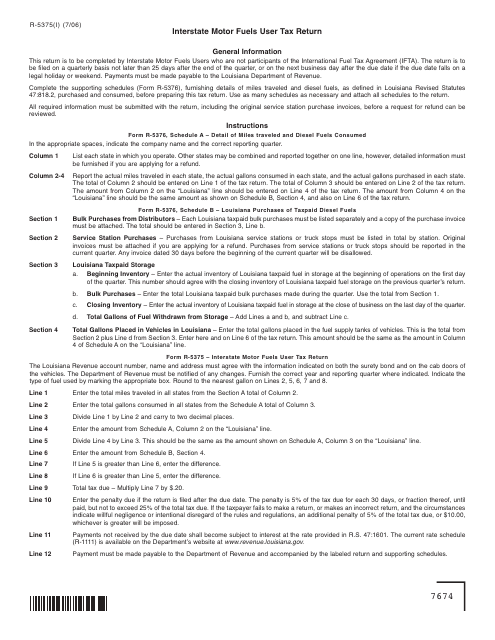

This form is used for filing the quarterly tax return for interstate motor fuels users in Louisiana. The instructions provide information on how to properly fill out and submit the form.

This form is used for obtaining a Distributor of Motor Fuels Tax Bond in the state of New Jersey. It is required for businesses that distribute motor fuels to ensure compliance with tax obligations.

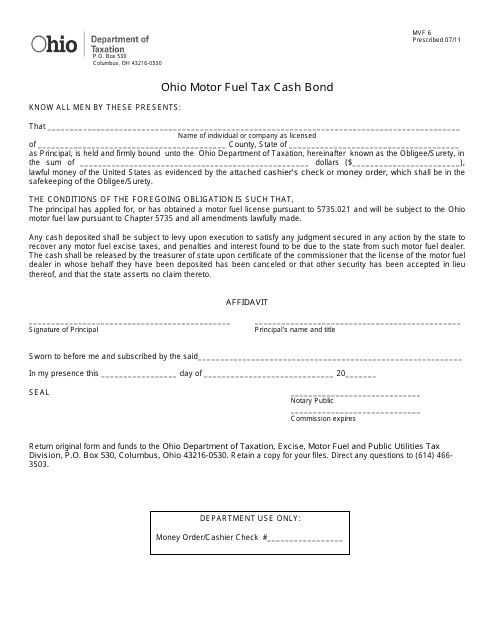

This form is used for applying for a cash bond to pay Motor Fuel Tax in the state of Ohio.

This document is used for monthly tax calculation for motor fuel tankwagon importers in Oklahoma

This type of document, OTC Form 130, is used for applying for a refund of motor fuel tax for gasoline and undyed diesel in the state of Oklahoma.

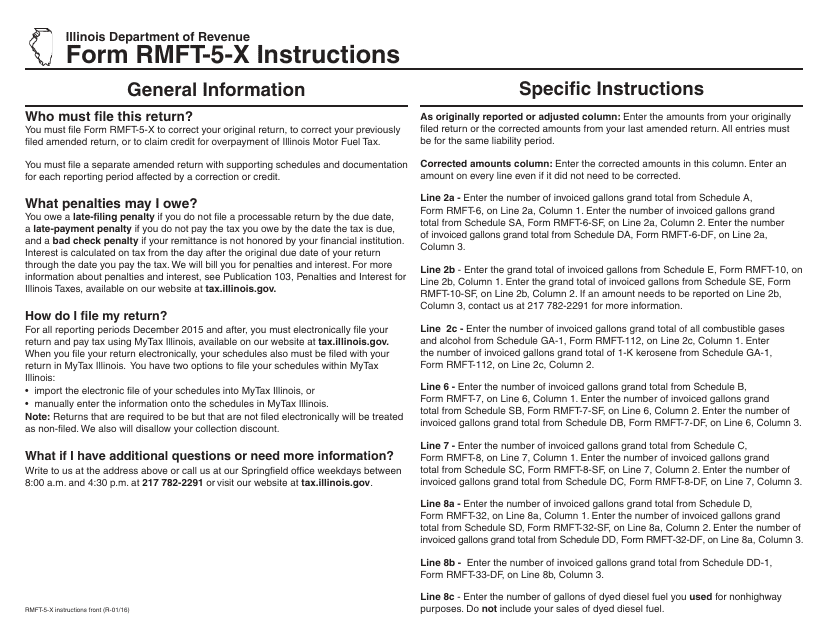

This Form is used for filing an amended return or claiming a credit for motor fuel tax for distributors or suppliers in the state of Illinois.

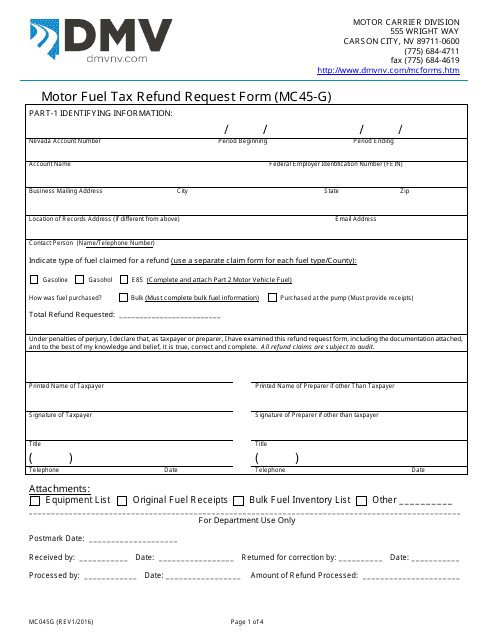

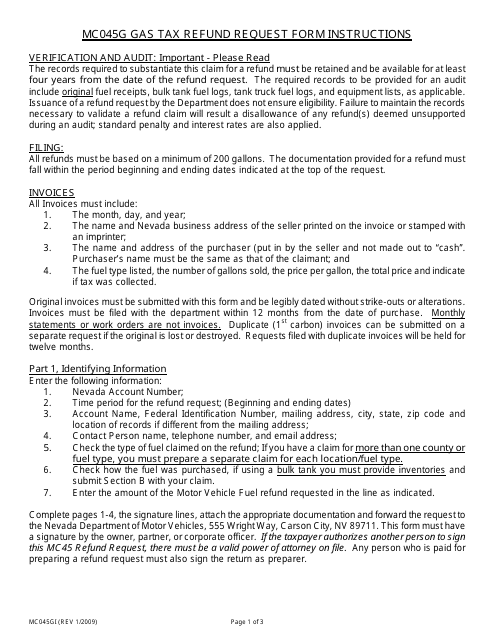

This form is used for requesting a refund of motor fuel tax paid in the state of Nevada.

This Form is used for requesting a refund of motor fuel tax in Nevada.

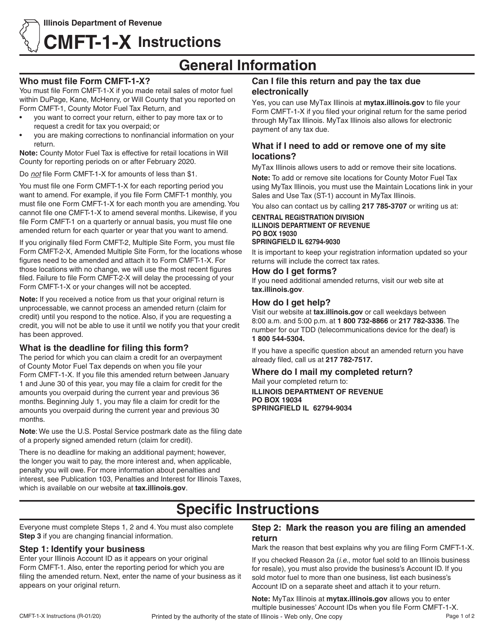

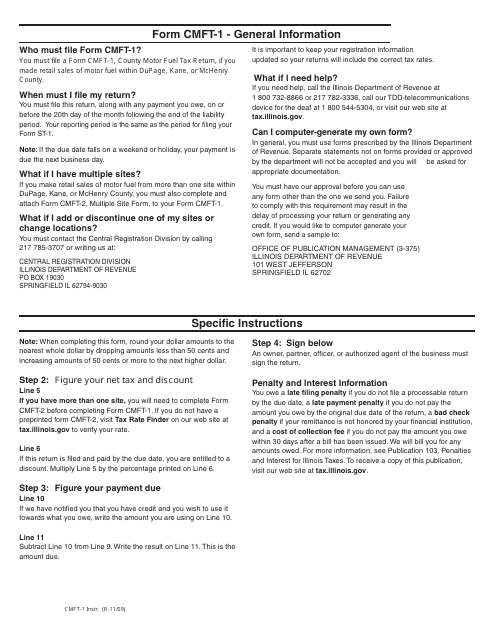

This document provides instructions for completing the CMFT-1 County Motor Fuel Tax Return in Illinois. It guides taxpayers on how to accurately report their motor fuel taxes and provides step-by-step instructions on filling out the form.

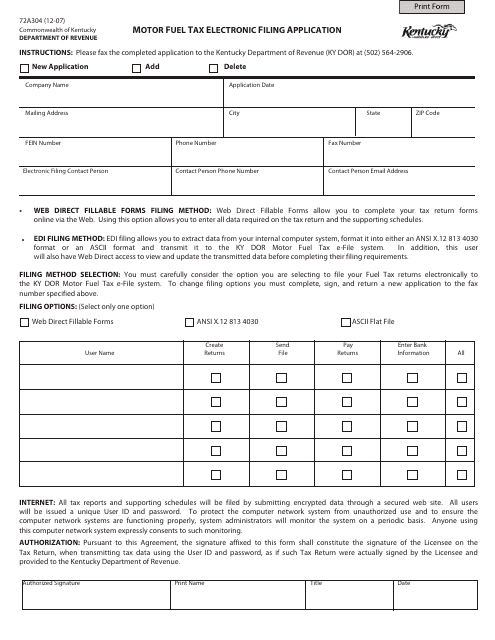

This form is used for electronically filing motor fuel tax in Kentucky.

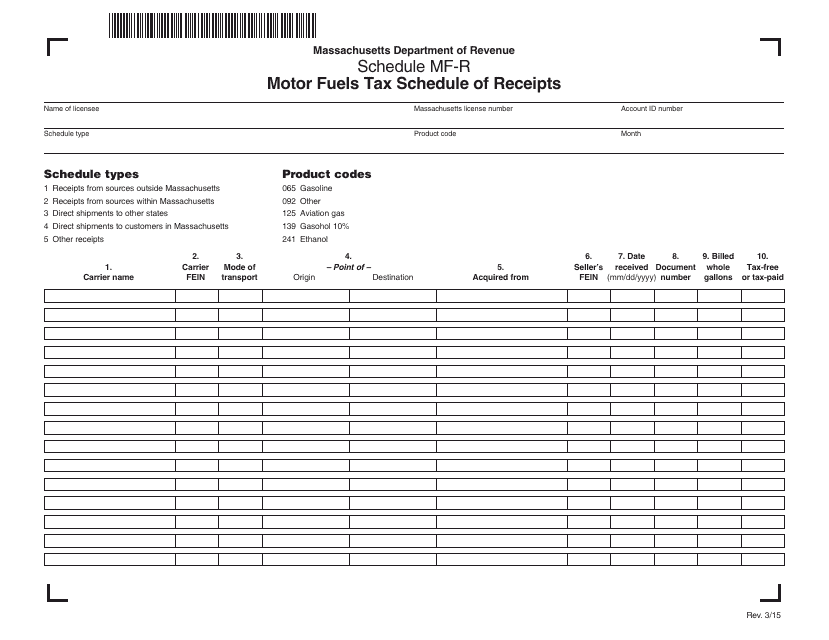

This document is a tax schedule for motor fuels in Massachusetts. It provides a schedule of receipts for MF-R motor fuels tax.

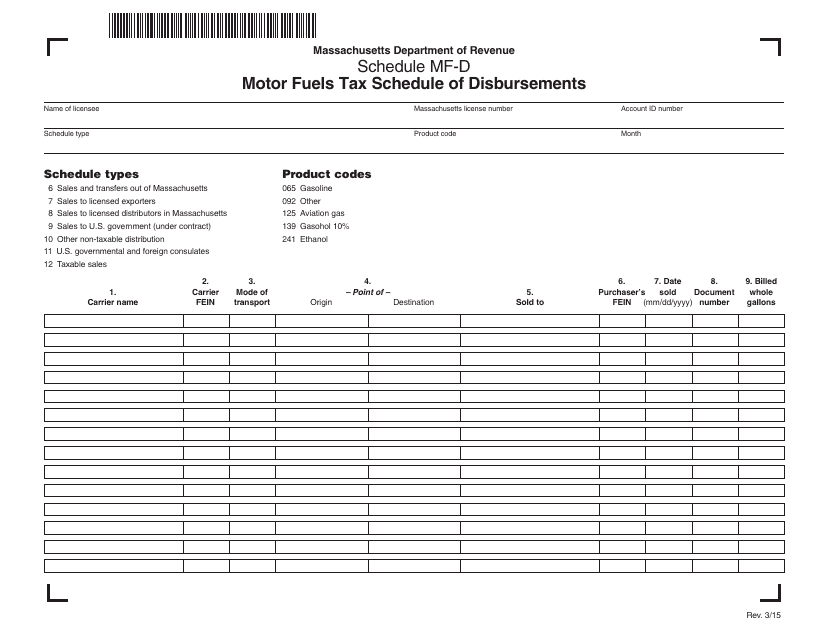

This type of document is used to report the disbursements of motor fuels tax in Massachusetts.

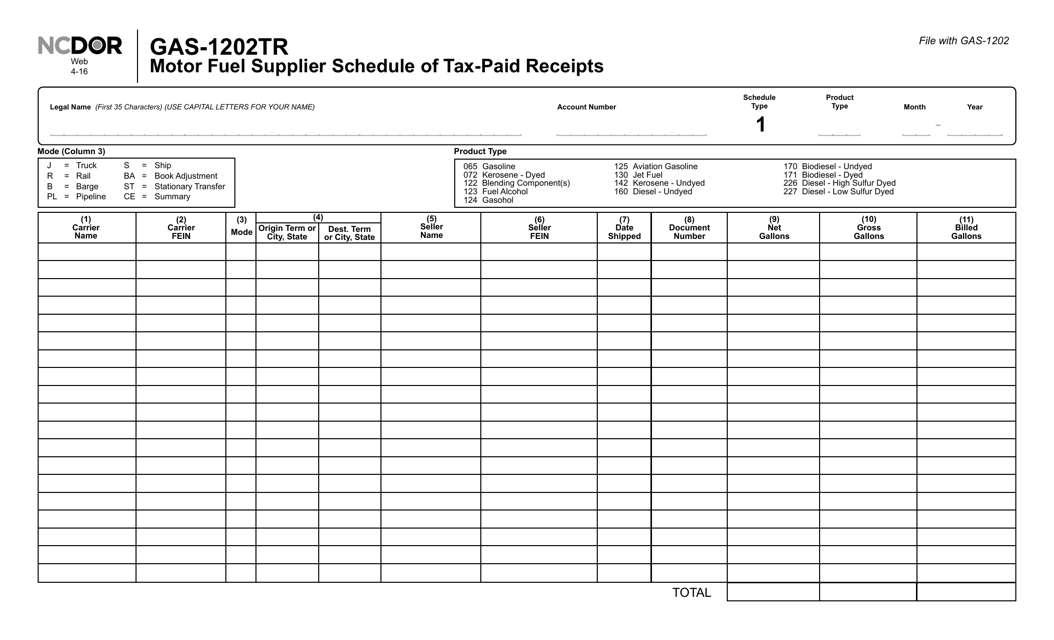

This Form is used for reporting tax-paid receipts for motor fuel suppliers in North Carolina.

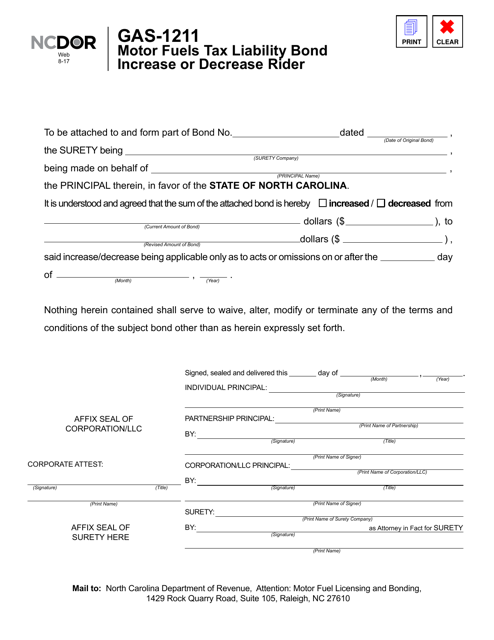

This form is used for applying for an increase or decrease of the motor fuels tax liability bond in North Carolina.

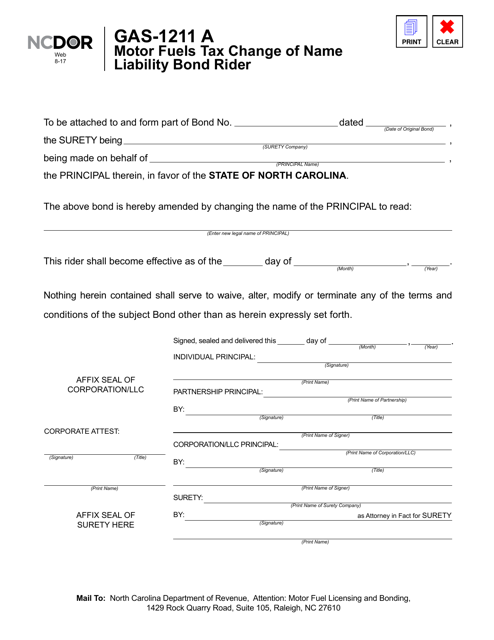

This Form is used for making changes to the liability bond for motor fuels tax in North Carolina due to a name change.