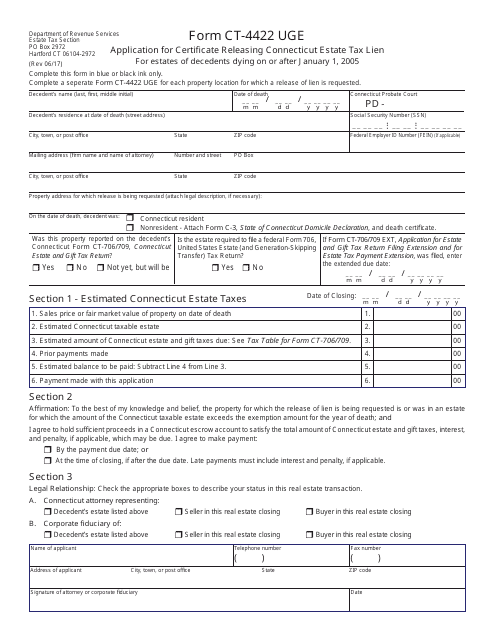

Form CT-4422 UGE Application for Certificate Releasing Connecticut Estate Tax Lien for Estates of Decedents Dying on or After January 1, 2005 - Connecticut

What Is Form CT-4422 UGE?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-4422 UGE?

A: Form CT-4422 UGE is an application for releasing a Connecticut estate tax lien for estates of decedents who died on or after January 1, 2005.

Q: Who needs to file Form CT-4422 UGE?

A: Form CT-4422 UGE should be filed by the executor or administrator of the estate to release a Connecticut estate tax lien.

Q: When should Form CT-4422 UGE be filed?

A: Form CT-4422 UGE should be filed within 9 months from the date of the decedent's death.

Q: Do I need to pay a fee to file Form CT-4422 UGE?

A: No, there is no fee required to file Form CT-4422 UGE.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-4422 UGE by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.