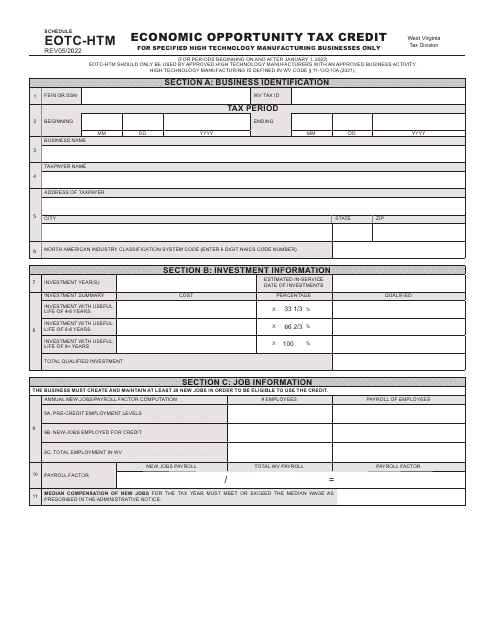

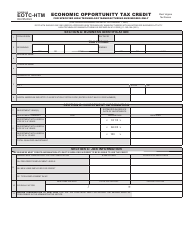

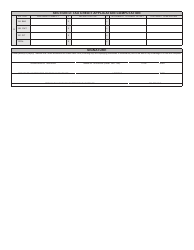

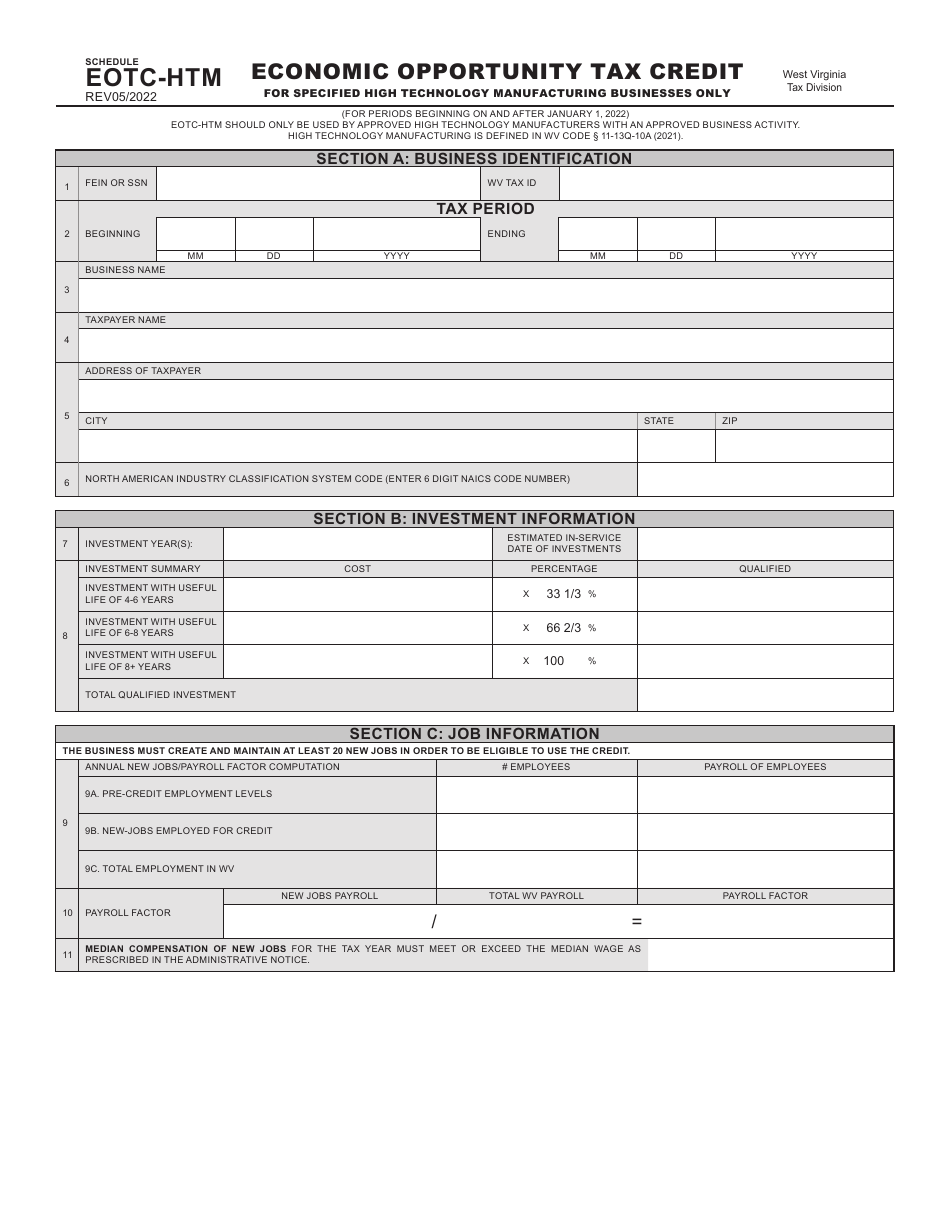

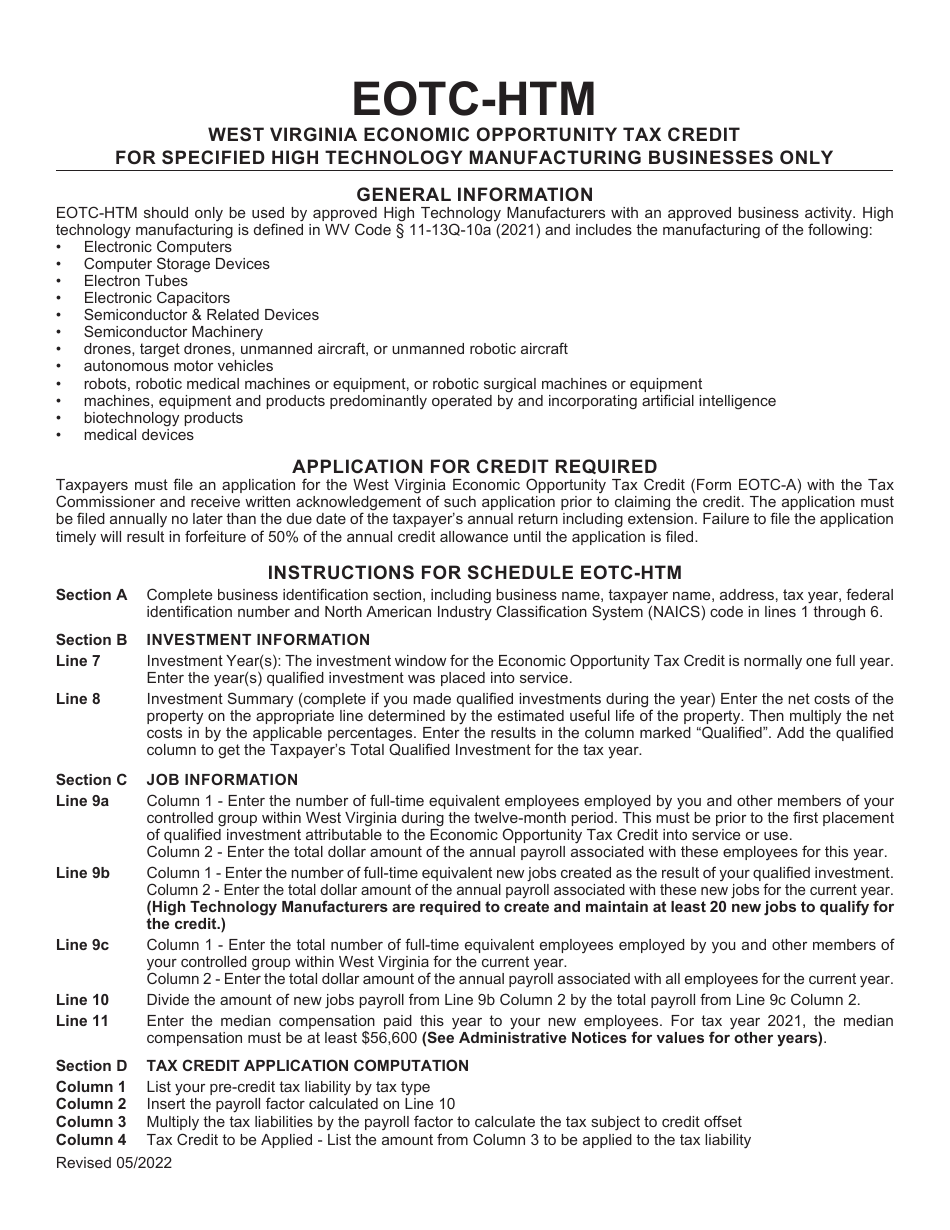

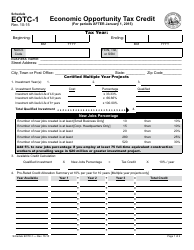

Schedule EOTC-HTM Economic Opportunity Tax Credit for Specified High Technology Manufacturing Businesses Only - West Virginia

What Is Schedule EOTC-HTM?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the EOTC-HTM?

A: The EOTC-HTM is the Economic Opportunity Tax Credit for Specified High Technology Manufacturing Businesses.

Q: What does the EOTC-HTM provide?

A: The EOTC-HTM provides tax credits to eligible high technology manufacturing businesses in West Virginia.

Q: Who is eligible for the EOTC-HTM?

A: Only specified high technology manufacturing businesses in West Virginia are eligible for the EOTC-HTM.

Q: What benefits does the EOTC-HTM offer?

A: The EOTC-HTM offers tax credits to incentivize high technology manufacturing businesses to operate and create jobs in West Virginia.

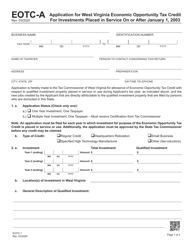

Q: How can businesses apply for the EOTC-HTM?

A: Eligible businesses can apply for the EOTC-HTM by following the application process outlined by the West Virginia Department of Revenue.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule EOTC-HTM by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.