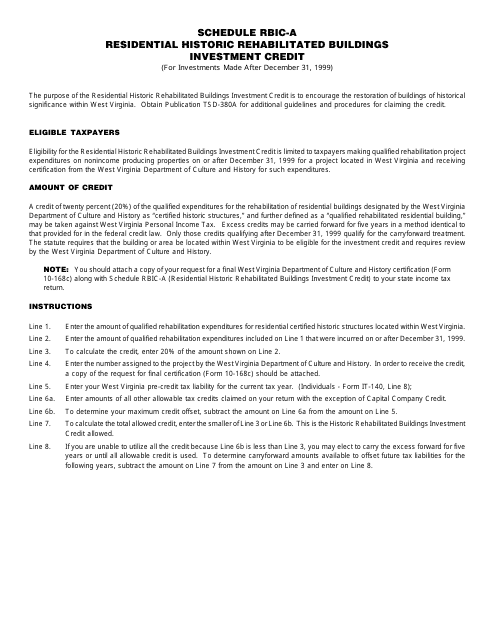

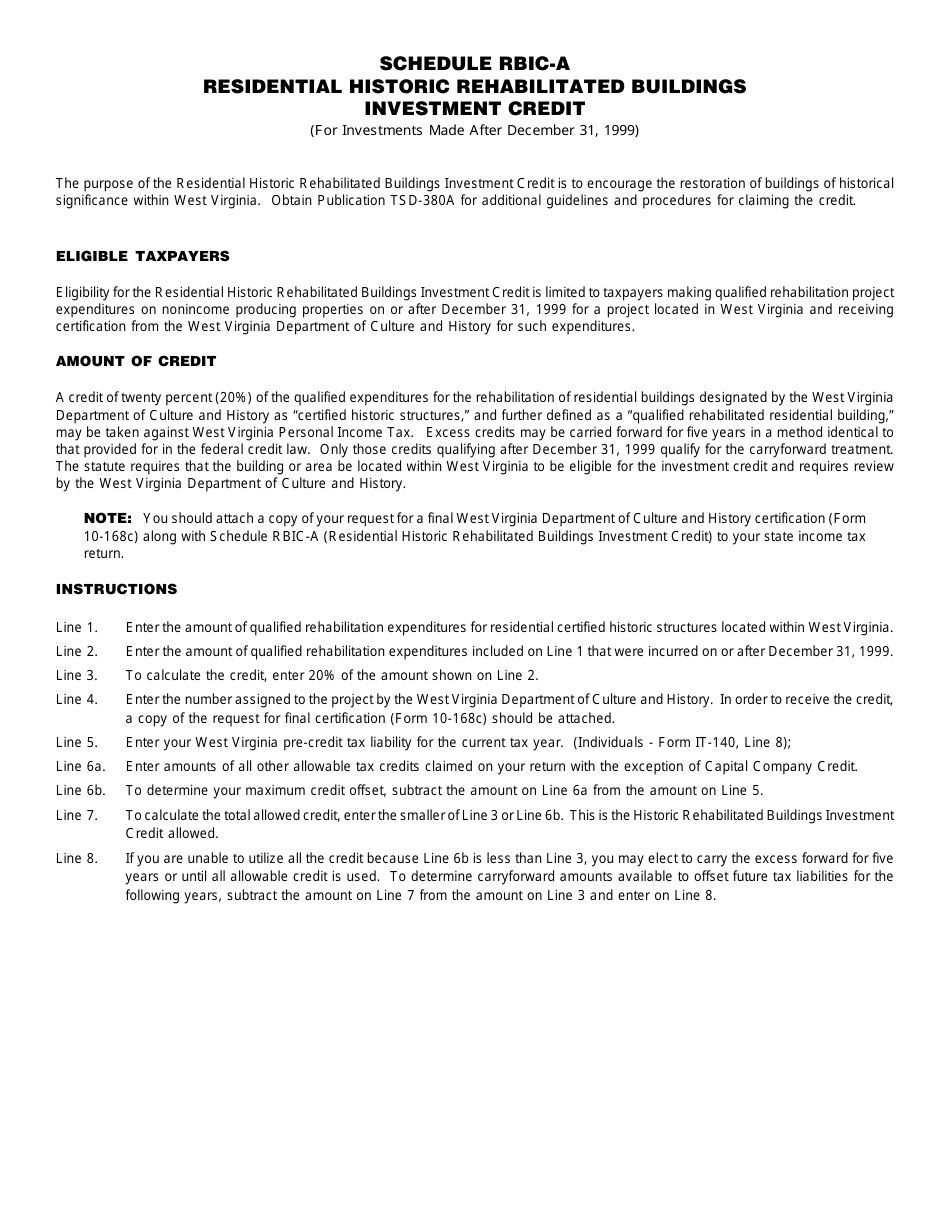

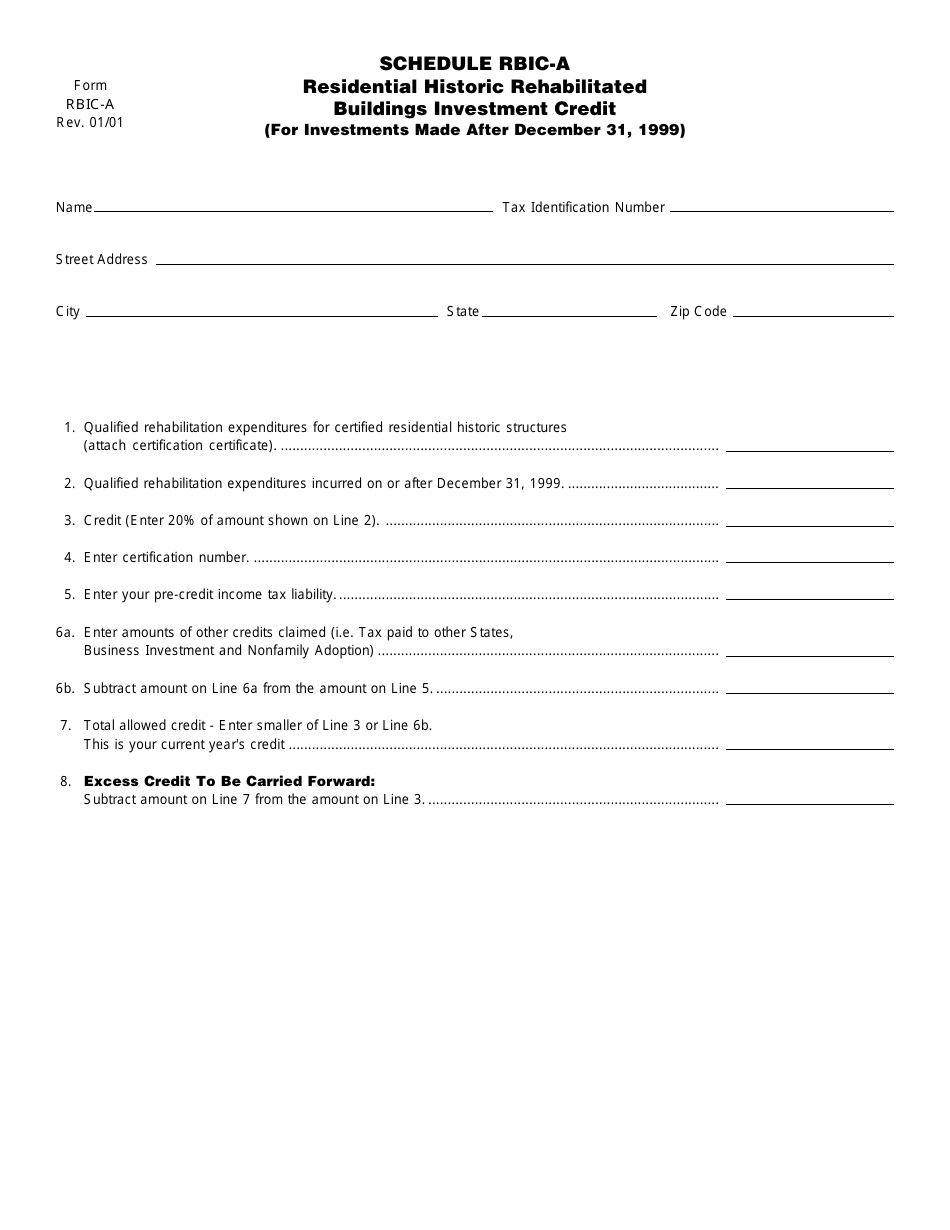

Schedule RBIC-A Residential Historic Rehabilitated Buildings Investment Credit (For Investments Made After December 31, 1999) - West Virginia

What Is Schedule RBIC-A?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RBIC-A Residential Historic Rehabilitated Buildings Investment Credit?

A: RBIC-A Residential Historic Rehabilitated Buildings Investment Credit is a tax credit for investments made after December 31, 1999 in residential historic rehabilitated buildings in West Virginia.

Q: Who is eligible for RBIC-A Residential Historic Rehabilitated Buildings Investment Credit?

A: Individuals, corporations, and partnership entities that invest in residential historic rehabilitated buildings in West Virginia after December 31, 1999 are eligible for RBIC-A Residential Historic Rehabilitated Buildings Investment Credit.

Q: What is the purpose of RBIC-A Residential Historic Rehabilitated Buildings Investment Credit?

A: The purpose of RBIC-A Residential Historic Rehabilitated Buildings Investment Credit is to incentivize investment in the rehabilitation of residential historic buildings in West Virginia.

Q: When can the investments be made to qualify for RBIC-A Residential Historic Rehabilitated Buildings Investment Credit?

A: The investments must be made after December 31, 1999 to qualify for RBIC-A Residential Historic Rehabilitated Buildings Investment Credit.

Q: Is there a specific type of building that qualifies for RBIC-A Residential Historic Rehabilitated Buildings Investment Credit?

A: Yes, only residential historic buildings in West Virginia are eligible for RBIC-A Residential Historic Rehabilitated Buildings Investment Credit.

Form Details:

- Released on January 1, 2001;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule RBIC-A by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.