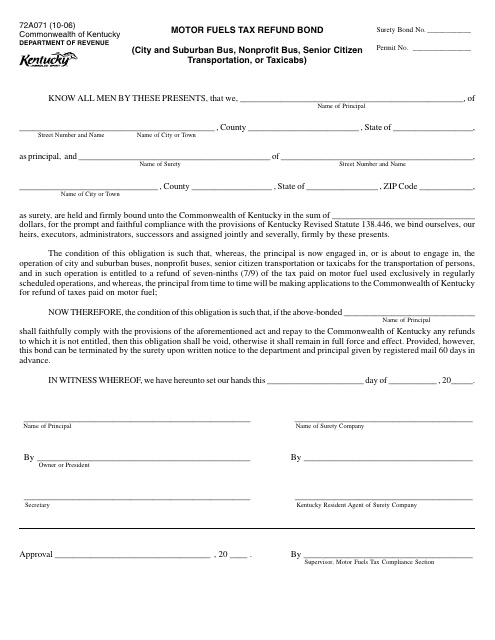

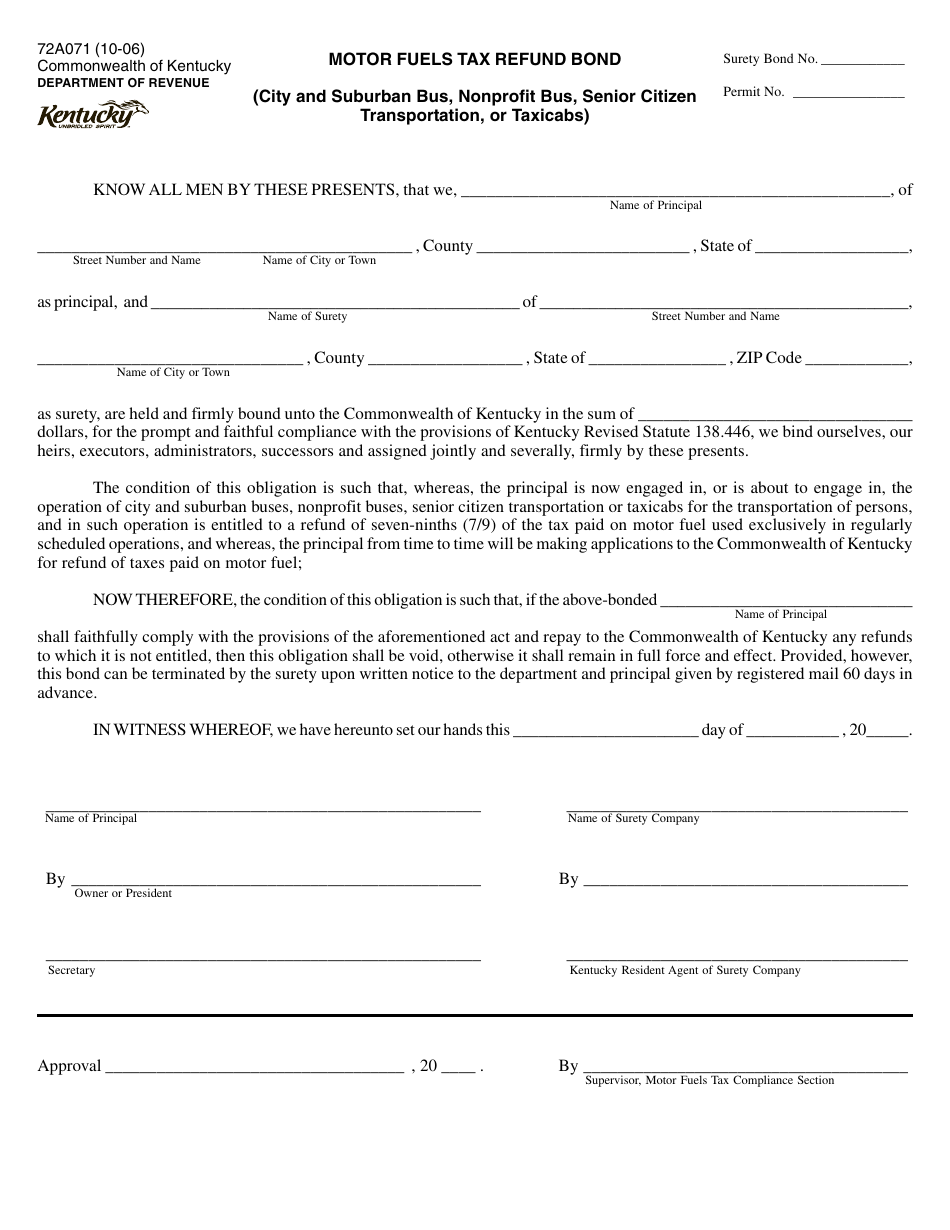

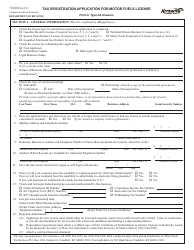

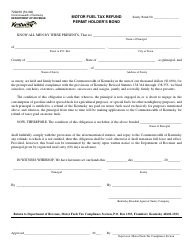

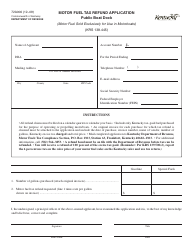

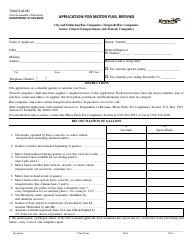

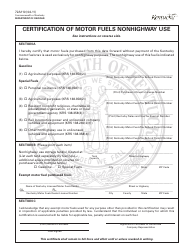

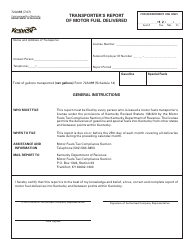

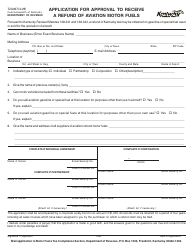

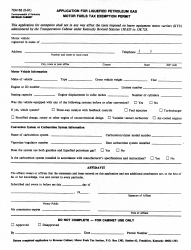

Form 72A071 Motor Fuels Tax Refund Bond (City and Suburban Bus, Nonprofit Bus, Senior Citizen Transportation, or Taxicabs) - Kentucky

What Is Form 72A071?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A071?

A: Form 72A071 is a Motor Fuels Tax Refund Bond specific to certain types of transportation services in Kentucky.

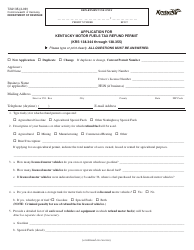

Q: Who should use Form 72A071?

A: Form 72A071 should be used by providers of City and Suburban Bus, Nonprofit Bus, Senior Citizen Transportation, or Taxicab services in Kentucky.

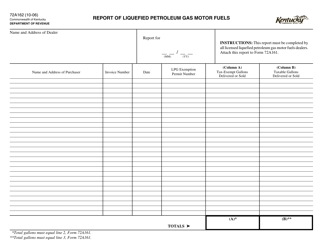

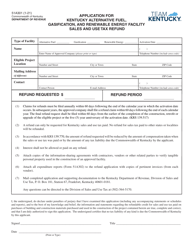

Q: What is the purpose of Form 72A071?

A: The purpose of Form 72A071 is to apply for a motor fuels tax refund bond as required by the Kentucky Department of Revenue.

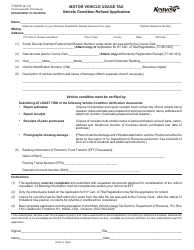

Q: Are there any eligibility requirements to use Form 72A071?

A: Yes, only providers of City and Suburban Bus, Nonprofit Bus, Senior Citizen Transportation, or Taxicab services are eligible to use Form 72A071.

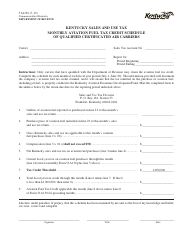

Q: What information is required on Form 72A071?

A: Form 72A071 requires information about the transportation provider, the type of services provided, and financial information.

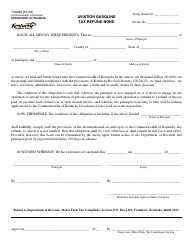

Q: Can Form 72A071 be filed electronically?

A: No, Form 72A071 cannot be filed electronically. It must be printed, signed, and mailed to the Kentucky Department of Revenue.

Q: Are there any fees associated with Form 72A071?

A: Yes, there is a fee for obtaining the motor fuels tax refund bond, as well as an annual renewal fee.

Q: Is Form 72A071 required for all transportation providers in Kentucky?

A: No, only providers of City and Suburban Bus, Nonprofit Bus, Senior Citizen Transportation, or Taxicab services are required to submit Form 72A071.

Q: What is the deadline for filing Form 72A071?

A: The deadline for filing Form 72A071 is specified by the Kentucky Department of Revenue and may vary.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A071 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.