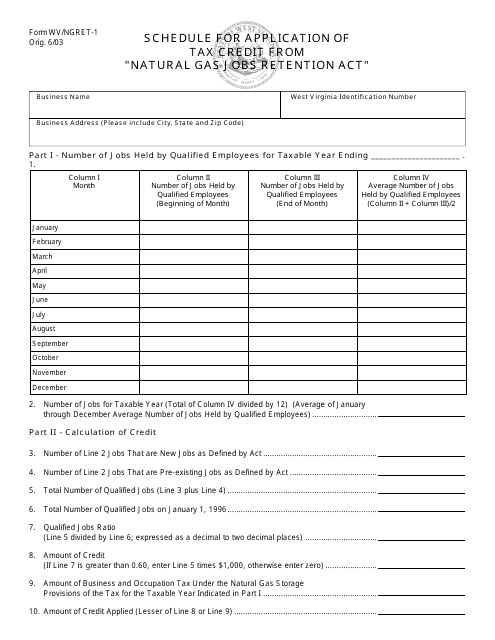

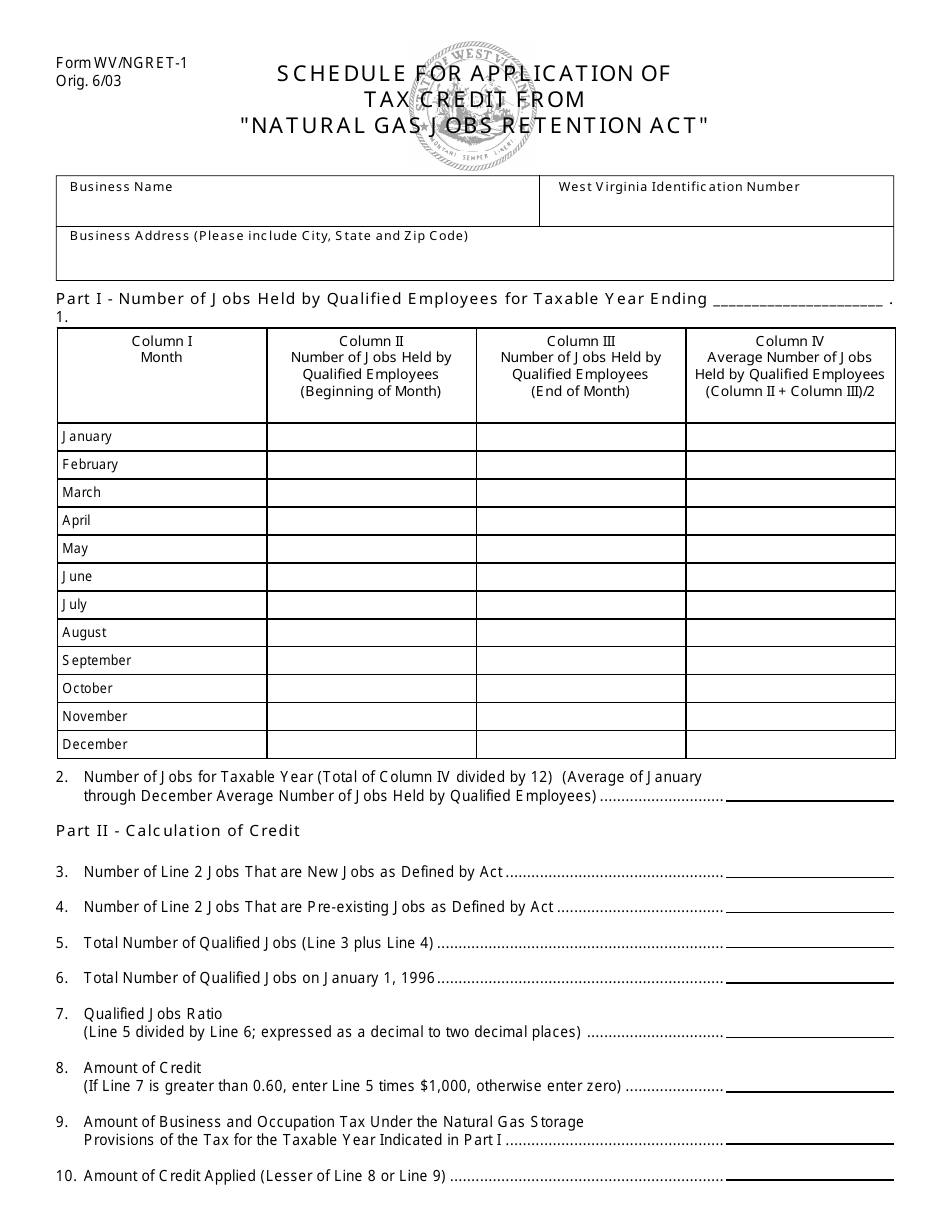

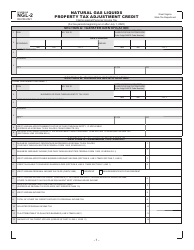

Form WV / NGRET-1 Schedule for Application of Tax Credit From "natural Gas Jobs Retention Act" - West Virginia

What Is Form WV/NGRET-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

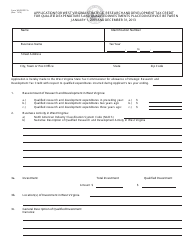

Q: What is the purpose of Form WV/NGRET-1?

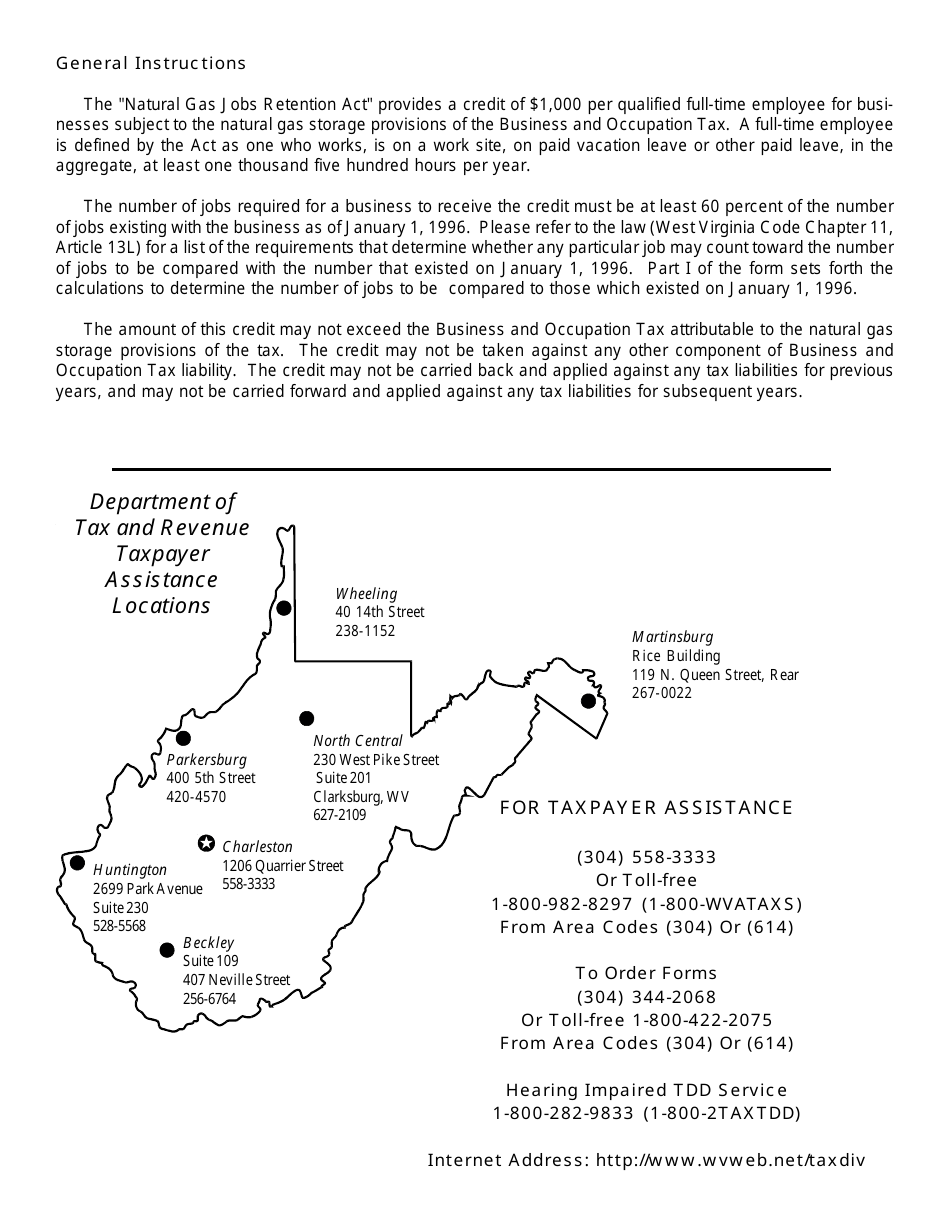

A: Form WV/NGRET-1 is used to apply for the tax credit provided by the Natural GasJobs Retention Act in West Virginia.

Q: What is the Natural Gas Jobs Retention Act?

A: The Natural Gas Jobs Retention Act is a legislation in West Virginia that provides tax credits to companies in the natural gas industry.

Q: Who can use Form WV/NGRET-1?

A: Companies in the natural gas industry in West Virginia can use Form WV/NGRET-1 to apply for the tax credit.

Q: How do I fill out Form WV/NGRET-1?

A: You need to provide information about your company, the number of eligible positions retained, and the amount of qualified wages paid.

Q: Is there a deadline for filing Form WV/NGRET-1?

A: Yes, the deadline for filing Form WV/NGRET-1 is generally on or before March 31 of the year following the calendar year in which the wages were paid.

Q: How long does it take to receive the tax credit?

A: The processing time for the tax credit application can vary, but it is typically processed within a few weeks to a couple of months.

Q: Can I claim the tax credit for previous years?

A: No, the tax credit can only be claimed for the calendar year in which the wages were paid.

Q: Are there any limitations on the tax credit?

A: Yes, there are limitations on the amount of tax credit that can be claimed per eligible job position.

Q: What supporting documents are required with Form WV/NGRET-1?

A: You need to attach a copy of each eligible employee's Federal Form W-2 and a detailed listing of qualified wages.

Form Details:

- Released on June 1, 2003;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/NGRET-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.