This version of the form is not currently in use and is provided for reference only. Download this version of

Form AEC

for the current year.

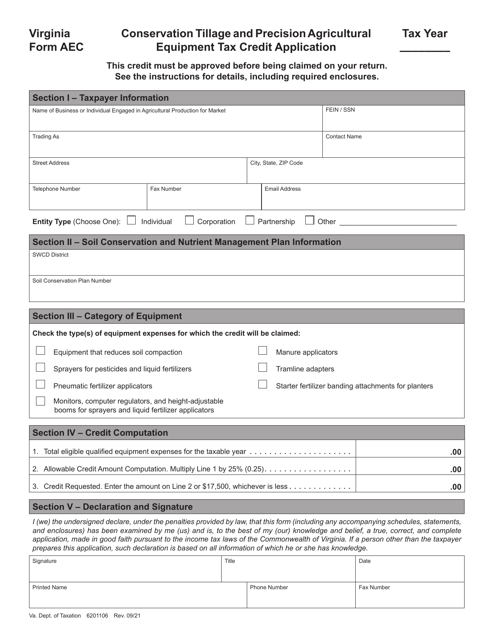

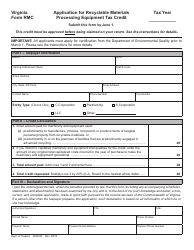

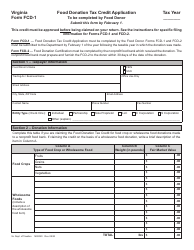

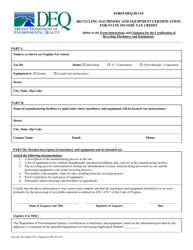

Form AEC Conservation Tillage and Precision Agricultural Equipment Tax Credit Application - Virginia

What Is Form AEC?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

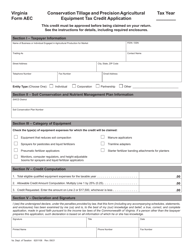

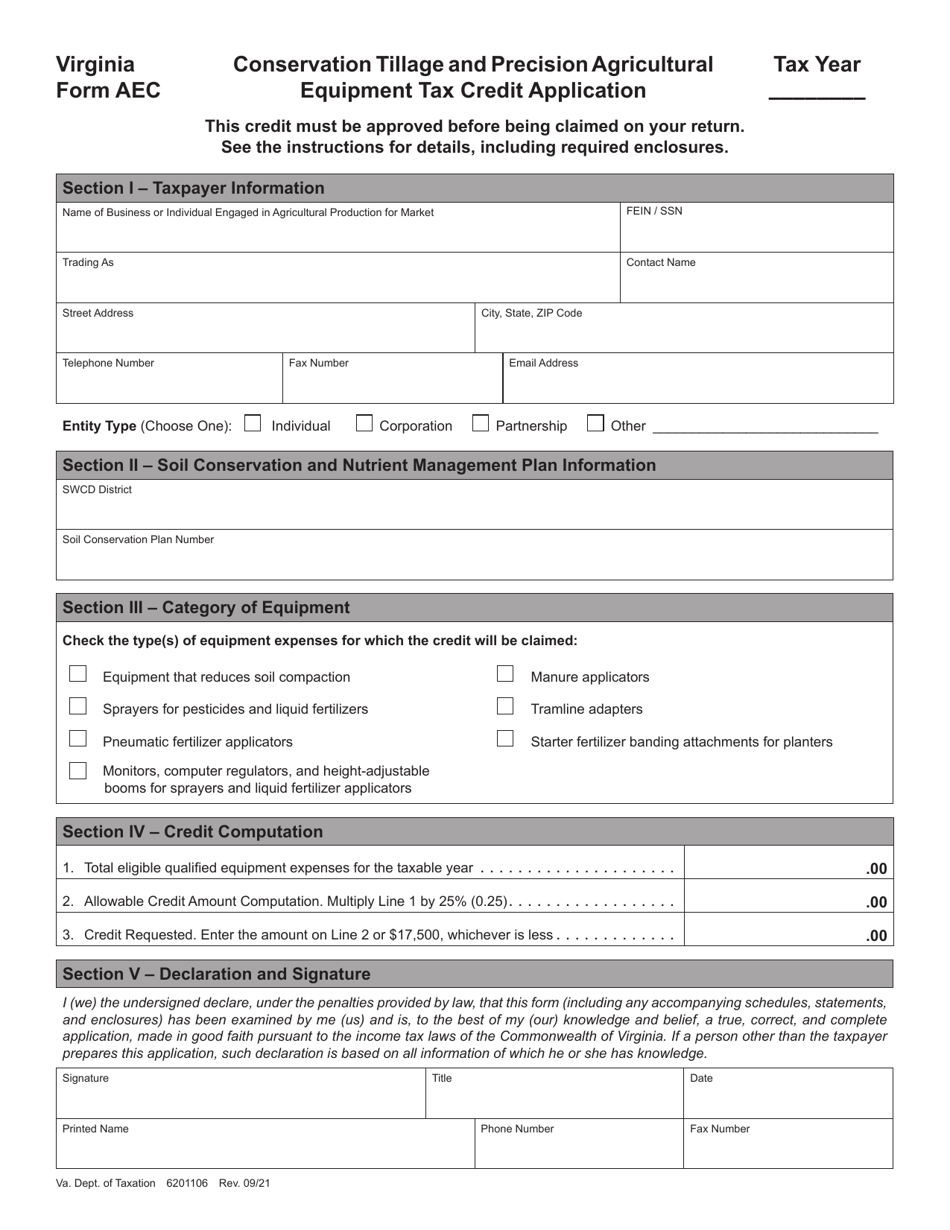

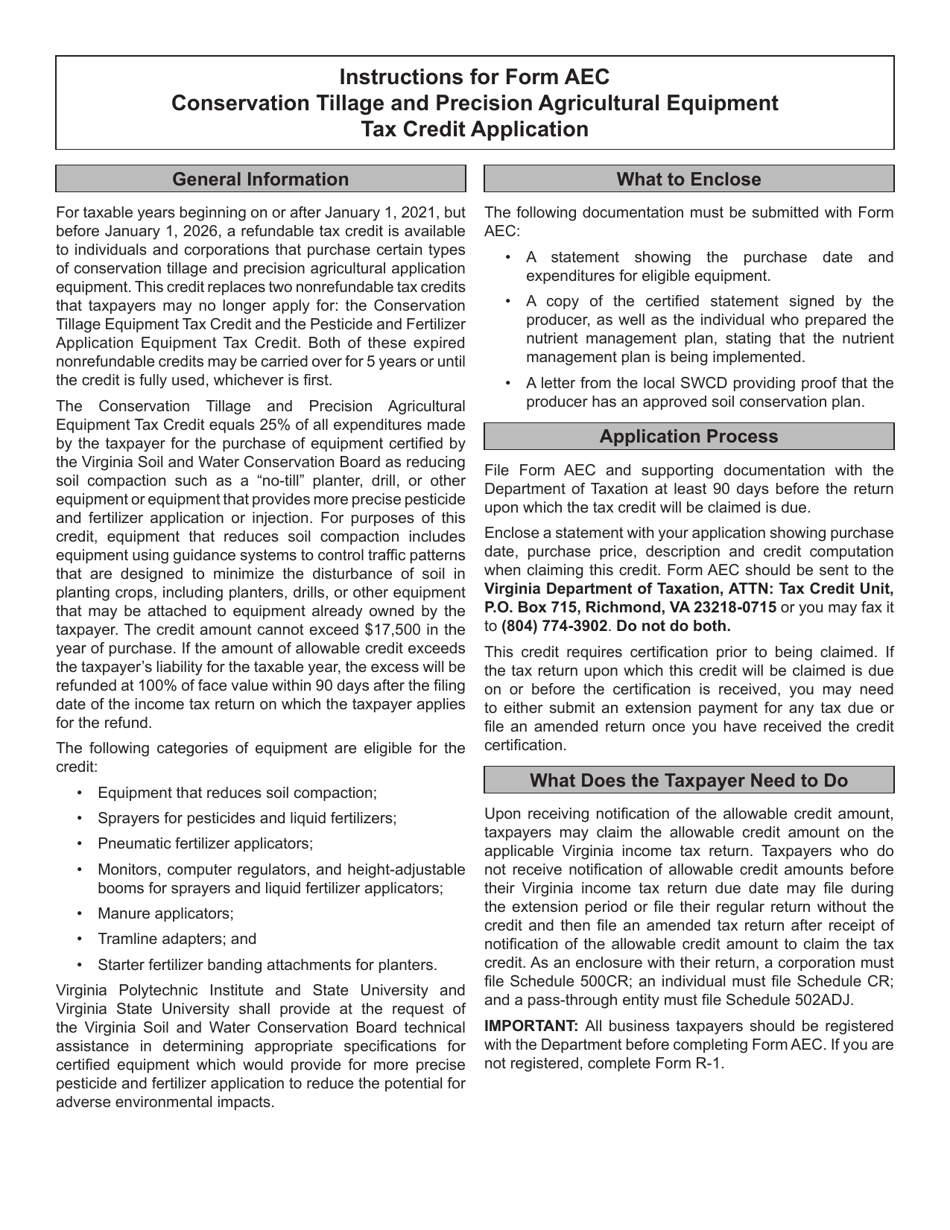

Q: What is the AEC Conservation Tillage and Precision Agricultural Equipment Tax Credit?

A: The AEC Conservation Tillage and Precision Agricultural Equipment Tax Credit is a tax credit offered in Virginia.

Q: What is the purpose of the tax credit?

A: The purpose of the tax credit is to incentivize farmers to use conservation tillage and precision agricultural equipment.

Q: Who is eligible for the tax credit?

A: Farmers in Virginia who use conservation tillage and precision agricultural equipment are eligible for the tax credit.

Q: How much is the tax credit?

A: The tax credit is 25% of the purchase price of the conservation tillage or precision agricultural equipment, up to a maximum of $5,000.

Q: What is conservation tillage?

A: Conservation tillage is a farming practice that helps reduce soil erosion and improve soil health by minimizing the amount of soil disturbance during planting and cultivation.

Q: What is precision agricultural equipment?

A: Precision agricultural equipment refers to technology and machinery that allows farmers to optimize the use of resources such as seeds, fertilizers, and water, by using data and analytics.

Q: How can I apply for the tax credit?

A: You can apply for the tax credit by completing the AEC Conservation Tillage and Precision Agricultural Equipment Tax Credit Application in Virginia.

Q: Is there a deadline for applying?

A: Yes, the application must be submitted by June 30th of the year following the purchase of the equipment.

Q: What supporting documentation do I need to provide?

A: You will need to provide proof of purchase of the conservation tillage or precision agricultural equipment, as well as any additional documentation specified in the application.

Q: When will I receive the tax credit?

A: If your application is approved, you will receive the tax credit in the year following the purchase of the equipment.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AEC by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.